Why Have 54% of Jupiter ASR Recipients Claimed Less Than $10?

Over $43M has been distributed via Jupiter’s Active Staking Rewards, with 17% of available $JUP still unclaimed.

- Published:

- Edited:

On October 21, the second installment of Jupiter’s eagerly awaited ASR (Active Staking Rewards) finally went live.

Promising to distribute 50M $JUP and 7.5M $CLOUD to Jupiter stakers participating in governance, Jupiter ASR has become a significant quarterly liquidity event in the Solana ecosystem.

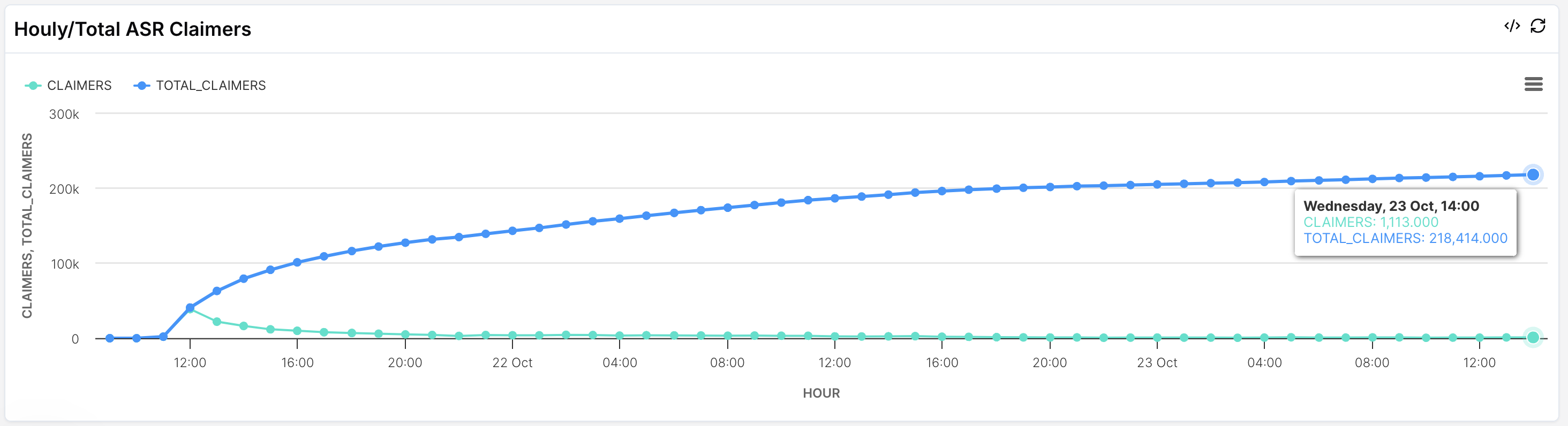

Within 2 days of ASR claims going live, over $43M worth of assets have already been claimed, but what does claimant analytics tell us about $JUP stakers?

Only 36% of Unique Staking Wallets Claim ASR

Throughout 2024, JupiterDAO has cemented itself as the largest and most engaged community in the crypto space. According to JupiterDAO, over 605,000 unique wallets have staked 424.9M $JUP tokens to the governance protocol.

Despite being the industry’s biggest DAO, a surprisingly low percentage of wallets have stepped forward to claim their ASR. According to Flipside data, only 218,414 wallets have claimed their allocation, representing a mere 36% of the total number of wallets with staked assets.

Currently, protocol governance is $JUP’s only utility, with $JUP stakers who vote on proposals being eligible for their proportional share of ASR rewards. To ensure voters are aligned with Jupiter’s growth long-term, all staked $JUP is subject to a 30-day unlock period.

With this in mind, it’s remarkable that over 390k wallets with staked $JUP have not claimed any ASR rewards. Arguably, there’s no reason to stake $JUP if not to join in governance and earn the associated rewards.

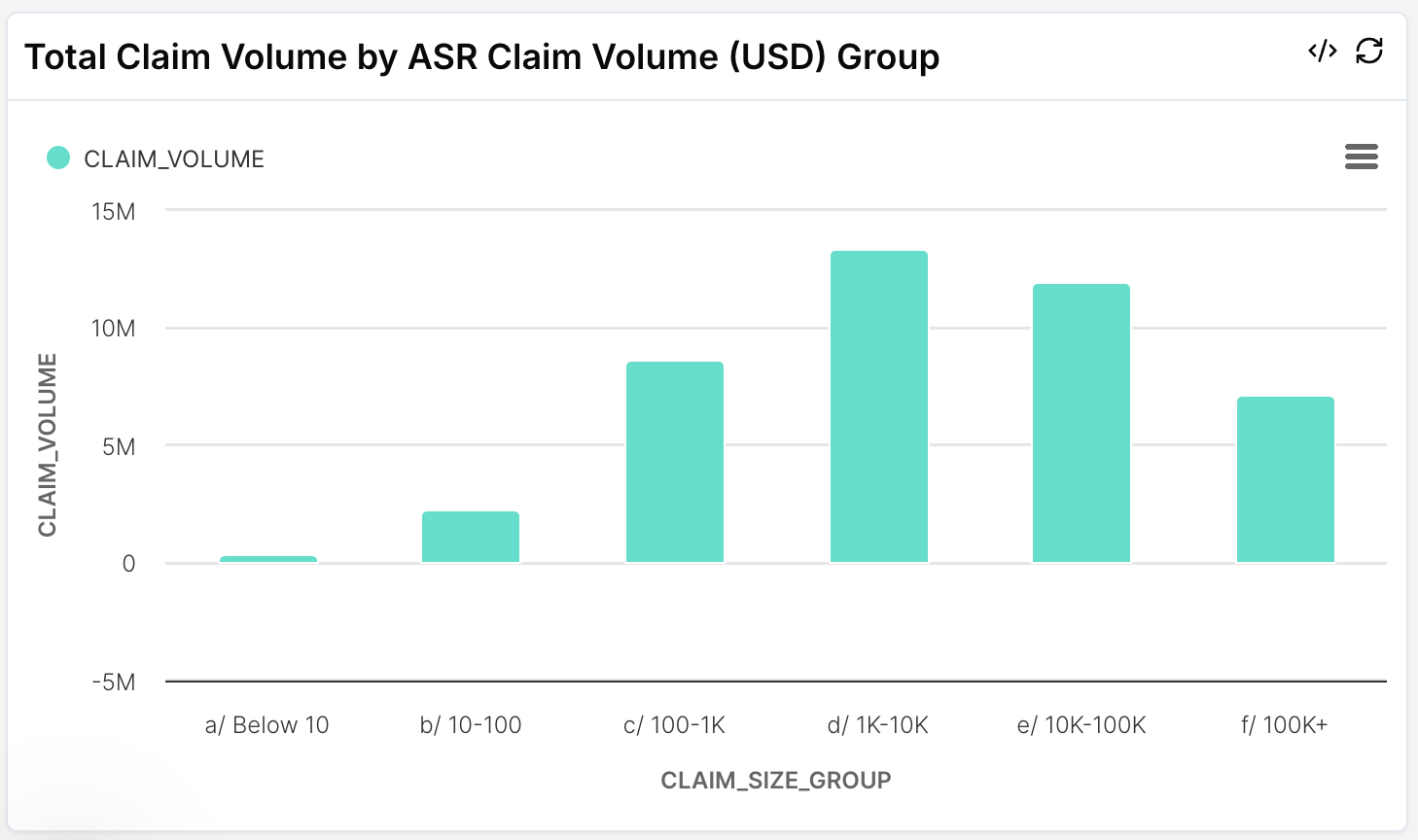

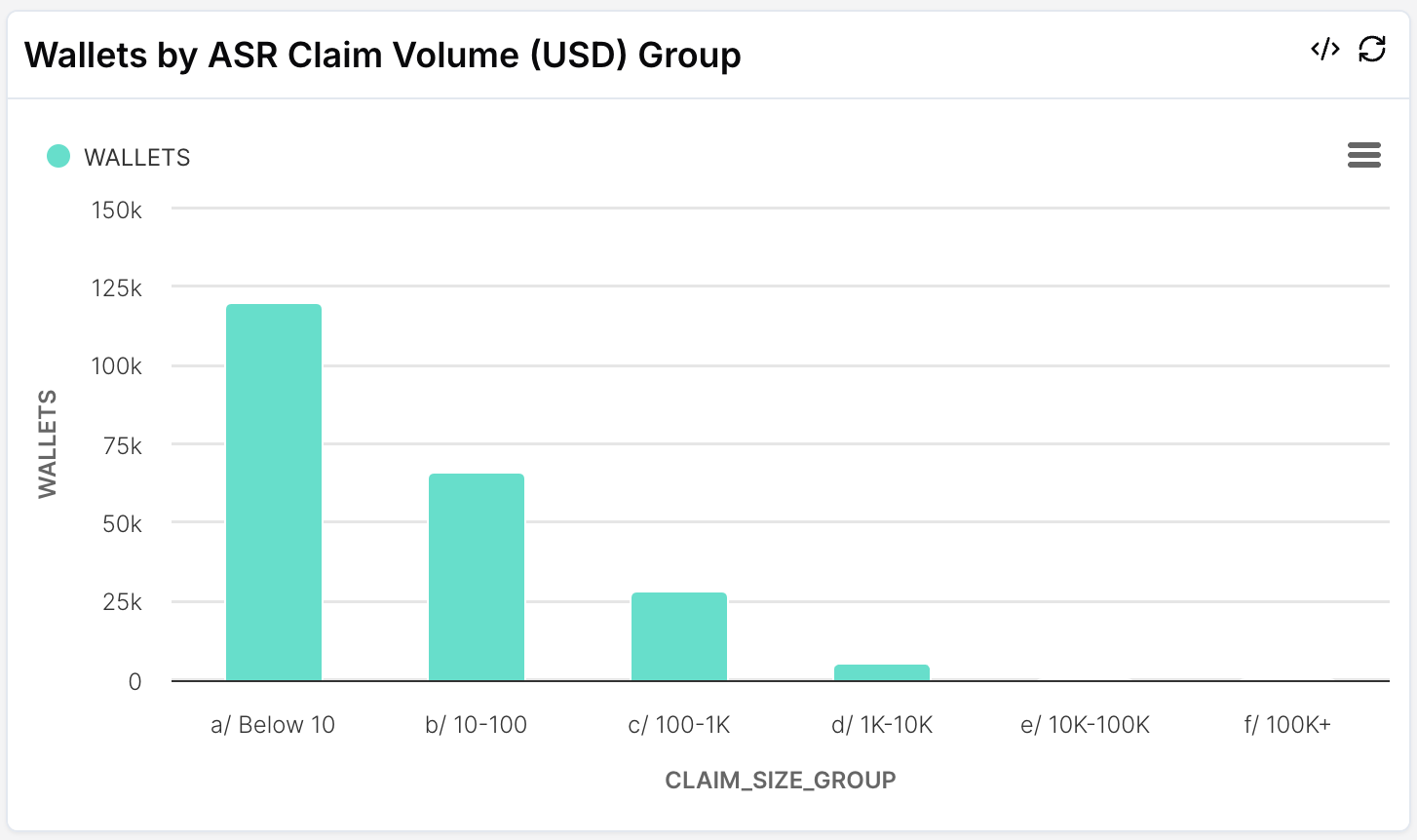

Additionally, it would appear that the bulk of claimants received relatively small allocations when compared to the total claim volume.

Voters claiming between $1,000-$10,000 worth of ASR represent the greatest volume of allocations, with these wallets representing roughly 30.9% of the total volume of claimed assets. However, the number of wallets claiming less than $10 far exceeds all other claim group sizes, suggesting that the vast majority of voters have less than 100$ JUP staked in governance.

According to Pine Analytics findings, 86.72% of voters claimed less than $100 worth of tokens. This is slightly higher than the 79% witnessed during the first ASR claim, despite changes made to Jupiter governance that required voters to stake more than 10 $JUP to be eligible.

The high frequency of small claims indicates that the majority of staked $JUP is controlled by smaller wallets. However, this concentration could also be due to stakers splitting their holdings across multiple wallets in the hope of favorable allocations in future Jupuary airdrops.

$CLOUD Down 7% Following ASR Distribution

Alongside 50M $JUP, Jupiter’s LFG Launchpad partner Sanctum distributed its native token $CLOUD, through ASR.

Surprisingly, $CLOUD witnessed higher claim rates than $JUP, with over 99% of the 7.5M allocated $CLOUD tokens already claimed. $CLOUD’s higher claim rate could be due to its immediate availability. While $CLOUD tokens go directly to a staker’s wallet, claimed $JUP is automatically restaked and subject to a 30-day unstaking period.

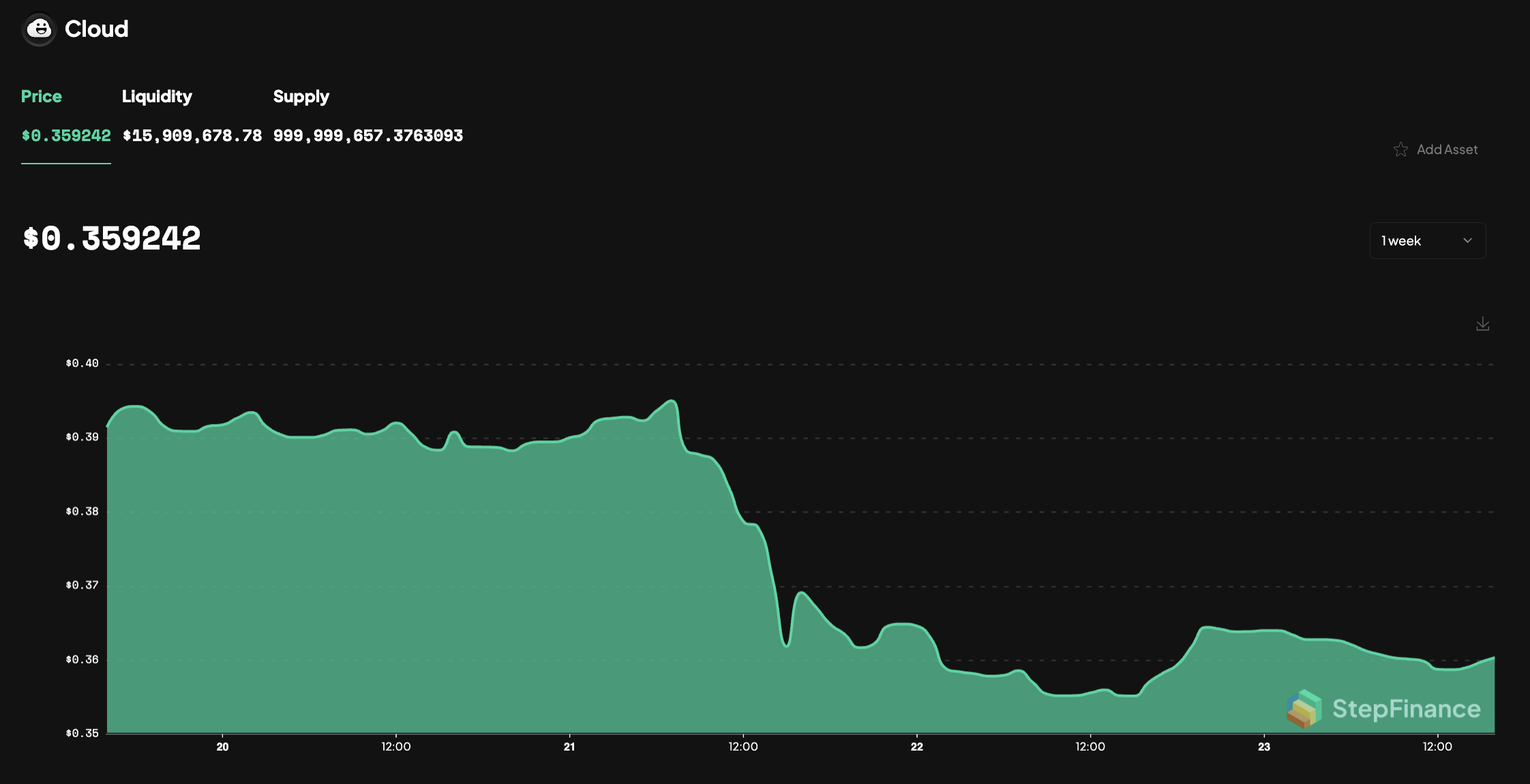

Unfortunately for $CLOUD holders, the ASR event inflicted sharp sell pressure on the asset. According to Step Finance data $CLOUD dropped 7.6% during ASR claims, sliding from $0.39 to currently exchange hands at $0.36.

Jupiter DAO Schdules Next Vote

Following the successful completion of the second Jupiter ASR, Jupiter DAO has already set plans in motion for the next proposal.

Scheduled to go live on October 25, 2024, the next vote deliberates on whether or not the protocol should raise the quorum, or voting threshold, required to pass a proposal.

As more $JUP tokens entering ciruculation, community members are concerned that “a small group could push through decisions that don’t reflect the community as a whole”. By raising the quorum, future proposals need to accumulate 12M ‘votes’ to officially pass.

Read More on SolanaFloor

Solana’s biggest governance protocol is evolving

Realms Breaks Ties with Solana Labs to Form Separate Entity

What Are Crypto Airdrops?