Depegged: What happened with USDC?

Silvergate, a bank heavily linked to the US crypto economy, has announced its closure due to a bank run caused by the collapse of FTX. A few days later, Silicon Valley Bank, with over $220B in assets, also experienced a bank run leading to its stock and cash reserves crash.

- Published:

- Edited:

Silvergate, a bank heavily linked to the US crypto economy, has announced its closure due to a bank run caused by the collapse of FTX. A few days later, Silicon Valley Bank, with over $220B in assets, also experienced a bank run leading to its stock and cash reserves crash. The collapse of Silicon Valley Bank caused fears of contagion among other banks and companies and prompted analysts to investigate the status of USDC, which announced on March 2nd that it had approximately 26% of its reserves held in US banks, including Silicon Valley Bank.

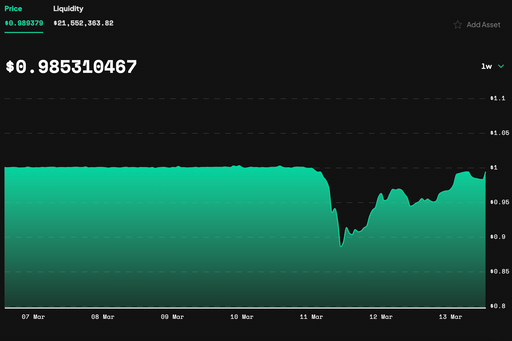

Concerns about USDC's missing reserves triggered a run on other stablecoins such as USDT, causing the stablecoin to depeg and drop to $0.88. Circle responded within 24 hours, assuring the market would honor its commitment to maintaining a 1:1 redemption ratio. The stablecoin has since recovered to $0.99 (at the time of writing). While the situation appears to be increasingly under control, it's essential to consider the implications that the collapse of USDC could have on the Solana ecosystem.

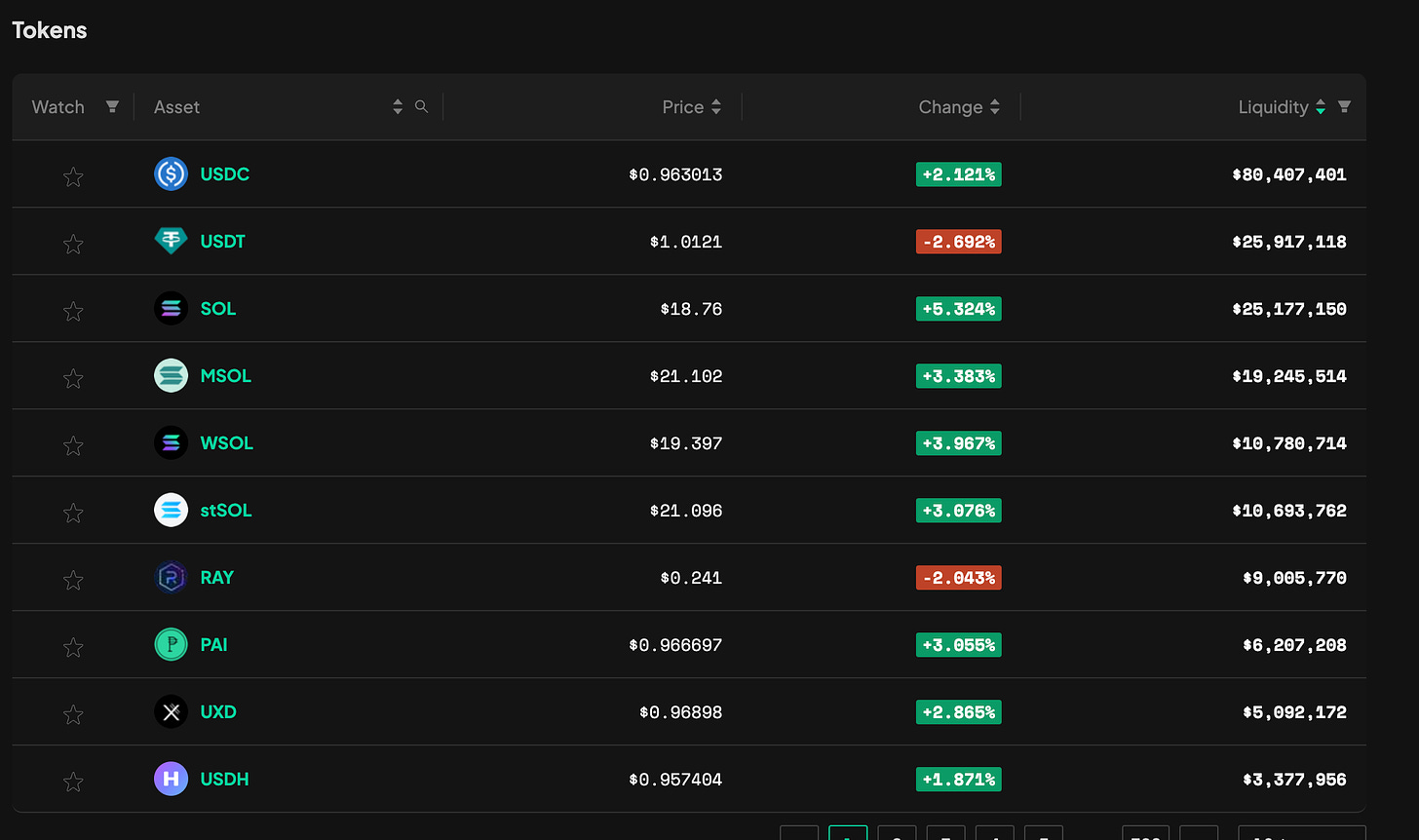

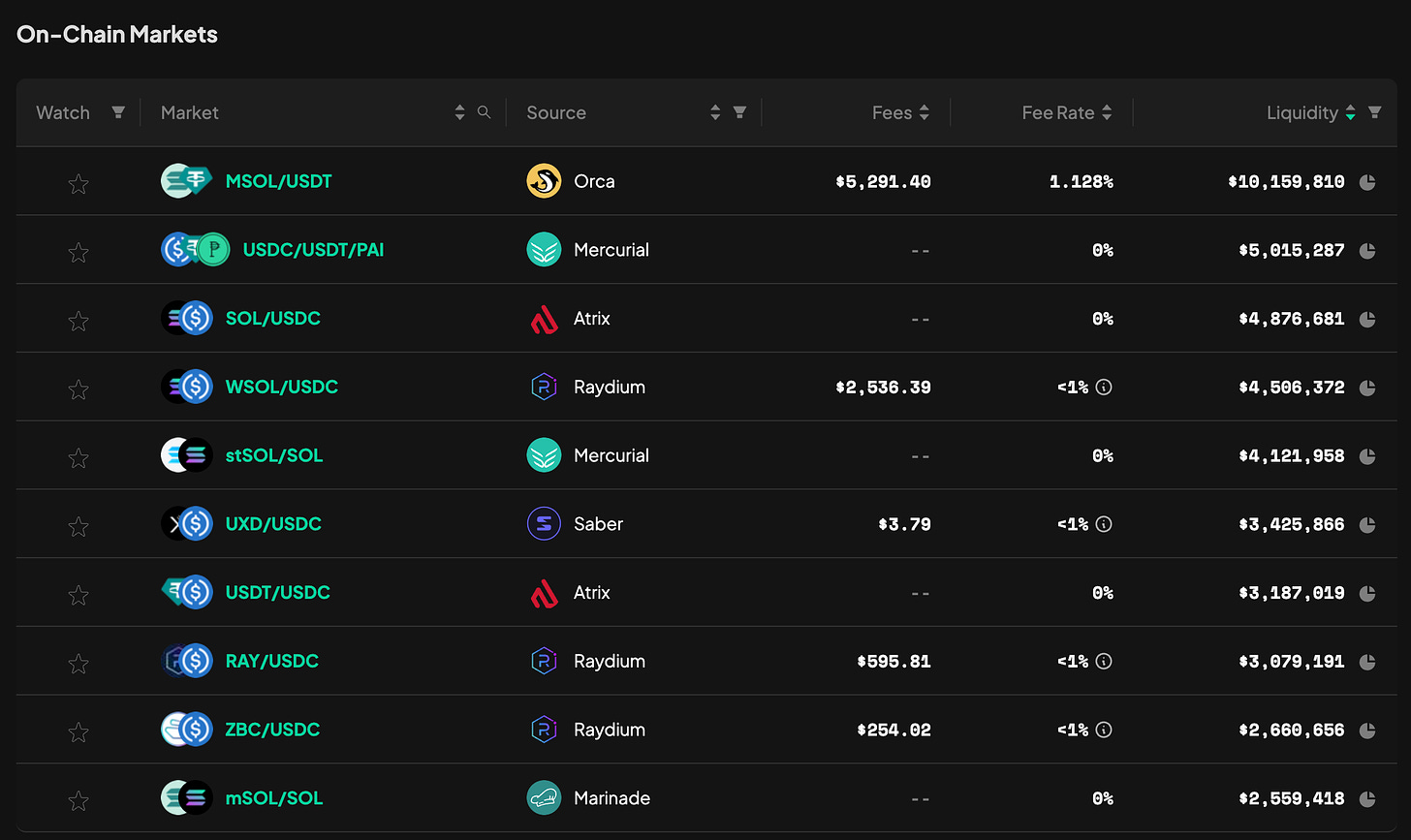

Most users do not use USDT for any purposes as the Solana ecosystem works mostly around USDC. According to data from Step Finance Analytics, USDC’s liquidity amounts to $80M, taking into account its current depeg price, while USDT holds significantly less liquidity, with a total of $26M.

A collapse of USDC would cause a loss of confidence in the market and the destruction of several liquidity pools. According to usdc.cool, there’s currently $776M worth of USDC on the Solana blockchain which would go to zero and cause immeasurable losses to its holders. Another issue that arises, is the number of protocols that have their funds in USDC. A collapse could lead to a liquidity crunch, making it difficult for such projects to access funding and meet their financial obligations.

The repeg came after Circle announced yesterday that the $3.3 billion held within the collapsed SVB would be "fully available" when U.S. banks open. The U.S. Treasury, Federal Reserve, and Federal Deposit Insurance Corporation announced a plan to backstop depositors with money, which is a step towards curbing the feared systemic panic brought on by the collapse of the emerging technology-centric bank.

With the Treasury Department designating both SVB and Signature bank as systemic risks, it gave them the authority to unwind the failed institutions that would "fully protect all depositors." The Federal Reserve also announced that they would be moving towards a new Bank Term Funding Program to safeguard institutions affected by the fallout. Additionally, a joint statement said that there would be no bailouts and no taxpayer costs associated with the plans moving forward.

The Treasury Department is providing up to $25 billion from its Exchange Stabilization Fund as a backstop for any potential losses from the funding program. A senior Fed official said the Treasury program likely won’t be needed and will exist only as a safeguard.

The events that occurred over the past week held similarities to Sept 15, 2008, when the banking giant Lehman Brothers ended up insolvent and in search of a buyer. When the government was unsuccessful after a weekend of exploring options, it triggered the worst of the Globe Financial Crisis.

Conclusion

While it appears as though the banking crisis has been avoided, it's important to note that USDC is backed by a reserve of USD held in regulated financial institutions. While the likelihood of a complete collapse of USDC is considered to be low, anything is possible when others manage your money. It is highly recommended to always be wary of possibilities related to where you store your money. To minimize risks related to a single point of failure it can be recommended to store your stables across multiple stablecoin providers so that in the event one goes under, you do not have full exposure to it.