Stablecoins on Solana: Growth, Adoption, and Onchain Trends

Solana’s total stablecoin supply has surpassed $11.7 billion, with nearly half of the growth occurring in January.

- Published:

- Edited:

Stablecoins are the backbone of any blockchain ecosystem, ensuring liquidity, enabling seamless trading, and driving DeFi applications. On Solana, their impact is more significant than ever, spanning across DEXs, DeFi protocols, bridges, dApps, and more. Understanding their flow is crucial to grasping the ecosystem's health and trends.

In this article, we analyze stablecoin supply, adoption, trading volume, and utility within the Solana blockchain to uncover key insights from onchain data.

Stablecoin Supply

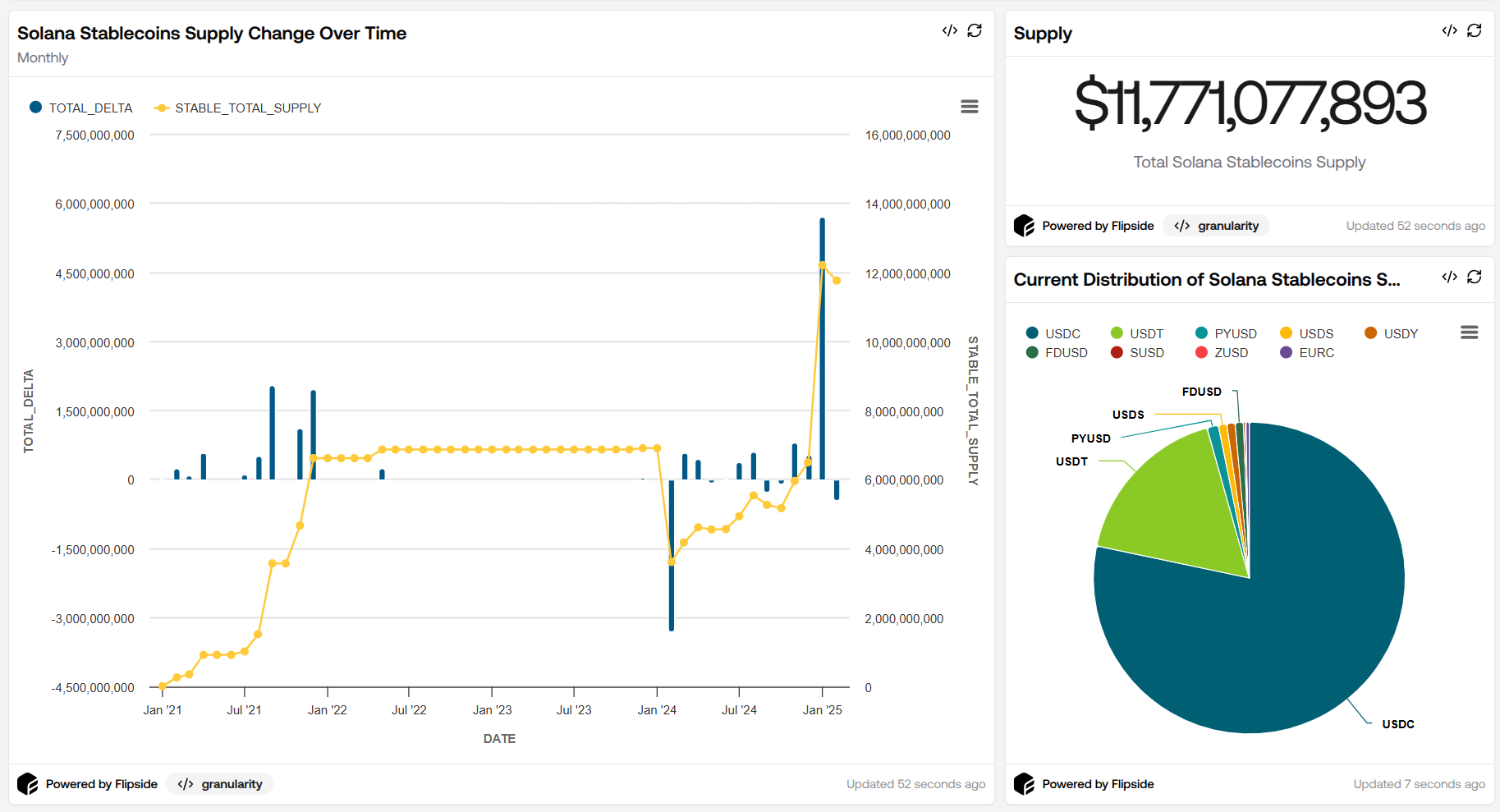

As of now, based on Flipside data, the total stablecoin supply on Solana has exceeded $11.7 billion, with nearly half of this increase happening in January alone—a massive $5.7 billion growth.

Leading the charge is USDC, dominating with a 78.3% market share and a supply of $9.2 billion. Its nearest competitor, USDT, lags behind with a supply difference of over $7.2 billion.

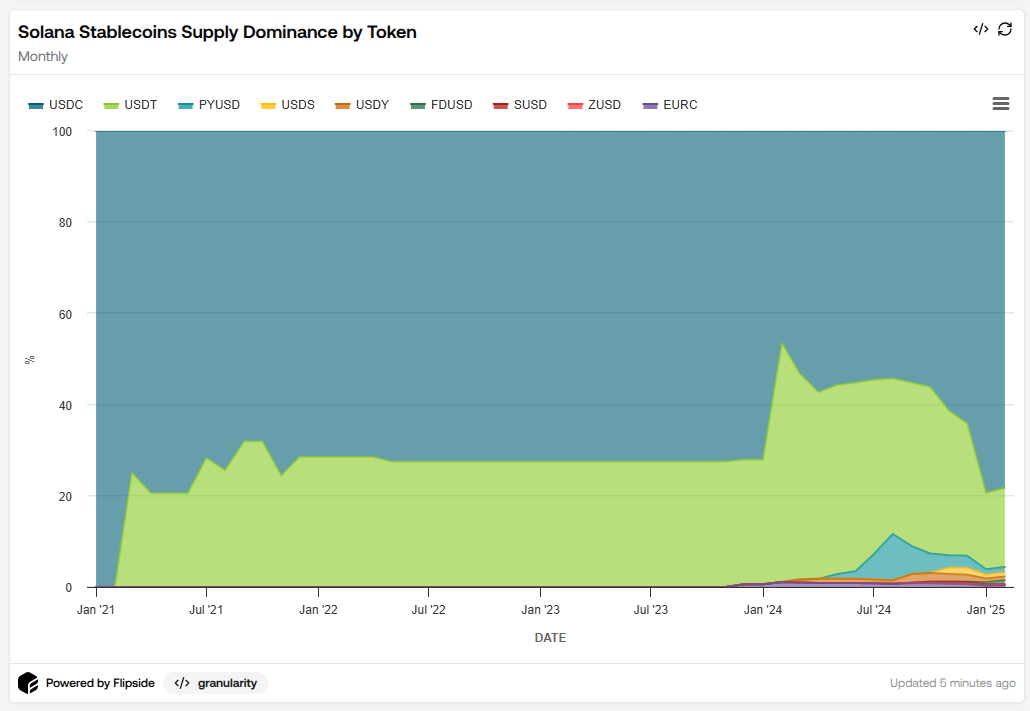

Before November 2023, Solana only had two major stablecoins—USDC and USDT—with a ratio of 72.5% to 27.5%. However, since then, new projects have introduced alternative stablecoins, including:

-

EURC (by Circle)

-

USDY (by Ondo)

-

PYUSD (by PayPal)

-

USDS (by Sky Protocol)

-

FDUSD (by First Digital)

Some of these new stablecoins have experienced rapid growth. PYUSD, for example, reached a peak supply of $560 million in August 2024.

After USDC and USDT, the largest stablecoins on Solana are:

-

PYUSD – $138.8M

-

USDS – $103M

-

USDY – $100M

Massive Supply Increase in the Past 30 Days

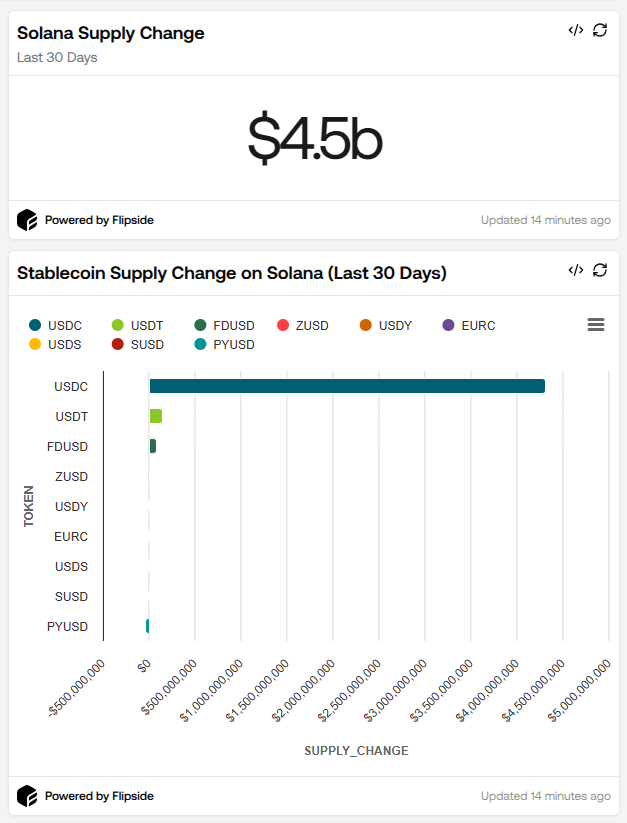

Over the past 30 days, the total stablecoin supply on Solana has grown by over $4.5 billion. Notably, $4.3 billion of this came from USDC.

One key development was the introduction of FDUSD, which has gained traction, increasing its supply by $80 million in the last 30 days. On the other hand, PYUSD’s supply has dropped by $33 million.

Supply Decline in the Past 7 Days

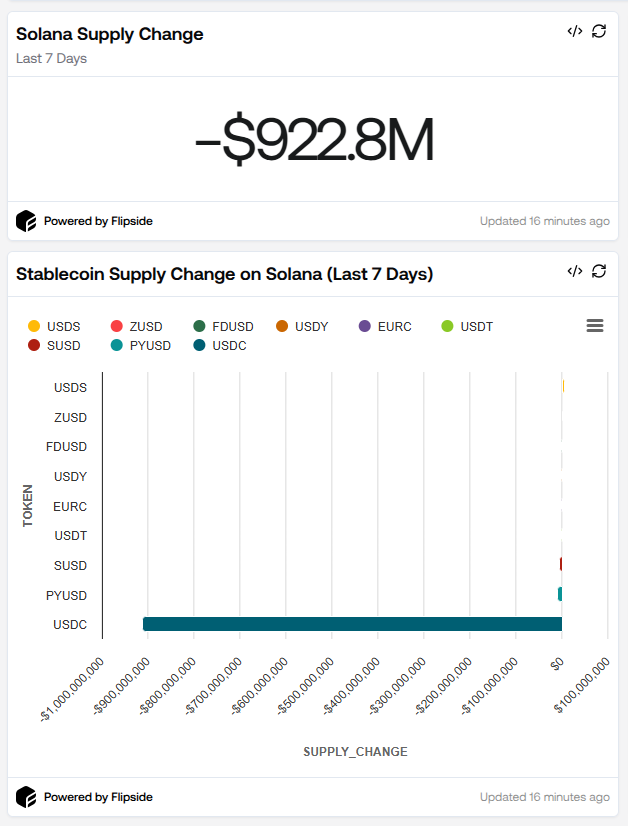

Despite the strong 30-day growth trend, the last 7 days have seen a decline of $922 million in stablecoin supply, mainly driven by USDC’s $911 million drop. However, USDS was the only stablecoin to increase its supply, growing by $5.4 million in just a week.

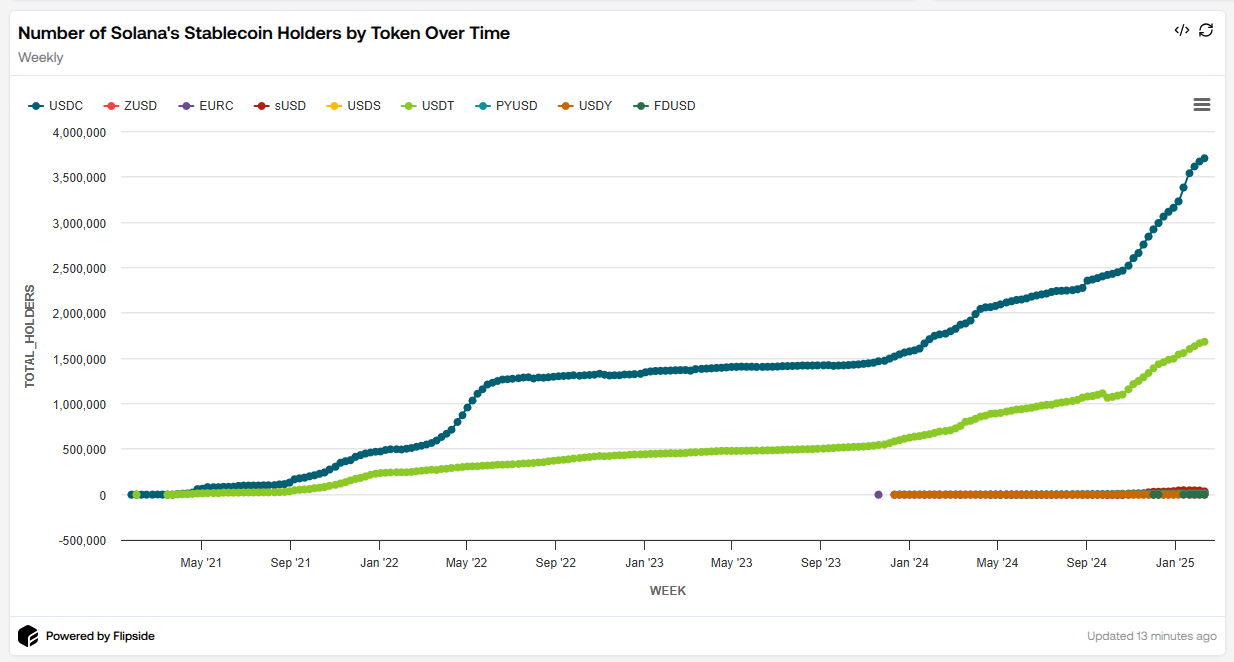

How Many Wallets Hold Them?

Stablecoins are widely used, with many holders preferring them for stability and trading. Here’s a breakdown of the top stablecoins by the number of wallets holding them:

-

USDC – 3.7M wallets (+500K increase since January!)

-

USDT – 1.7M wallets

-

SUSD – 35.5K wallets

-

EURC – 27K wallets

-

PYUSD – 15.8K wallets

USDC remains the most adopted stablecoin on Solana, with 500,000 new holders added in just one month.

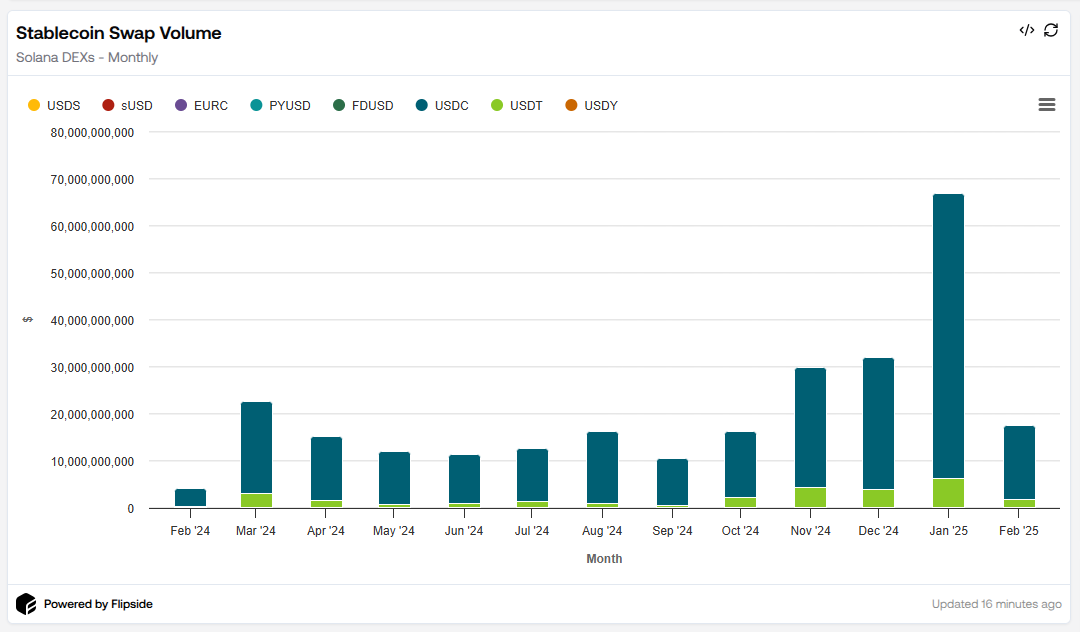

Trading Volume Surges: Over $67B in January!

The rise in stablecoin adoption is largely due to growing trading activity. Since late October 2024, the trading volume of stablecoin pairs has skyrocketed.

DEX Trading Volume Over Time:

-

October 2024: $16.2 billion

-

January 2025: $67 billion (+315% increase!)

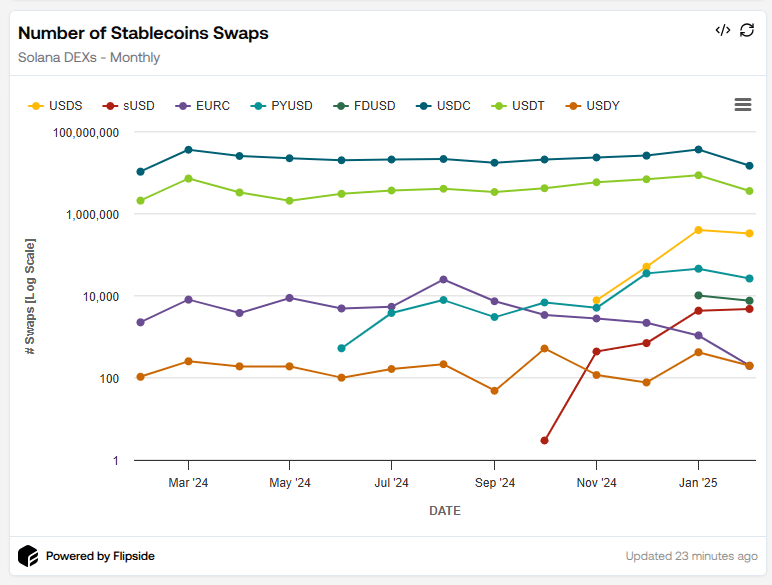

January volume accounted for 25% of all trading volume in the past year, with USDC dominating over 90% of all stablecoin pair trades.

In terms of number of swaps, USDC and USDT were the most traded, while USDS ranked third with 407K swaps.

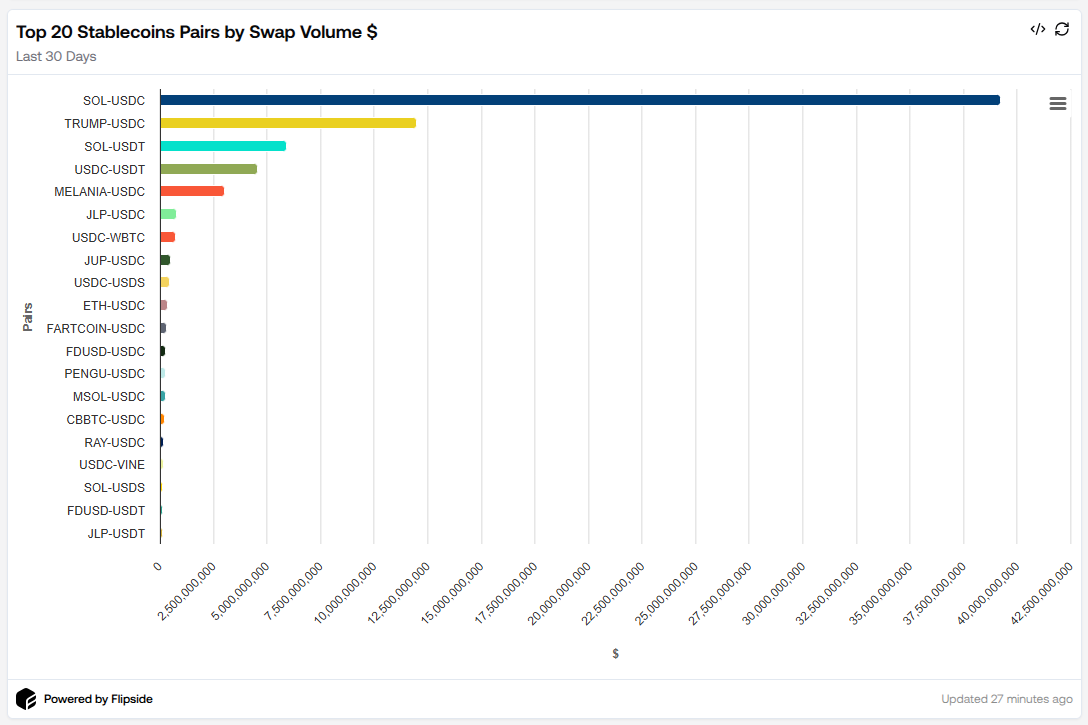

Most Traded Stablecoin Pairs in the Last 30 Days

The top three trading pairs involving stablecoins over the past 30 days were:

-

SOL-USDC – $39B in volume

-

TRUMP-USDC – $11.9B (most of it in just 4 days!)

-

SOL-USDT – $5.9B

The launch of TRUMP and Melania tokens on Solana brought a surge in stablecoin minting and trading activity, particularly for USDC.

Stablecoin Utility Beyond Trading

Stablecoins are not just for trading. They play a crucial role in DeFi, lending, liquidity provision, and more.

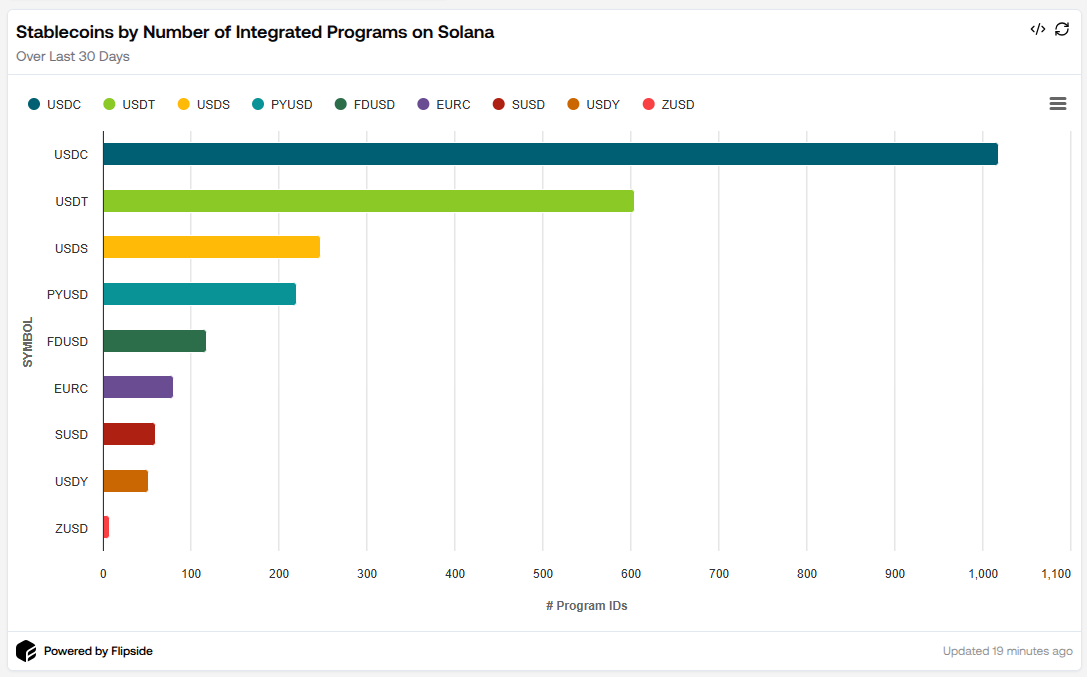

USDC Leads in Program Interactions

-

USDC interacts with 1,018 Program IDs, far ahead of other stablecoins.

-

USDT follows but with 400 fewer Program IDs.

-

USDS (247 Program IDs) ranks third.

-

PYUSD (220) and FDUSD (118) come in fourth and fifth, respectively.

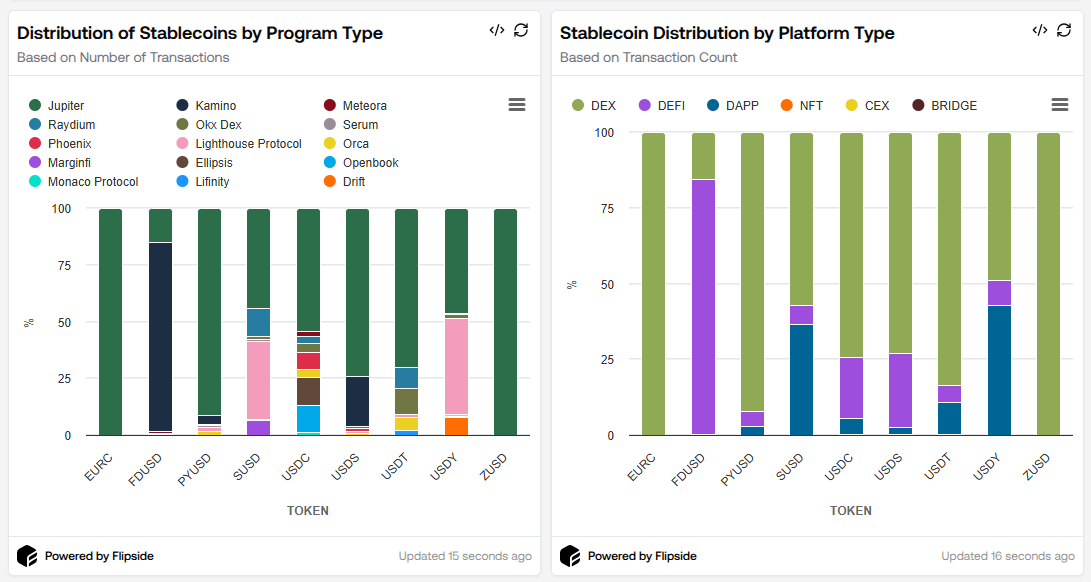

DEXs Dominate Stablecoin Usage

-

74% of USDC transactions happen on DEXs.

-

FDUSD stands out with 84% of its transactions occurring in DeFi, mainly on Kamino (83%).

-

USDY and SUSD are primarily used on Lighthouse Protocol, where 42% and 34% of their transactions occur, respectively.

Final Thoughts: USDC Remains the King

From supply growth and adoption to trading volume and utility, USDC is the undisputed stablecoin leader in Solana’s ecosystem. Its dominance continues to grow across DEXs, DeFi, and integrations with various programs.

While USDS, PYUSD, and FDUSD are gaining traction, they still have a long way to go before they can challenge USDC’s market position.

Solana’s stablecoin ecosystem is expanding rapidly, and onchain trends suggest further adoption and trading activity ahead. Keep an eye on USDC’s evolving dominance and the rise of new competitors!

Read More on SolanaFloor

Doodles Chooses Solana For $DOOD Memecoin Launch