Some Solana Validators Are Concerned by Marinade’s Stake Auction Marketplace

Marinade’s novel Stake Auction Marketplace promises 10% APY on staked SOL, but some validators argue this comes at too great a cost.

- Published:

- Edited:

Marinade Finance, one of Solana’s original staking providers, has found itself in hot water with validator operators.

Validators argue that Marinade’s new Stake Auction Marketplace (SAM) harms the staking landscape, allowing malicious actors to thrive at the expense of honest validators.

Beyond losing stake in the network, chagrined validators suggest that, left unchecked, the SAM model is a threat to decentralization and Solana’s scalability moving forward.

Marinade has dismissed these accusations. Countering claims of apathetic negligence, Marinade argues those who criticize the new system do so out of spite.

Is this a case of willful blindness, or are validators looking for a scapegoat to blame for their own shortcomings?

Why Are Validators Upset?

Once heralded as a powerful new model that would push staking APY to new heights, the SAM has drawn scorn and skepticism from certain validators. Marinade’s SAM enables validators to bid on network stake, with winners securing stake and passing on elevated rewards to delegators.

To win auctions, validators competitively bid on network stake. However, surging demand for stake has driven validators to bid at potentially unsustainable levels. In previous epochs, winning validators needed to yield over 10% APY to win auctions, a rate considered impossible to achieve through native staking alone.

This has led certain operators to speculate on how these validators can afford such high bids. Suggesting that such yield can only be achieved through malicious activities, like sandwich attacks, private mempools, and off-chain deals, some validators argue that Marinade is turning a blind eye to dishonest validators.

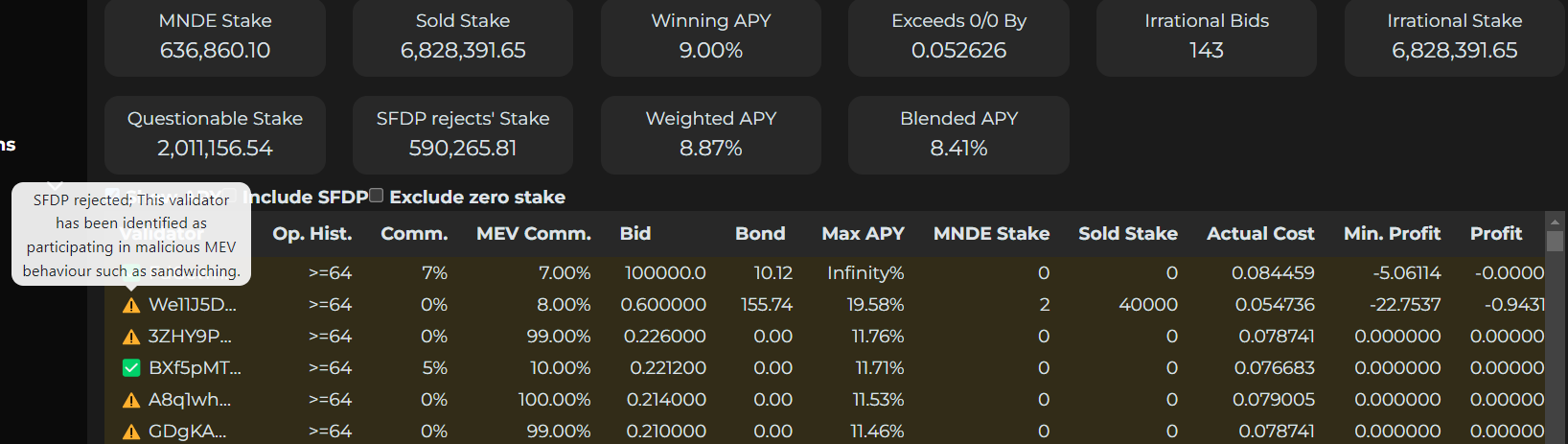

Distressed validators have created analytics dashboards to express their frustrations and support their claims. Hanabi’s ‘Marinade Stake Selling’ dashboard highlights that a number of validators flagged for malicious activity have won stake through the SAM.

Responding to accusations levied by third-party dashboard creators, Marinade CEO Michael Repetny argues “Hanabi lacks any methodology, they only copy labels from other Stakewiz dashboard to call it a day.”

Adding further context to the claims of disgruntled operators, Repetny affirms “Hanabi lost 1M SOL from Marinade so it’s understandable he fights the new system.”

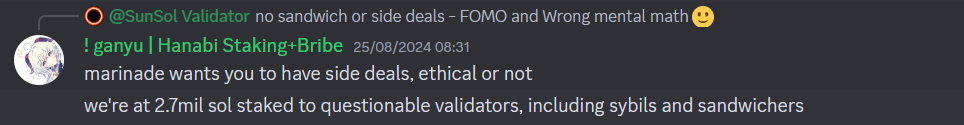

Concerned validators have taken to Marinade’s Discord server to air their grievances. Operators have claimed that, through the SAM, over 2.7M SOL has been staked to questionable validators, including sybils and sandwiches. Disgruntled operators even suggested “Marinade wants you to have side deals, ethical or not.”

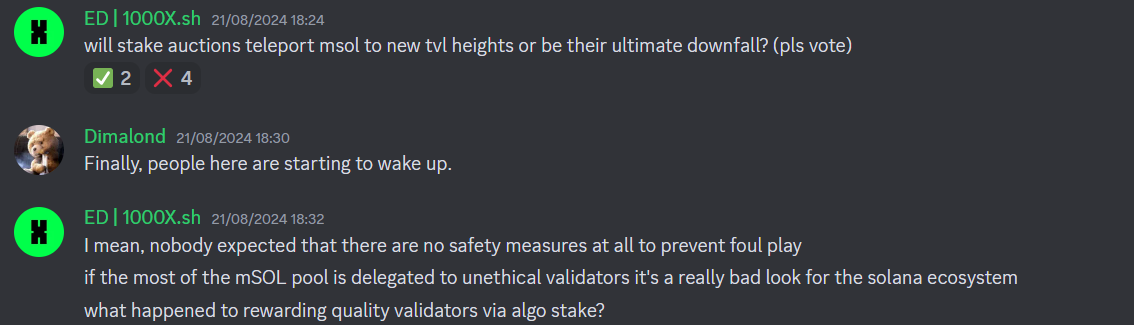

Additionally, validators have argued that if “most of the mSOL pool is delegated to unethical validators it’s a really bad look for the Solana ecosystem.”

In an exclusive statement with SolanaFloor, Max Kaplan, Head of Engineering at Edgevana, credits Marinade for trying something inventive that “had never been done before”.

However, Kaplan admits that Marinade “went full capitalist… basically, the highest bidder wins. Marinade doesn’t really care if a validator bids for stake and is just gonna lose money on that stake, that’s not their problem… They’re happy to take the money and give that to mSOL holders.”

Experts argue that in current conditions, staking yield over 10% simply isn’t sustainable. Kaplan contends “10% APY is higher than the native staking yield that is paid out on chain. The money has to come from somewhere.”

Without making any accusations, Kaplan theorizes that additional yield could potentially come from a validator’s own “marketing/growth budget” or other sources like “SWQoS / private mempool deals”.

Responding to any accusations, Repetny reinforces Marinade's stance that “SAM provides the best yield on the market for delegators. It is not an active policy maker or opinionated strategy to tweak the network.”

Solana Foundation Stokes the Flames

The Solana Foundation’s Delegation Program (SFDP) has further exasperated the unfolding conflict. Designed to support decentralization and maximize the number of validators on the Solana network, the SFDP matches delegated SOL on a 1:1 basis.

Effectively, validators who are eligible for SFDP matching can double the stake obtained through winning bids via Marinade’s SAM. This means that previously unprofitable SAM bids can be made profitable through SFDP matching.

This arguably provides SFDP-eligible bidders with an advantage, because they can place higher bids knowing that the Solana Foundation will match any stake the bidder wins in the auction, effectively doubling their stake.

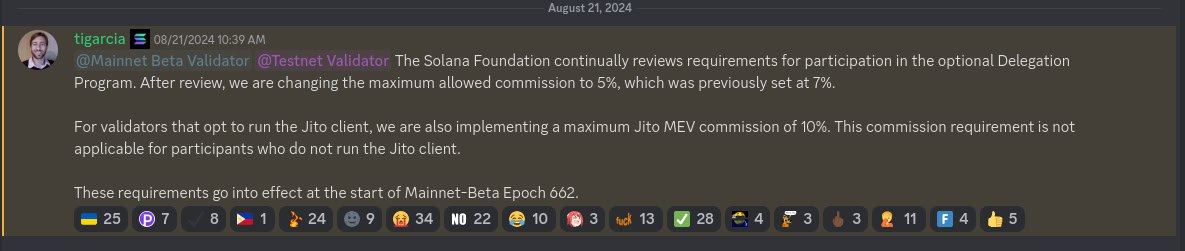

Adding another layer of complexity, the Solana Foundation announced on August 21 that they would be dropping the maximum validator commission from 7% to 5% and setting a maximum MEV commission of 10%.

When the Solana Foundation dropped the required commission from 7% to 5%, operators were required to cut into their profitability to maintain SFDP eligibility.

Some validators argue that this development indirectly benefits ‘dishonest validators’ who allegedly have SWQoS/private mempool offchain side deals that allow them to bolster their yield. At the same time, the move has supposedly hamstrung honest validators, who are now unable to bid as much as they would like in the SAM due to reduced profitability.

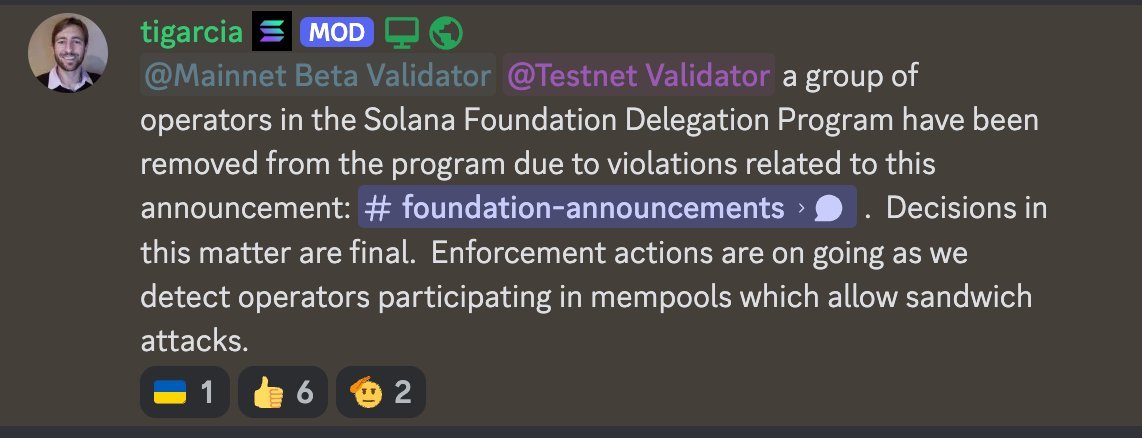

Conversely, the Solana Foundation also vets all validators involved in the program and removes malicious actors.

Combatting Malicious Validators

The crypto space is a fiercely competitive environment. Even in sectors supposedly dedicated to noble pursuits like decentralization and the common good, there are always players looking for a larger slice of the pie.

In a bid to disarm malicious actors, community groups have formulated complex methodologies designed to expose harmful validators. Once exposed, stakepool operators can blacklist bad actors.

SolBlaze, one of Solana’s largest stakepool operators, has expressed its desire to work alongside the validator community to counter malicious operators.

However, the process is easier said than done. According to Kaplan, one of the main obstacles is ensuring that the data is 100% accurate. In some cases, honest validators can be still blacklisted for genuine mistakes, despite their best intentions.

Though staking providers like Jito are making progress in this endeavor, Kaplan argues that validators should also be allowed to remove themselves from blacklists, provided they adhere to operational guidelines.

Meanwhile, Paladin MEV developer and bloXroute CEO Uri Klarman argues "there's very little value to 'blacklisting' validators, since after each blacklist the validator can spin up a fresh new validator and bid for stake."

Marinade Refutes Validator’s Accusations

Marinade Finance has been resolute in its response to these severe claims. In an exclusive statement with SolanaFloor, Marinade Head Chef Michael Repetny contends that the protocol is delivering its intended outcome: Optimized APY at scale.

Regarding the hunt for bad actors, Repetny asserts “There is no objective methodology to identify malicious validators continuously.” However, the founder assures validators “We are researching the topic together with other ecosystem projects like Foundation or Jito.”

Instead of subjecting the protocol to the whims of vexed operators, Marinade believes “the malicious validators should be eliminated by in protocol changes or on the application/RPC layer instead.”

Finally, Repetny noted that, ironically, “80% of [the] network runs Jito and directly participate on negative MEV externalities like sandwich transactions. By using this logic we should ban Jito client which we don't consider a step forward in decentralization.”

All things considered, competition within Solana’s staking landscape is reaching a fever pitch. While decentralization and improved network security are crucially important, the reality is that the typical staker is motivated primarily by financial rewards.

Marinade’s SAM model is inherently designed to competitively maximize staking rewards. Network participants are free to deposit their SOL where they see fit, regardless of the opinions of concerned validators.

Read More on SolanaFloor

Solana-based oracle makes its mark:

Pyth Network Market Share Up 120% YTD, Closing Gap on Chainlink

What is Solana Staking: