Solana Stablecoin Supply Up 46% in 5 Months - Bullish or Bearish?

Stablecoins supplies are surging on Solana. Is smart money taking profit, or are traders preparing to take positions ahead of the next leg up?

- Published:

- Edited:

Off the back of new 24-hour all-time high volumes in DEX and perpetual trading volumes, stablecoin supplies on Solana are steadily increasing.

At its highest point since March 2024, Solana’s soaring stablecoin supply indicates one of two things. Either savvy traders are taking profits and storing wealth in pegged assets, or market participants are establishing new positions in ecosystem tokens.

Stablecoin Market Cap Breaks $5B

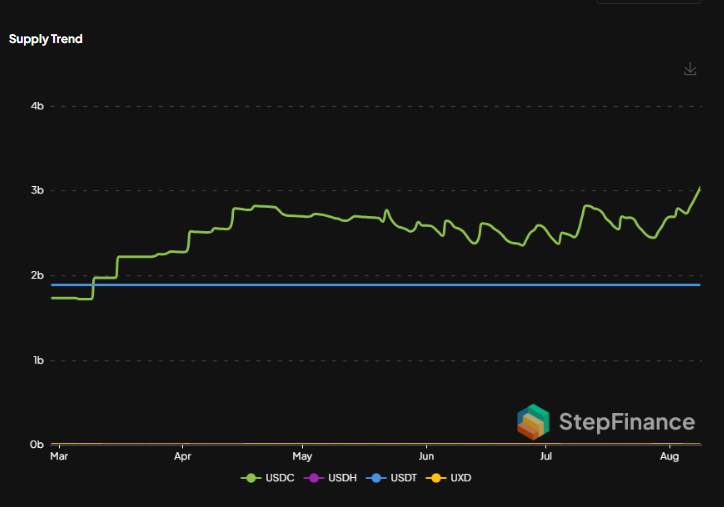

Following volatile market conditions earlier this week, the total supply of stablecoins on Solana has surpassed 5B. The key milestone comes off the back of a consistent surge in stablecoin growth, with the total supply of Solana-based stablecoins increasing by 46% since March 1st, 2024, based on Step Finance data.

Solana’s sustained stablecoin growth can be credited to several factors. The network has witnessed meteoric growth within its thriving DeFi sector, with Solana flipping Ethereum to lead all Layer 1 blockchains in monthly DEX trading volume.

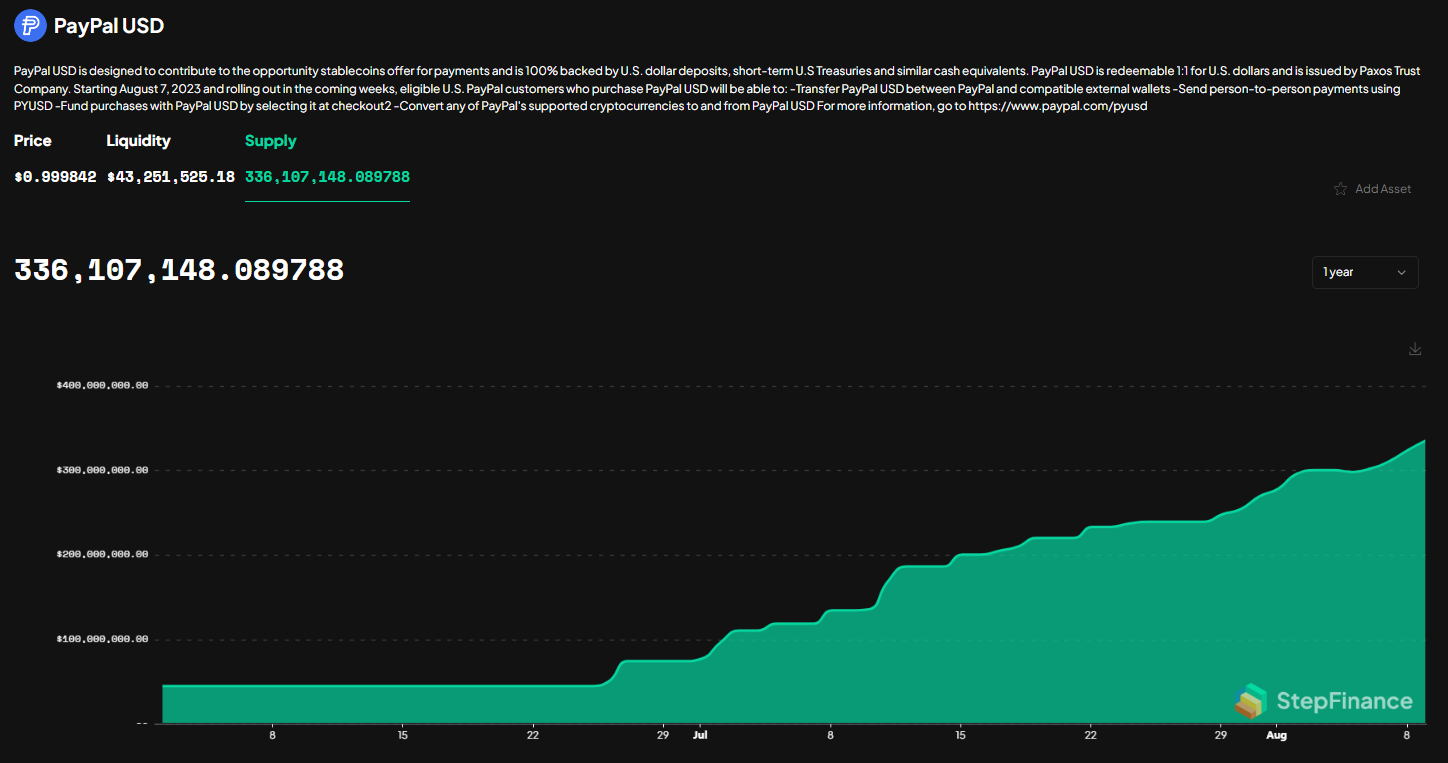

The expansion of additional stablecoins to Solana has also played a role in the network’s DeFi growth. Emerging stablecoins like Paypal’s PYUSD and Ethena’s USDe have also migrated to Solana in the hopes of capturing some of Solana’s growing user base.

At press time, Circle’s USDC is the clear leader in market dominance. USDC currently accounts for 57.52% of all stablecoins on the network, however, PYUSD’s relentless growth in recent months cannot be overlooked. According to Step Finance data, PYUSD’s supply has exploded by 646% since June 1st, rising from 45M to 336M.

It also needs to be noted that approximately 400M USDC is currently stored on the Solana blockchain, but not included in circulation. These tokens have been pre-minted to onchain accounts, but are yet to be issued. For this reason, stablecoin data across platforms can sometimes be inconsistent.

Inflows Suggest Bullish Trajectory

A growing stablecoin supply onchain can be perceived as both a bullish or bearish catalyst, depending on external factors. For example, traders taking profits and exchanging large amounts of SOL or other tokens for stablecoins could suggest that markets have peaked.

However, the inverse could also be true. The growth of stablecoins on the network could also indicate that a growing number of traders and investors are preparing to establish positions ahead of the next leg up.

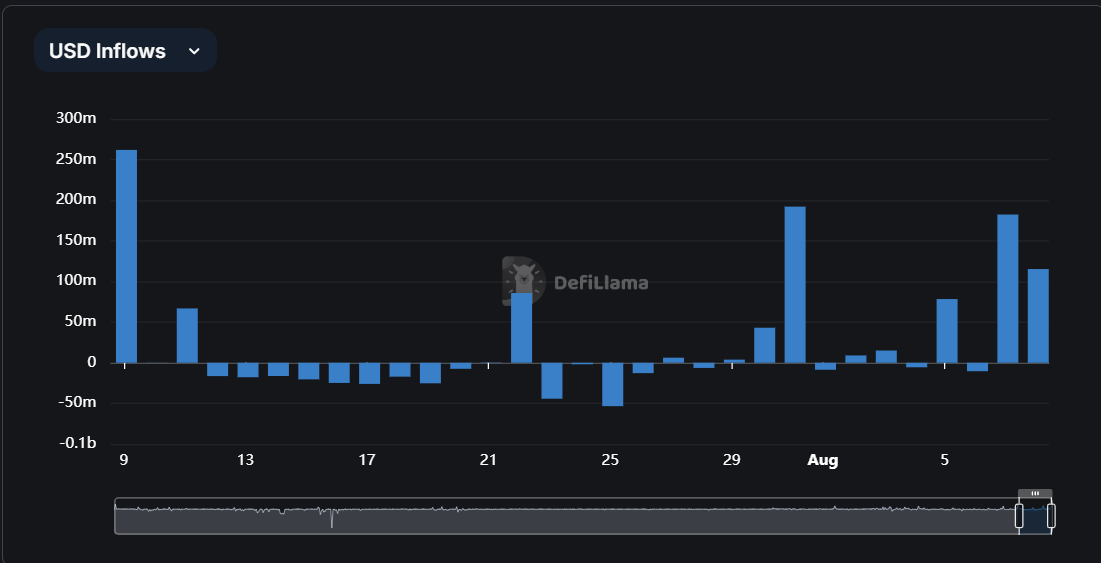

In recent months, the Solana blockchain has witnessed immense inflows of stablecoins, both from cross-chain bridges and issuers like Circle. According to the last 30 days of DeFiLlama data, Solana has witnessed over $744M worth of net stablecoin inflows. Moreover, 49.15% of this figure was bridged to Solana since the market crash suffered on the 5th of August.

As noted by Gumshoe, a prominent influencer, there are now significantly more stablecoins now than back in March, a time when SOL was trading at $210.

The significant inflows of stablecoins to the Solana network suggest that traders are looking to deploy capital within the ecosystem. Now that the dust has settled following this week’s devastating crash, hopeful traders and investors across the space are eager for the market to resume a bullish trajectory.

Read More on SolanaFloor

Binance Labs increases its exposure to Solana DeFi:

Binance Labs Backs Solayer, Stepping Into Solana’s Restaking Arena

Need a Primer on Stablecoins?