Solana Perps TVL Up 447% YTD: Jupiter, Drift Leading the Charge

Defying expectations, Solana’s burgeoning perpetual markets continue to explode with activity in the wake of TGE airdrop farming.

- Published:

- Edited:

With the network’s perpetual trading platforms notching all-time highs in TVL (Total Value Locked) and daily trading volume, Solana summer is in full swing.

Despite the belief that mercenary capital and airdrop farmers were generating artificial volume in Solana’s perpetual scene, trading appetite has returned in full force.

Since January 1st, Solana perpetual exchange TVL is up 447%. Which DeFi apps are leading the charge?

Jupiter Records All-Time High in TVL and Trading Volume

At the forefront of Solana’s perpetual trading resurgence, Jupiter seems to be achieving new milestones every week. After launching its perpetual exchange in Q4 2023, Jupiter’s TVL has steadily increased. At press time, the protocol boasts over $554M in TVL.

Beyond its growing TVL, the Jupiter perpetual exchange also recorded a new all-time high in daily trading volume, netting over $1.13B over a 24-hour period.

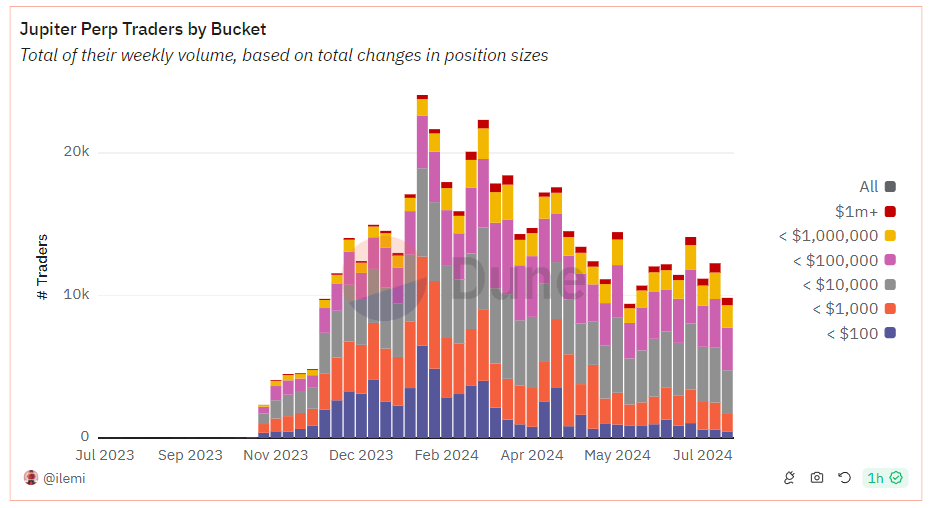

While it could be argued that much of this volume is generated by airdrop farmers in anticipation of upcoming JUP token distribution, trade bucket sizes indicate that may not be the case. Sybil farmers targeting tier-based airdrops generally spread micro trades (worth under $100) across a large number of wallets.

Based on Dune Analytics data pulled over the last week of trading activity, 61.48% of position sizes are trading between $1,000-$100,000. This suggests that the bulk of trading activity on the Jupiter perpetual exchange is organic.

Liquidity Providers Capitalize on Abundant DeFi Yields

Solana’s expansive DeFi ecosystem and surging perpetual trading volumes benefit more than traders alone. Liquidity providers and yield farmers have been served a veritable feast, with generous lending rates being offered across the network.

Kamino Finance, Solana’s largest lending platform, has been offering impressive APYs across a vast range of assets. Notably, the protocol’s ongoing collaboration with Paypal’s PYUSD has been a strong driver of liquidity, consistently offering over 15% yearly returns on deposits.

Thrilled with the application’s performance, Kamino co-founder asserted that Kamino lenders were earning approximately $180,000 per day.

Never far from the action, Drift Protocol has also been distributing liberal APYs to its many liquidity providers.

Courtesy of Drift’s wide diversity of perpetual markets and trading pairs, USDC lending through Drift Earn has become one of the best places for stablecoin deposits in the stablecoin ecosystem.

Trading Activity Remains Consistent, Despite Farmer Exodus

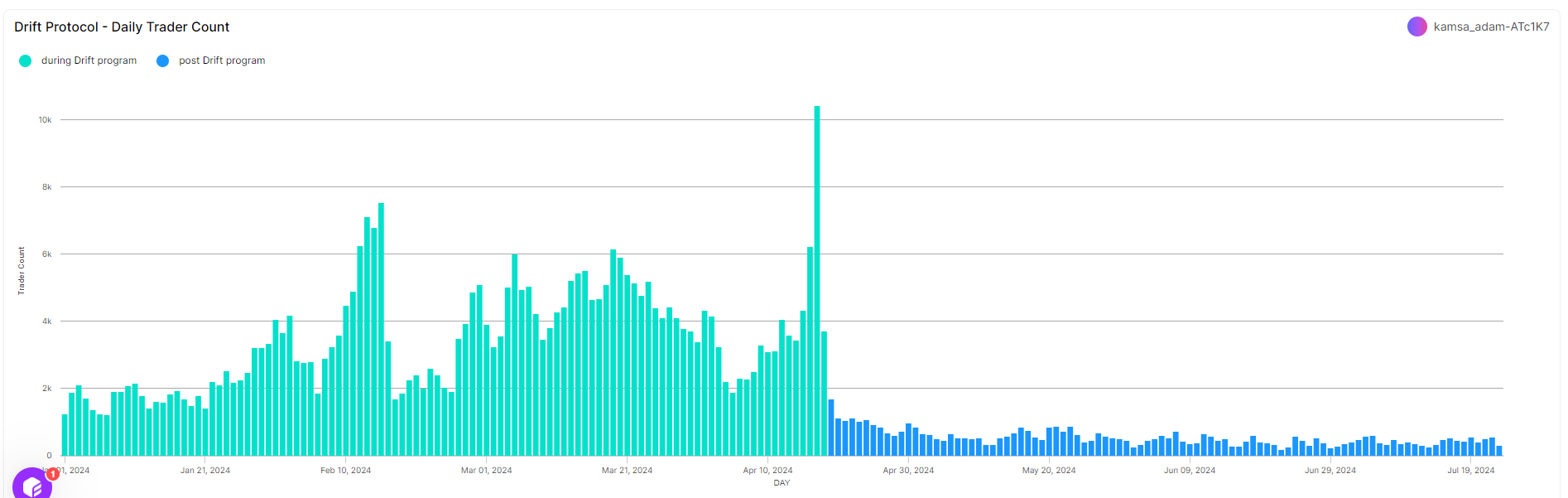

Admittedly, much of the perpetual trading adoption and activity earlier in the year could have been attributed to airdrop farmers generating artificial volume.

However, despite a reduction in active accounts, trading volumes on platforms like Drift Protocol have remained consistent with pre-airdrop levels.

Flipside data illustrates a significant drop in the number of active accounts on the platform following the protocol’s TGE (Token Generation Event) in April.

Yet, despite dramatically reduced users, Drift’s TVL has continued to increase while trading volume has maintained consistent levels, as evidenced by DeFiLlama data.

With thousands of new Solana wallets being created every day and the cryptocurrency industry being further legitimized through the approval of ETFs, Solana’s burgeoning DeFi ecosystem is expected to continue its impressive growth.

Read More on SolanaFloor:

Are prediction markets a window to the future?

Need a DeFi Recap?