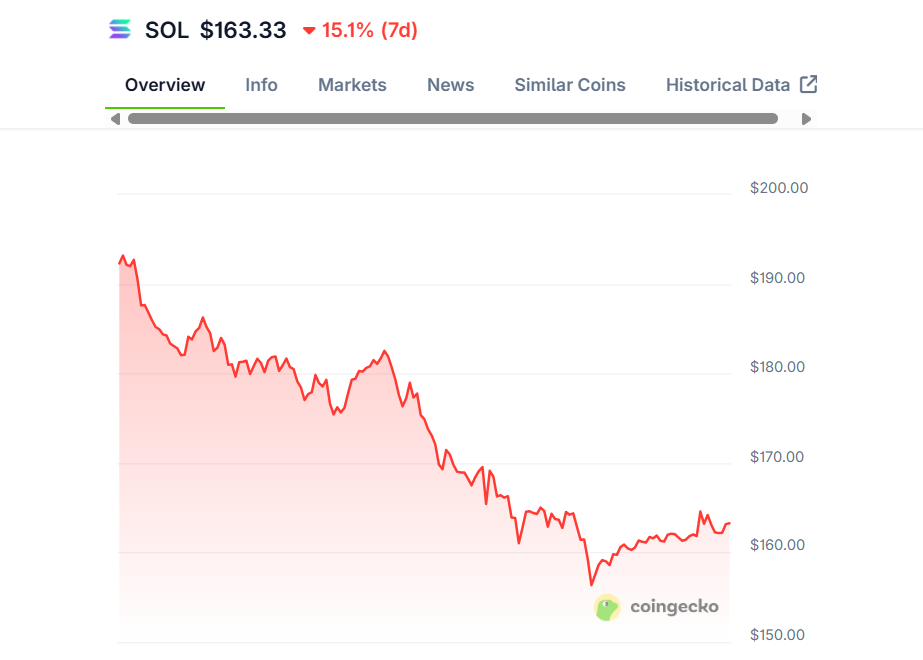

Following a strong July performance that propelled Solana past the $200 mark, the asset has experienced a notable pullback. Solana hit a monthly high of $206 before declining more than 15% over the past week. As of the time of writing, $SOL is trading around $165, reflecting broader market softness and increased volatility.

Following a strong July performance that propelled Solana past the $200 mark, the asset has experienced a notable pullback. Solana hit a monthly high of $206 before declining more than 15% over the past week. As of the time of writing, $SOL is trading around $165, reflecting broader market softness and increased volatility.

The recent downturn underscores the ongoing sensitivity to broader macroeconomic trends, as well as the impact of leveraged positioning in both centralized and decentralized trading environments.

DEXs are the New CEXs

Between July 31 and August 1, Solana traders faced $120 million in liquidations, driven by a sharp market correction. Notably, the majority of these liquidations occurred onchain. According to data from Ranger Finance and Coinglass, onchain liquidations totaled $77.45 million, significantly outpacing the $43.39 million in liquidations recorded on centralized exchanges.

This trend reflects a growing shift in trading behavior, where decentralized platforms are increasingly central to market activity during periods of heightened volatility. It also illustrates the degree of leverage and exposure many market participants maintain onchain.

CME Open Interest in Solana Futures Hits Record Levels

While short-term price action turned negative for the better part of last week, institutional demand for Solana exposure continued to strengthen. Open interest in Solana CME futures reached $800 million in July, a notable high and a 370% increase from $170 million earlier in the month.

The surge in futures activity aligns with the launch of the first U.S.-based Solana staking ETF and the growing expectation that a spot ETF approval may not be far off. These developments have positioned Solana as one of the primary vehicles for institutional engagement in the altcoin space.

The Chicago Board Options Exchange (CBOE) has also filed for Generic Listing Standards for crypto ETPs, which require that the underlying asset has traded on a U.S. exchange as a futures product for at least six months. Since Solana futures were listed on CME as of February 18, the asset will meet this requirement on September 17, making it eligible under the proposed framework.

The growing role of CME futures in Solana markets marks a shift in how large investors access crypto exposure. While CME products are typically used for hedging and speculative strategies, rising open interest signals confidence in sustained trading volumes and continued attention from professional market participants.

Solana-Based Investment Products See Steady Inflows

Solana digital asset products, including exchange-traded products (ETPs), funds, and ETFs, recorded $8.8 million in inflows last week. This marks the fifth consecutive week of net positive flows, pushing year-to-date totals to $852 million.

While inflow volumes remain modest compared to the record inflows for Bitcoin and Ethereum products in July, some investors may find $SOL a worthy substitute for these leading assets. These inflows reflect both long-term conviction in Solana’s ecosystem and anticipation surrounding potential regulatory approval for additional ETF structures.

The U.S. Securities and Exchange Commission faces a deadline of October 10 to respond to pending Solana ETF filings, with the possibility of approval as early as September. This timeline aligns with Solana's upcoming eligibility under CBOE’s Generic Listing Standards.

Outlook for $SOL Remains Mixed in Short Term

Despite the ongoing inflows and institutional interest, Solana faces near-term headwinds. The recent correction and liquidation wave suggest that leveraged positioning remains a key risk factor. At the same time, the underlying fundamentals, such as CME futures growth and ETF pipeline developments, continue to support the case for long-term adoption.

Read More on SolanaFloor

Meteora Launches Season 1 Points Checker Ahead of $MET Airdrop

July Sees Solana Stablecoin Transfers Surge 53% to $215B: A Deep Dive into Ecosystem Growth

How Will Solana ETFs Perform?