Which Solana Ecosystem Tokens Showed Resilience in Market-Wide Crash?

Despite red candles across the cryptocurrency markets, some Solana-based tokens held up better than others. Who’s showing strength amidst the bloodbath?

- Published:

- Edited:

Driven by continued BTC sell pressure from the German government and the looming threat of Mt. Gox claimants liquidating their returns, the crypto markets are seeing red this morning.

Dropping 5.34% in 24HR and 11.45% on a 7D timeframe BTC brought the rest of the market crashing down, dragging SOL down 6.92% on the daily and 13.83% on the weekly.

Amidst the chaos, some Solana ecosystem tokens have reacted to market dynamics better than others. Which assets have shown relative strength in the face of the crash, and which have suffered devastating drawdowns?

The ‘Winners’ Circle

While the majority of digital currencies are down across the board, certain assets have shown resilience and outperformed SOL during the drawdown. Outside of volatile, low-liquidity meme coins, established Solana projects like Step Finance (STEP) and Lifinity (LFNTY) have demonstrated remarkable toughness while the market collapses around them.

Disclaimer: SolanaFloor is owned and operated by Step Finance

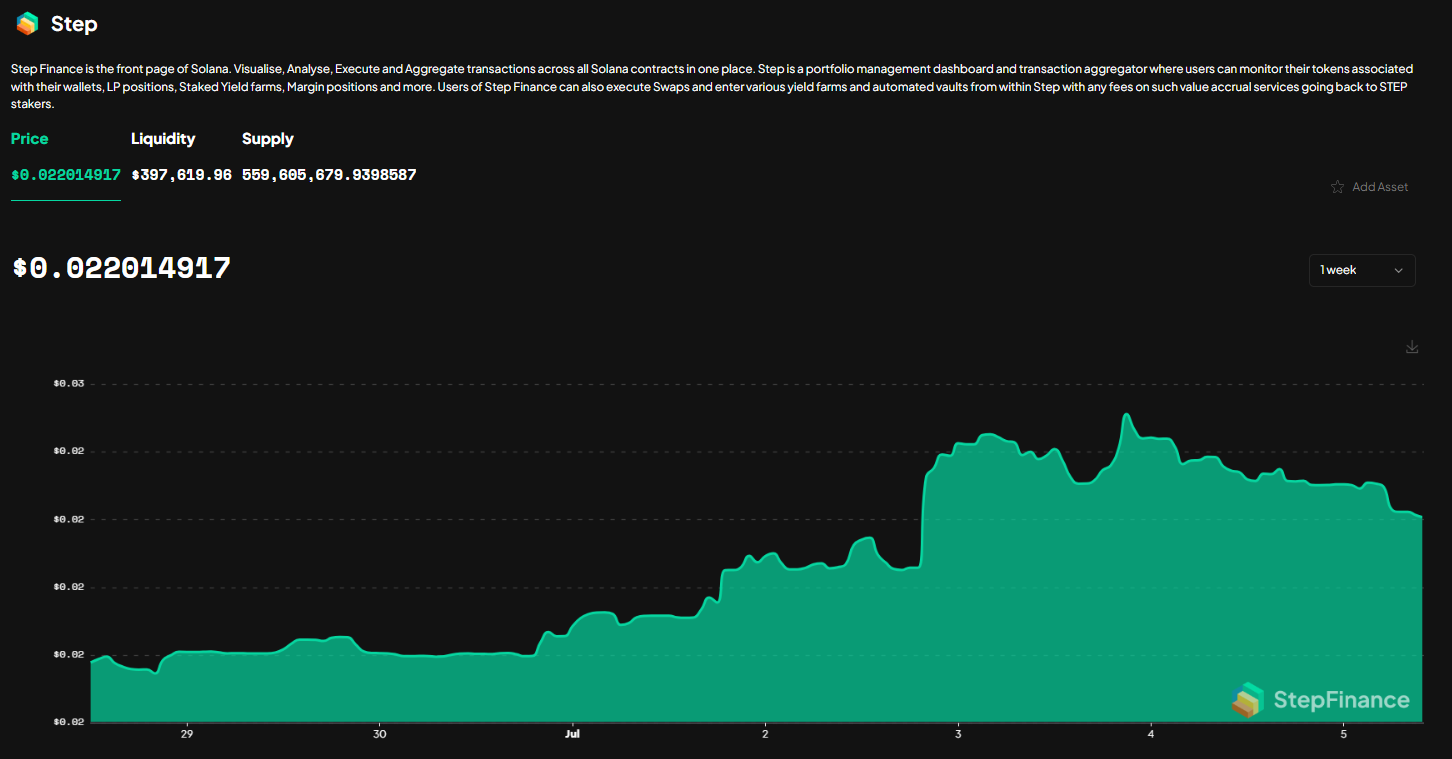

Step Finance, a long-standing Solana analytics platform, is weathering the storm admirably. Down a mere 4.72% over the last 24 hours, $STEP has outperformed SOL in this period. Moreover, despite fearful market conditions, $STEP is up 22.34% on a 7D timeframe, indicating that buyers are accumulating $STEP during this prolonged wider downturn.

$STEP's impressive performance could also be influenced by the platform's recent Summer Burn, in which 50M STEP tokens, valued at over $1M, were permanently removed from the total supply.

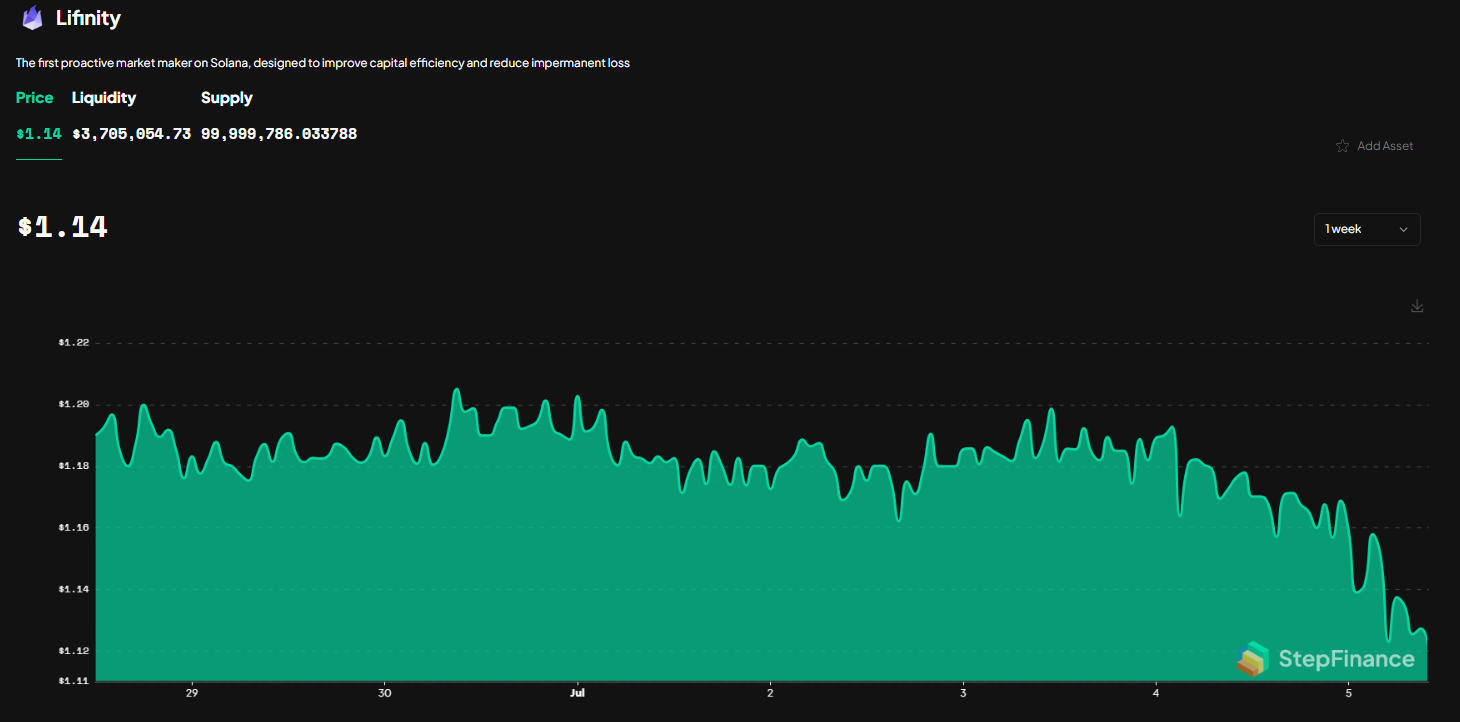

Decentralized market maker and concentrated liquidity provider Lifinity Protocol has also shown strength. Currently exchanging hands at $1.14, $LFNTY is down just 4.64% on a daily time frame. This drawdown is consistent with its 7D price history, which is similarly down 4.20%.

Unfortunately for the Solana ecosystem, these altcoins are the exception, not the rule. Which tokens suffered the most in the past week’s trading?

The Underperformers

Accelerated selling across the Solana ecosystem has left some cryptocurrencies looking a little worse for wear. Some of the worst-hit tokens include Wormhole (W), io.net (IO), and Tensor (TNSR).

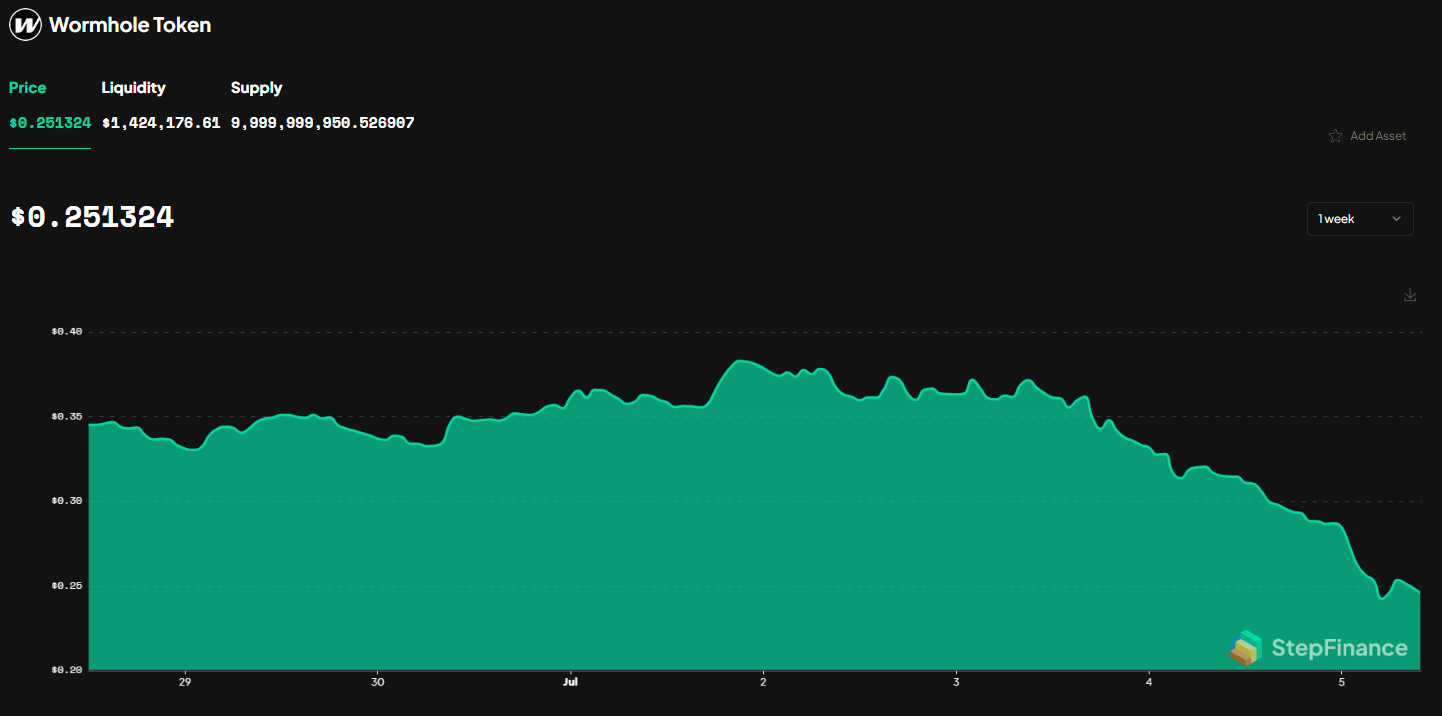

Bearish market conditions showed Wormhole no remorse, with the cross-chain bridge protocol’s native token $W sliding deeper into an extended period of consolidation. Trading at $0.35 this time last week, $W is down 27.3% on a 7D timeframe. Following BTC’s crash in the last 24 hours, $W has suffered a 19.4% decline on the daily.

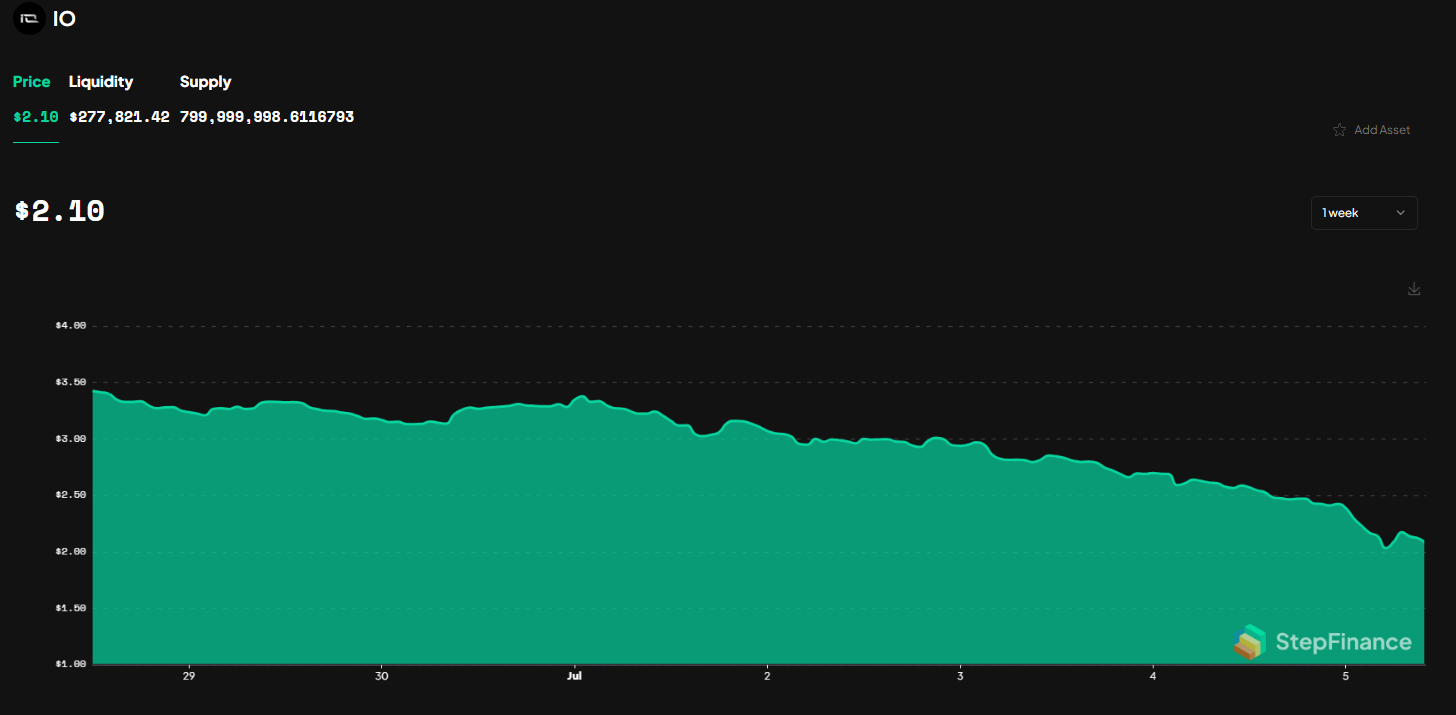

Likewise, DePin project and recent market entrant io.net hasn’t been spared. As if an 18.1% drop in price in 24 hours isn’t difficult enough, the project’s native token, $IO, is currently down 39.65% over a 7D period. Starting the week at $3.48, $IO is currently trading at $2.10 at press time.

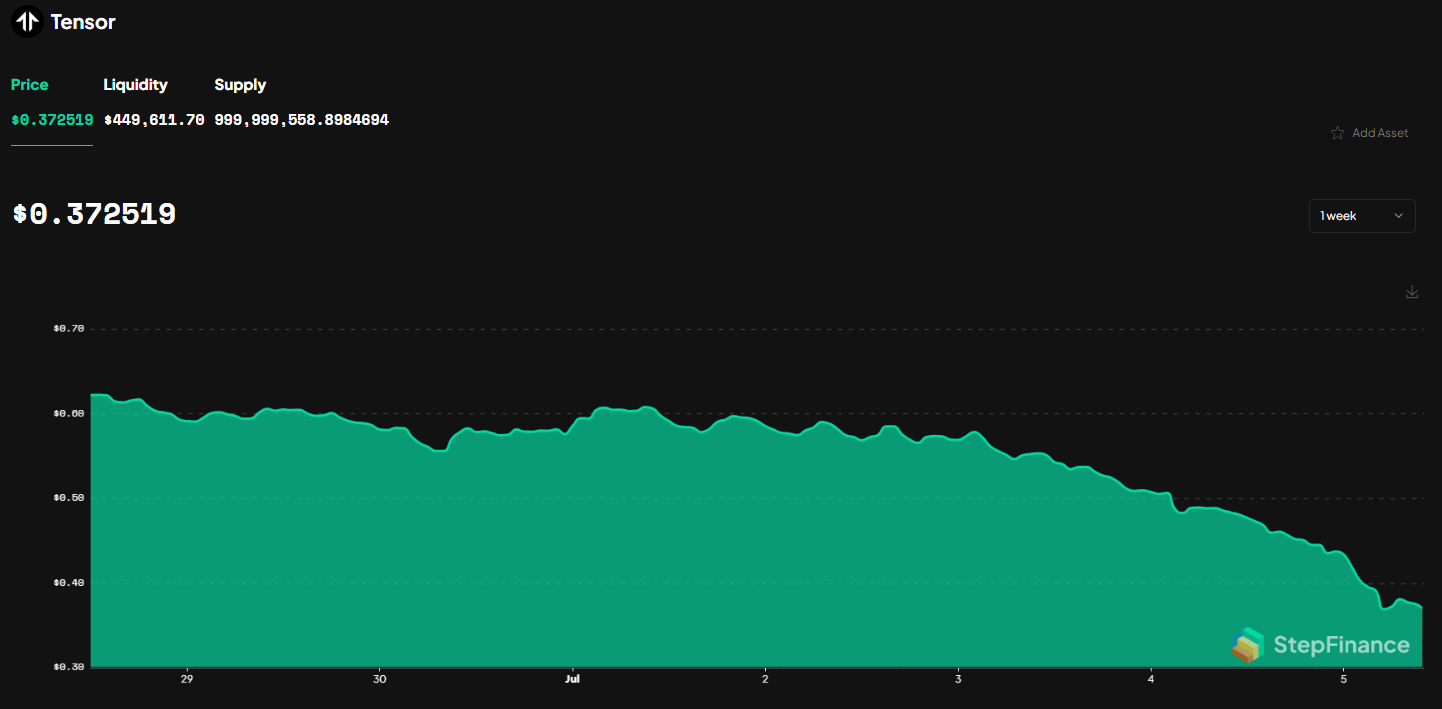

Finally, one of the hardest-hit tokens across the Solana ecosystem is none other than $TNSR. At press time, $TNSR is trading at $0.37 recording price declines of 21.2% and 40.3% on daily and 7D timeframes, respectively.

What About Meme Coins?

While Solana's iconic meme economy has suffered drawbacks that are consistent with the wider market, one brave puppy is defying all the odds and confidently breaking new all-time highs. $BILLY, the latest pooch to capture the attention and capital of meme coin traders has completely disregarded its rivals, gaining 20.9% in 24 hours and achieving a market capitalization of over 150M.

$BILLY's meteoric price action and volume have not gone unnoticed, with centralized exchanges like Gate.io and MEXC clamoring to list the burgeoning meme coin.

What Happens Next?

There’s no denying these are trying times for the crypto market. However, despite the volatile conditions, the Solana ecosystem is still showing signs of strength relative to the rest of the market.

Compared to other top 10 coins, SOL has been holding its own against BTC in the last 24 hours. Additionally, over 250M USDC has been minted on the network via Circle’s USD treasury, suggesting that buyers are eager to establish positions in Solana-based altcoins during this downturn.

Read More on SolanaFloor:

Zeta Markets TGE - By the numbers:

41.6% of ZEX Airdrop Recipients Have Diamond Hands - Did Zeta’s Gamified Claim Strategy Work?

Disclaimer: SolanaFloor is owned and operated by Step Finance