Solana Dominates DEX Volume, Economic Value, and Net Inflows in October

Q4 is off to a roaring start in the Solana Ecosystem, with the network leading all chains in several key metrics.

- Published:

- Edited:

After challenging Ethereum all year, the Solana network now consistently outperforms crypto’s biggest Layer-1 blockchain over longer time frames.

Throughout October, Solana eclipsed Ethereum in a variety of crucial metrics. Buoyed by bullish sentiment across the wider crypto market, network activity on Solana is flourishing.

With Q4 well underway, blockchain data suggests that Solana has become the first port of call for onchain activity.

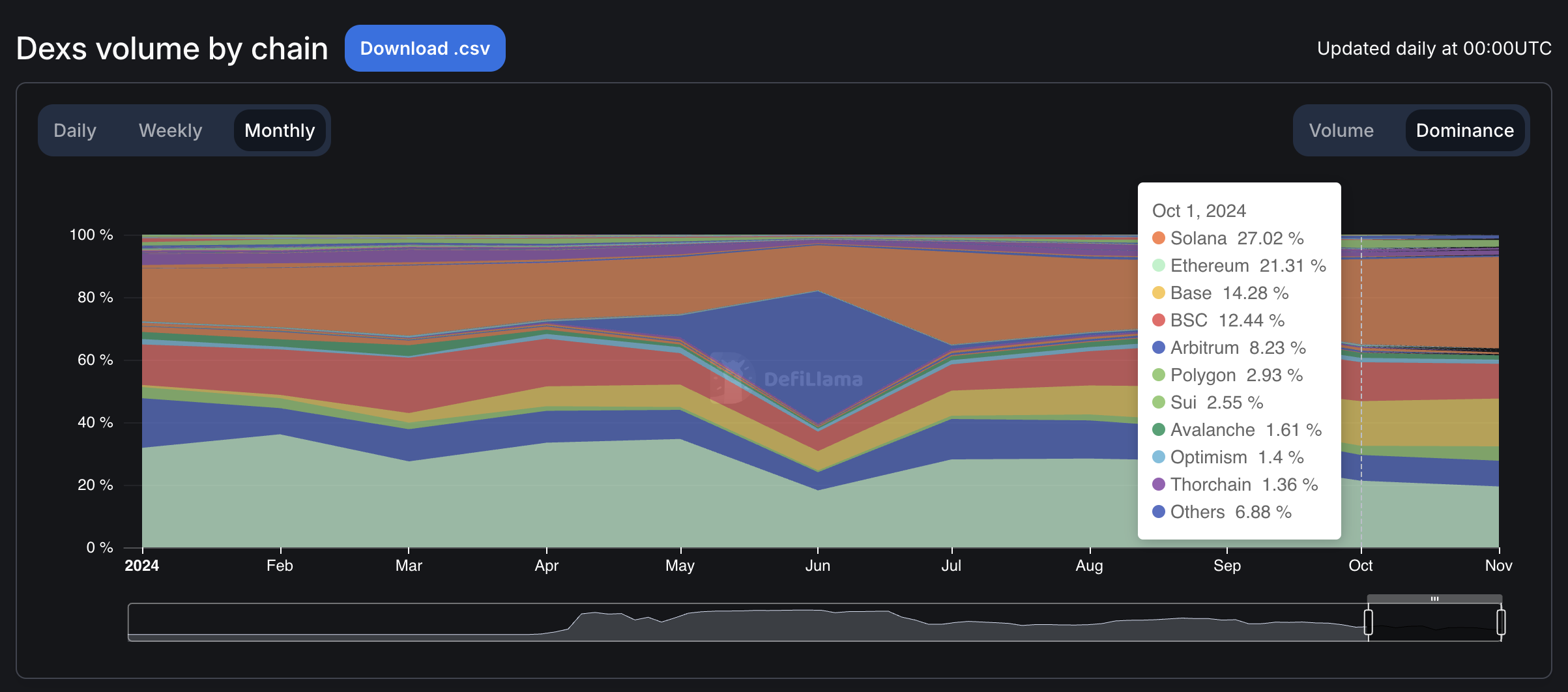

Solana Commands 27% of DEX Volume Market Share

Spearheaded by the network’s thriving meme economy, Solana DEX volumes dominated all rival chains in October.

According to DefiLlama data, Solana accounted for over 27% of DEX market share across all blockchains, witnessing over $52B in trading volume. Solana enjoyed over 26% more DEX trading volume than its closest rival Ethereum, which facilitated $41B in DEX volume.

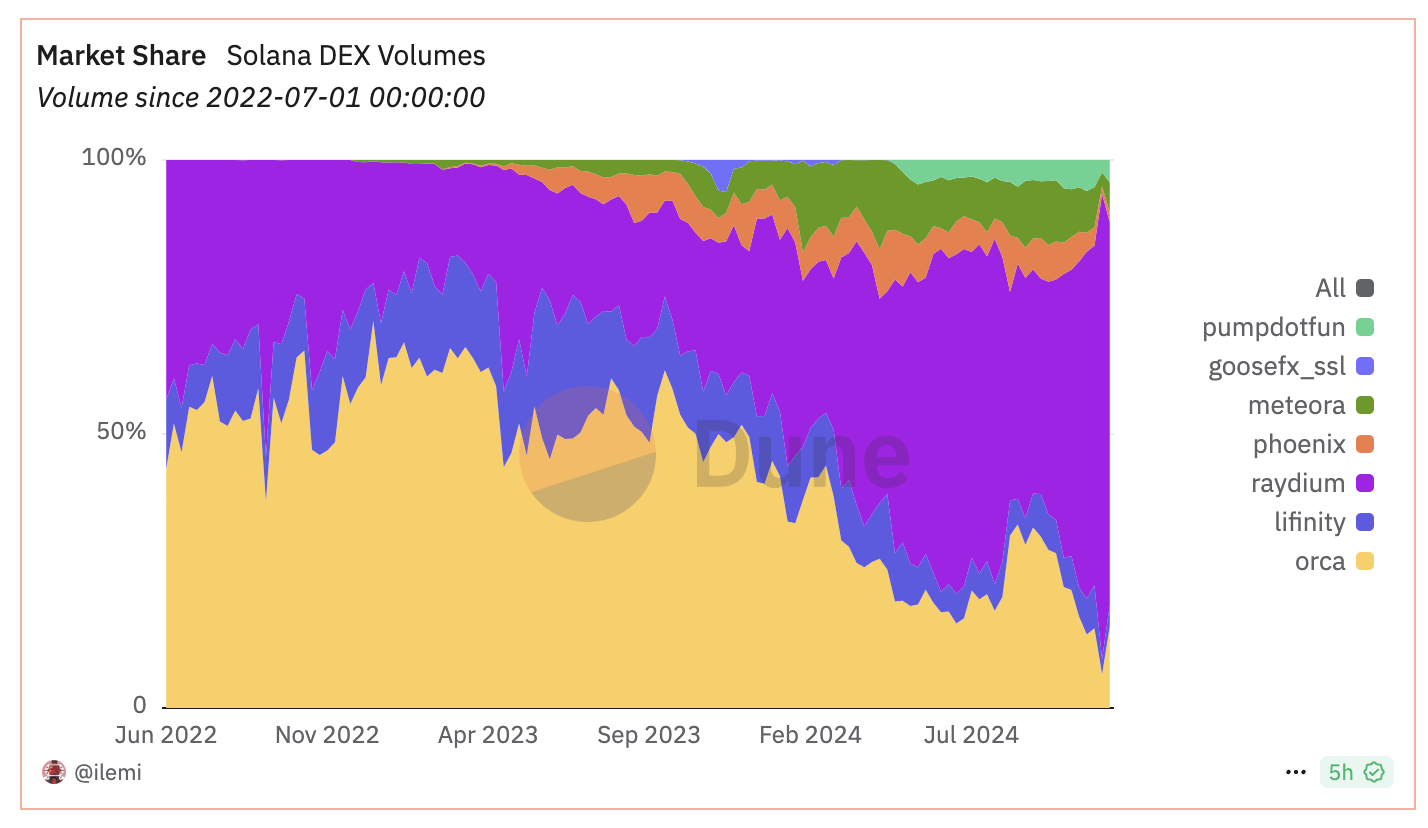

Raydium, Solana’s largest decentralized exchange, captured the lion’s share of trading volume. Based on Dune Analytics data, Raydium’s weekly dominance peaked towards the end of the month, when the DEX commanded over 60% of market share.

Solana’s prolific DEX trading volume was largely driven by the AI Agent memecoin frenzy. TruthTerminal’s $GOAT token ran to an all-time high market capitalization of $800M and attracted over $5.4B of cumulative trading volume.

Following $GOAT’s success, deployers launched dozens of copycat AI memecoins using pump.fun, a popular no-code token creator. Inspired by the viral trend, pump.fun witness its all-time high in daily launches, with 36,339 SPL tokens deployed on October 24, 2024.

Trend Favors Solana Value Generation

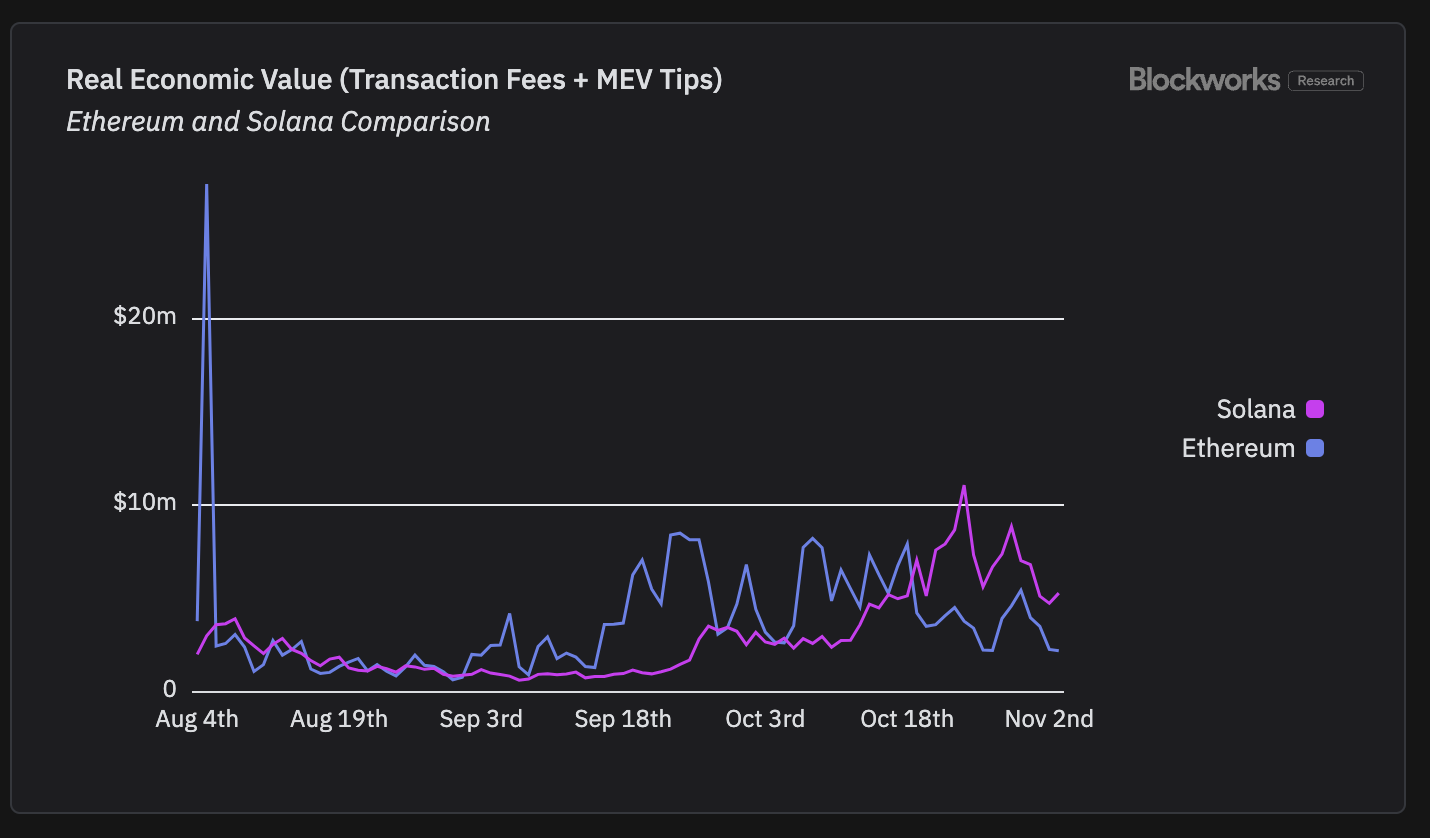

The network’s explosive DEX trading volumes have been a boon for Solana’s economic value. Surging network activity has caused a Solana transaction fees to increase, resulting in higher value generation for network validators.

In the final two weeks of October, Solana generated significantly more revenue from transaction fees and MEV tips than Ethereum. This trend has continued into early November, suggesting that validators can expect Solana’s high-fee generation to continue.

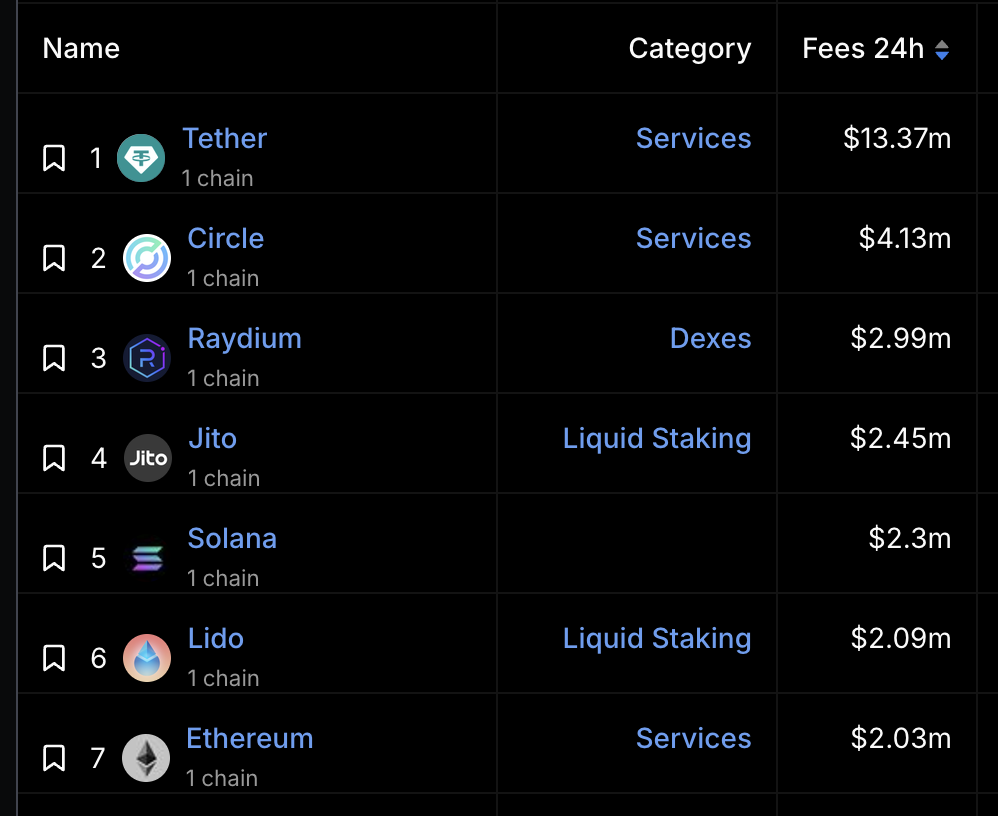

Within the ecosystem, Solana-based projects have continued to dominate fee-generation across the web3 world. Based on DefiLlama data, projects like Jito and Raydium regularly featured as some of the industry’s leading fee generators throughout the month.

Despite the Solana ecosystem’s impressive showings towards the end of the month, Ethereum was still the overall leader on a 30D time frame. However, Solana’s recent dominance has continued into November, suggesting momentum favors the network.

Liquidity Flows to Solana

On top of high DEX trading volumes and booming Real Economic Value, Solana also enjoyed high inflows of liquidity.

Solana witnessed over $600M of inflows throughout October, with over 90% of those bridging over from Ethereum.

October was one of Solana’s biggest months of the year in terms of onchain adoption and activity. After several months of sideways consolidation and market uncertainty, Q4 appears to be fulfilling the bullish expectations placed upon it.

Solana’s impressive network performance throughout October has been further reinforced by sustained activity so far in November. On a MTD timeframe, Solana currently leads Ethereum in DEX volume, Real Economic, and net inflows, highlighting the network’s position as crypto’s central hub of onchain activity.

Read More on SolanaFloor

One of Solana Gaming’s biggest giveaways has just begun:

Star Atlas Golden Carnival to Distribute $4M in Rewards to Players - Here’s How to Get Involved

Learn More About the Solana Ecosystem