Solana DePins Rally Over 30% While TradFi Platforms Suffer Outages - A Sign of the Future?

DePin tokens like SHDW, RENDER, and HONEY bounced hard after chaotic market dynamics sent crypto prices tumbling.

- Published:

- Edited:

Solana DePINs (Decentralized Physical Infrastructure Networks) once again proved their worth. Showing resilience in the face of bearish market forces, DePIN tokens have enjoyed a powerful resurgence from local bottoms, indicating strong demand.

Moreover, infrastructure outages across the world of traditional finance lend further credibility to DePINs and other decentralized services.

DePin Tokens Bounce Hard

Despite suffering devastating drawdowns off the back of recession fears and growing uncertainty in traditional markets, Solana’s DePin tokens are attempting a V-shaped recovery.

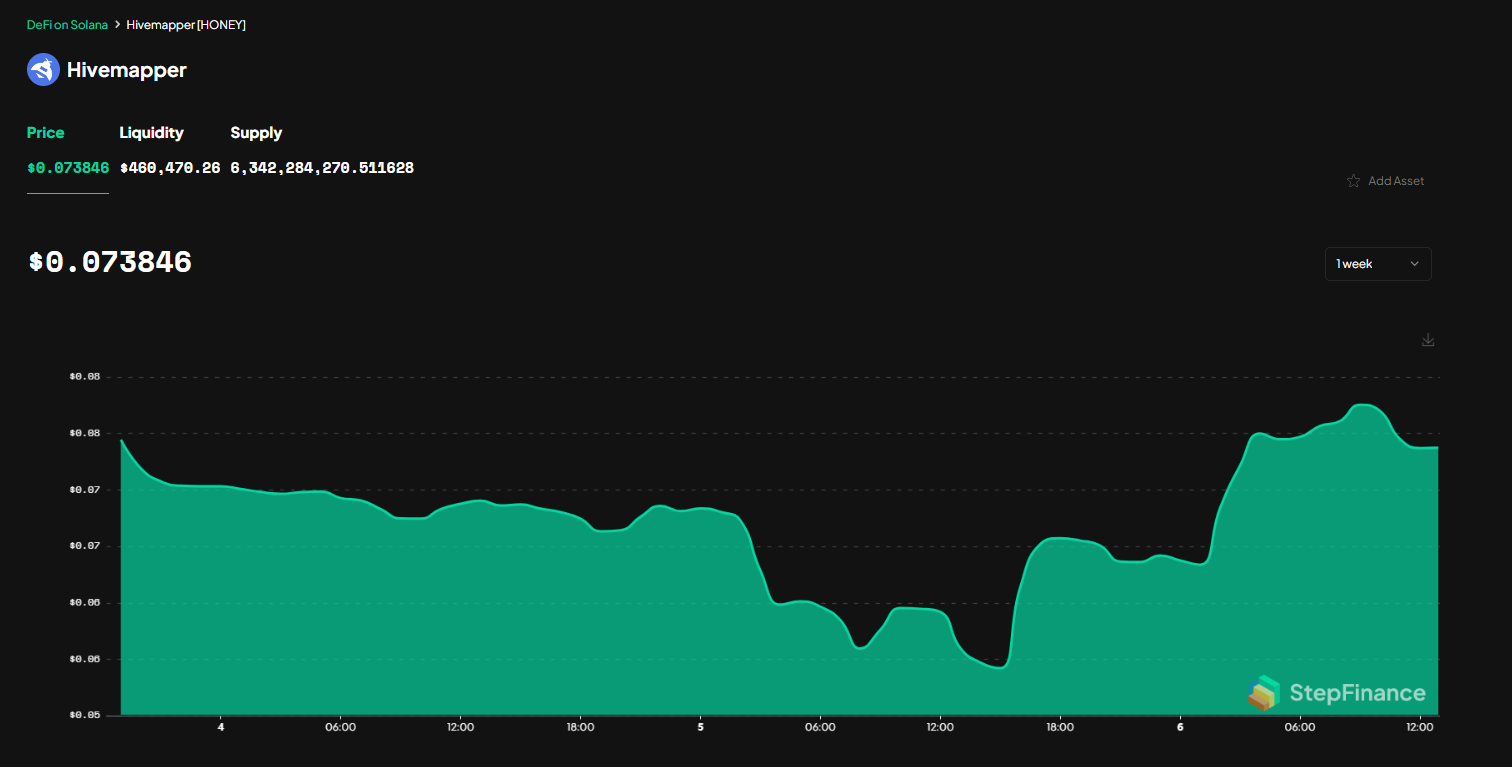

Leading the bounce, Hivemapper (HONEY) sprung from as low as $0.05 to currently exchange hands at 0.073, completing a 45.9% recovery from the lows based on Step Finance data.

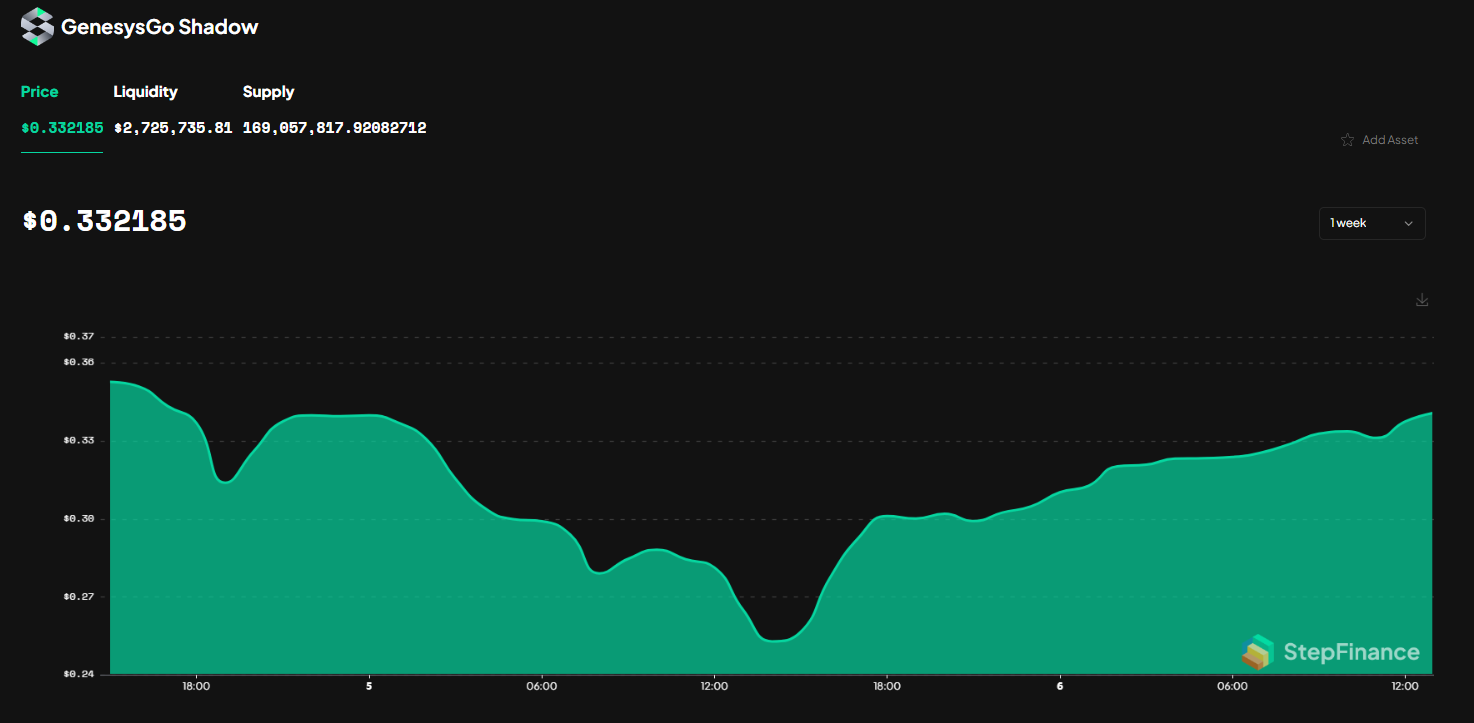

Hot on HONEY’s trail, GenesysGo’s native token SHDW also found plenty of eager buyers as market conditions shifted. After forming a local bottom at $0.25 the decentralized storage solution is up 32%, trading at $0.33 at press time.

Meanwhile, Render (RENDER) enjoyed one of the best performances among high-cap assets. The Solana-based GPU marketplace surged up 26% off the lows, trailing only PEPE (29%) and TAO (41%) among the industry’s top 50 cryptocurrencies by market capitalization. RENDER is currently priced at $4.63, based on Step Finance data.

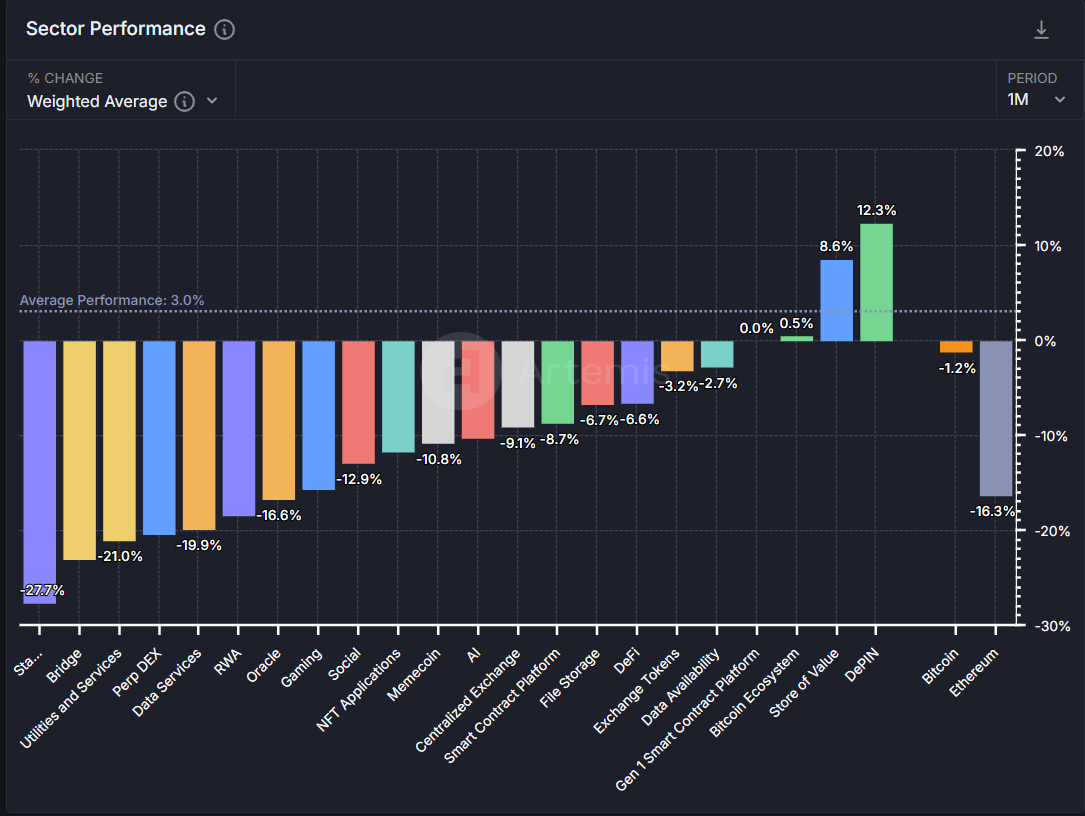

According to Artemis data, DePIN tokens have outperformed all other sectors by a considerable margin over the last month. While the majority of the market has suffered heavy losses, the DePIN sector is the only niche within the industry to have recorded double-digit average growth over the last 30 days.

DePIN’s impressive performance in the face of market-wide adversity indicates that the sector is witnessing high demand as incentives position themselves for the next phase of the cycle.

TradFi Meltdown Highlights Decentralized Solutions

Monday morning’s market opening unleashed chaos in traditional finance, with at least six prominent trading platforms collapsing under the weight of demand.

With investors and traders all over the world scrambling to access their portfolios, the following exchanges and platforms suffered outages:

-

Charles Schwab

-

Fidelity

-

TD Ameritrade

-

Vanguard

-

E-Trade

-

Citi

Despite the chaos, Solana’s decentralized ecosystem maintained perfect uptime, despite DeFi applications like Kamino processing over 6,000 liquidations.

The network’s performance during this black swan highlights the growing reliability of decentralized services. Admittedly, these TradFi platforms would’ve witnessed dramatically higher numbers of users during this period, but the fact that industry heavyweights like Fidelity and Vanguard weren’t prepared highlights why permissionless access is so important.

Skeptical social media commentators theorize that the outages might have been deliberate, allowing institutional players to exit positions before retail investors could access their trading desks.

Solana DePIN Stalwarts

One of the strongest performers in the recent market bounce, GenesysGo (SHDW) is one of Solana’s original DePIN projects.

Envisioning a mobile-first future, GenesysGo is developing the world’s first fully decentralized storage solution powered entirely by mobile devices. Through shdwDrive, users can transform their mobile devices into yield-bearing assets by safely providing unused hard-drive space.

Not only does shdwDrive optimize data storage, it also provides a far more sustainable alternative to centralized data storage providers. Traditional server farms can be devastating to local environments through high energy consumption and carbon emissions.

By transferring this infrastructure to devices that are already used daily and live in the pockets of millions of people around the world, decentralized storage solutions like shdwDrive help make the information age more eco-friendly.

Following a devastating sell-off triggered by recession fears and the dramatic unwinding of Jump Crypto’s assets, market participants have used the dip to establish new positions. Solana’s DePIN ecosystem has proved considerable strength on the market bounce, meaning that investors acknowledge the vast potential within this sector.

Read More on SolanaFloor

DeFi and Gaming weathered the dip, but who got hit hardest?

Solana DeFi, Gaming Tokens Show Relative Strength in Market-Wide Crash

What is DeFi?