SEC Greenlights Ethereum ETFs, What Does This Mean for Solana?

After looking like an ambitious pipe dream this time last year, spot Ethereum ETFs have finally been approved by the SEC. What happens next for Solana?

- Published:

- Edited:

Following the landmark approval of spot Bitcoin ETFs in the United States, Ethereum (ETH) has finally taken that critical step and cemented its position in traditional finance markets. Led by BlackRock, VanEck, and Fidelity, Ethereum ETFs are scheduled to go live for trading on the 23rd of July.

Ethereum ETFs Launch July 23rd

According to CBOE (Chicago Board Options Exchange), five Ethereum ETFs are scheduled to go live for trading on July 23rd, 2024. The five confirmed funds are:

- Vaneck Ethereum ETF (ETHV)

- Invesco Galaxy Ethereum ETF (QETH)

- Franklin Ethereum ETF (EZET)

- Fidelity Ethereum Fund (FETH)

- 21Shares Core Ethereum ETF (CETH)

While CBOE officially confirmed the five funds listed, ETFs operated by BlackRock, Bitwise, Grayscale, and ProShares will also be listed on the New York Stock Exchange and NASDAQ. To encourage immediate inflows and trading activity, several firms will implement fee waivers until caps of between $0.5B-$2.5B are reached.

Reacting positively to the announcement, the Ethereum community is optimistic that the launch of ETH ETFs will spearhead a surge of positive price action for the asset. Lofty ETH price targets returned to social media, with ETH bulls claiming that "$10,000 is programmed this cycle".

Since the official announcement, ETH price has remained relatively stable, trading hands at $3,477.

What Does This Mean for Solana?

While the Ethereum community is naturally thrilled by the announcement, all eyes now turn to the domino effects caused by the milestone achievement. With millions of institutional capital expected to flow into Ethereum ETFs, what could that mean for the rest of the market?

Primarily, Ethereum ETF approval paves the way for an eventual Solana ETF approval in the near future. It proves that some of the biggest obstacles previously blocking ETH ETF approval, namely decentralization concerns and its potential classification as a security, can be overcome.

The breakthrough approval not only puts cryptocurrency assets in front of thousands of potential investors, but it legitimizes the asset class in the eyes of the general public.

By approving Ethereum ETFs, the United States Securities and Exchanges Commission sends a clear message: Sufficiently decentralized cryptocurrencies have a place on Wall St. This belief is reinforced by some of the world’s largest institutional funds, including VanEck and 21Shares, who have already filed for Solana ETFs prior to Ethereum’s approval.

It is widely believed that the U.S. Presidential Election is a make-or-break moment for a Solana ETF approval. Bloomberg analysts argue that a Trump Presidency is a favorable outcome, but will not guarantee an eventual approval. Should events play out positively for Solana, experts suggest we may see approval by March 2025.

Will Ethereum’s Approval Boost SOL Price?

Looking at historical data, we could expect the approval and legitimization of one cryptocurrency asset to serve as a positive price catalyst for others.

When the SEC approved Bitcoin on January 10th, the global cryptocurrency markets initially suffered small pullbacks, likely due to sell-the-news behavior on behalf of traders who believed that the Bitcoin ETF narrative was already priced in.

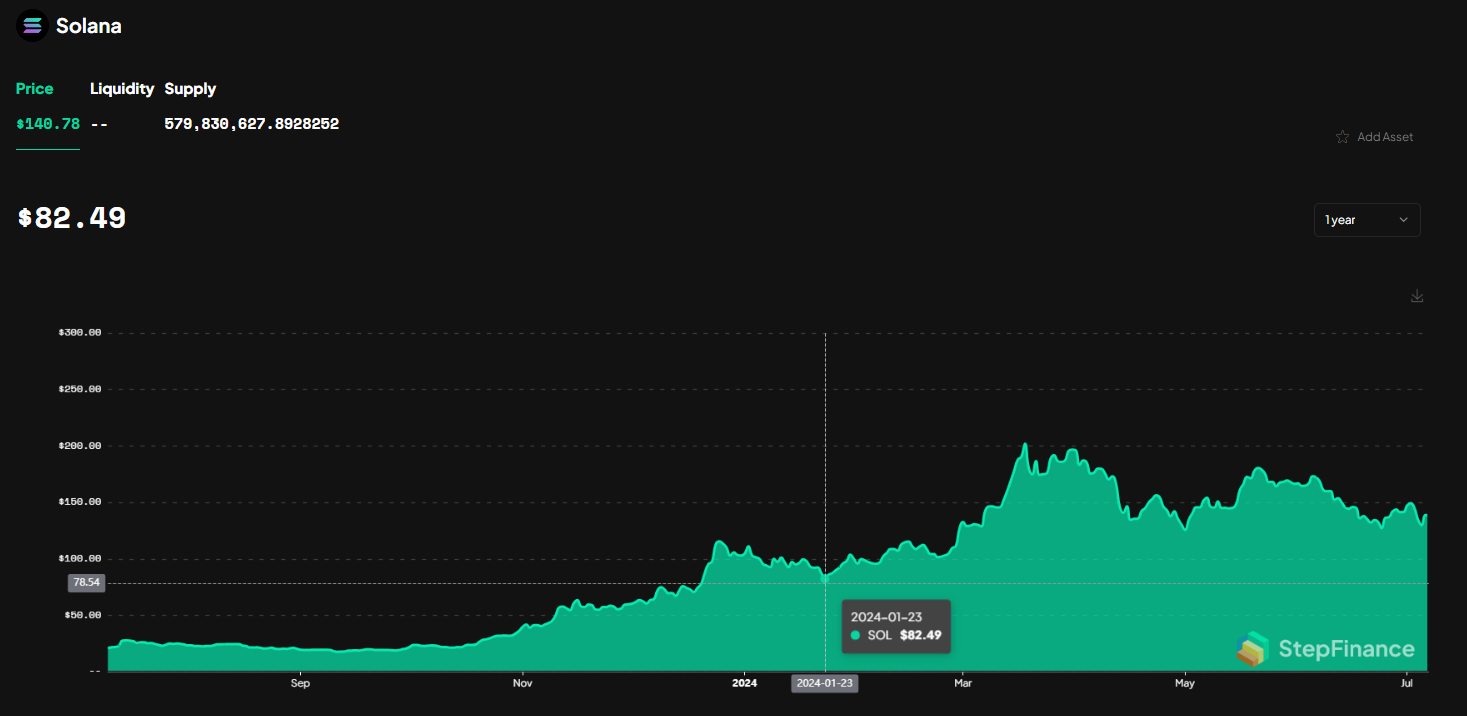

In the following months, steady inflows into Bitcoin ETFs drove bullish movement into the wider crypto market, with ETH surging from local lows of $2,236 in late January to as high as $4,070 in March, completing an 82% move. During the same period, SOL enjoyed a 144.87% price appreciation, skyrocketing from as low as $82 to local highs of $202 based on Step Finance data.

Regardless of immediate price impact and market dynamics, the approval of Ethereum ETFs ushers in a new era of mainstream cryptocurrency acceptance. With a Solana ETF next in line, the Ethereum ETFs performance in the coming months will play a key role in determining the remainder of this cycle.

Read More:

Marinade continues to offer unrivalled staking services:

Marinade PSR Optimizes Solana Staking for Consistent Yield