Raydium Perps TVL, Volume Up Only Since Launch

Solana’s biggest DEX is making ground on its new perps competitors.

- Published:

- Edited:

Despite fierce competition in Solana’s derivatives trading scene, Raydium’s new perpetual exchange has enjoyed impressive growth since its January 10 launch.

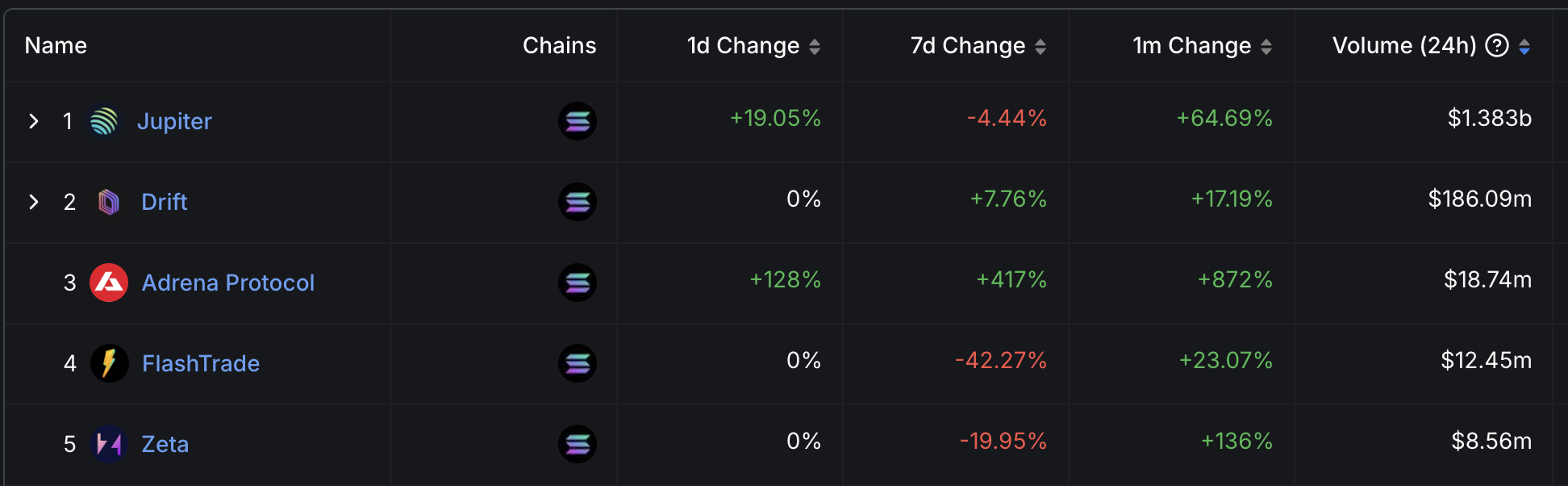

Daily trading volumes on the platform are surging, with Raydium perps flipping rival protocols like Adrena Finance and Flash Trade.

While the platform is currently feeless, Raydium’s perp DEX could be a welcome addition to its industry-leading buyback program.

Raydium Perps 24-Hour Volume Cracks $24M

Currently in its beta phase, Raydium’s new perpetual DEX is witnessing growing trading volume. According to Raydium API data, the protocol has facilitated over $24M in the last 24 hours.

When compared to perpetual volume data provided by DefiLlama, Raydium’s perpetual trading platform exceeds rivals like Adrena Protocol and Flash Trade. Additionally, the data suggests that Raydium is slowly gaining ground on Drift Protocol, one of Solana DeFi’s most popular perpetual exchanges.

According to Orderly Network, the permissionless liquidity layer underlying Raydium perps, the platform is witnessing consistent growth, with average daily trading volume reportedly increasing by 81.9% every day, as of January 24, 2025.

Perpetual Collateral Up 34% in 7 Days

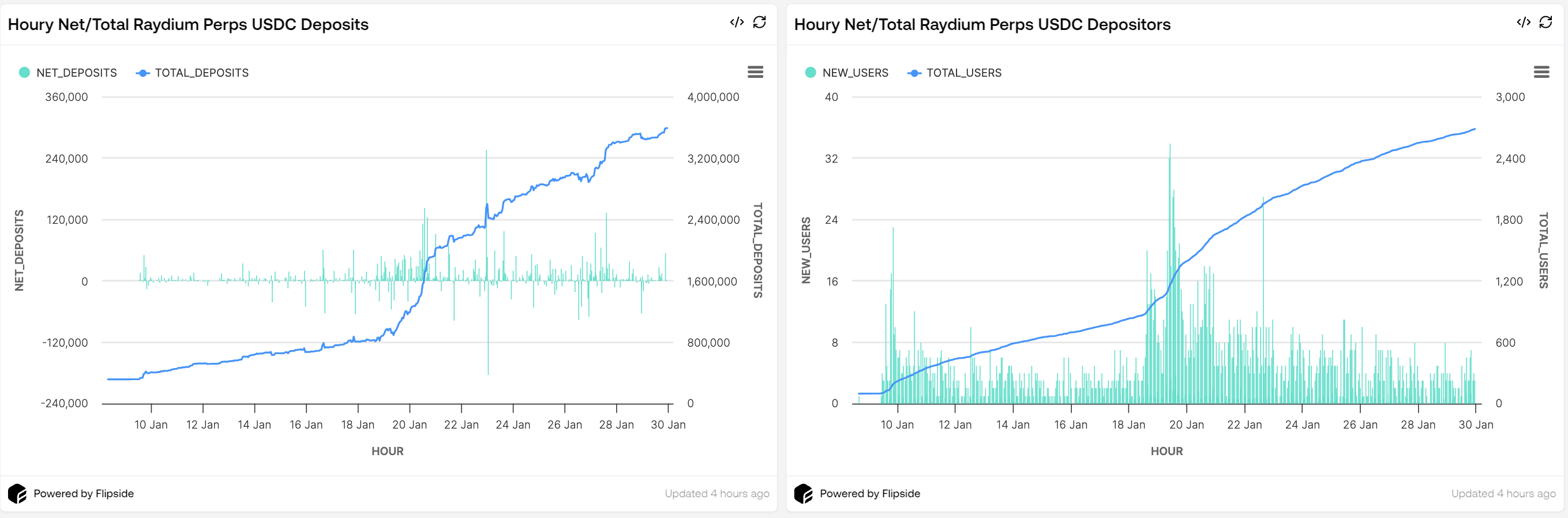

Alongside steadily rising trade volumes, Raydium perps is consistently onboarding new traders and growing its TVL and collateral.

According to Flipside data, the number of unique depositors has increased by around 30% in the last 7 days, with over 2,600 traders committing funds to the protocol.

Over the same time frame, $USDC collateral deposited to the platform is up 34% in the last 7 days, rising from $2.6M to $3.5M.

While the number of unique depositors can only increase over time, the fact that collateral continues to rise suggests that users are keeping funds within the app. If the protocol’s TVL remained stable while unique depositors increased, that would suggest traders were removing their funds after trying the platform.

$RAY Buybacks Crack $420M

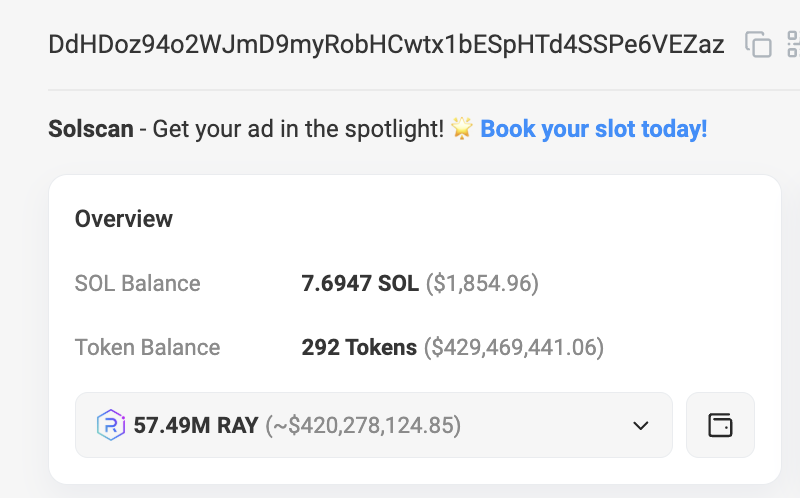

Like many crypto projects aiming to support token value, Raydium directs a percentage of platform fees toward purchasing its native token, $RAY, directly off the market.

Raydium’s buyback mechanism is one of Solana’s biggest value drivers, with the protocol’s buyback wallet holding over 57M $RAY, currently valued at over $420M.

During its beta period, Raydium perpetuals has committed to charging traders zero fees, excluding the 0.025% taker fee enforced by Orderly Network.

|

Exchange |

Maker Fee |

Taker Fee |

|

Raydium |

0% |

0.025% (via Orderly) |

|

0.06% |

0.06% |

|

|

-0.01% |

0.03-0.1% |

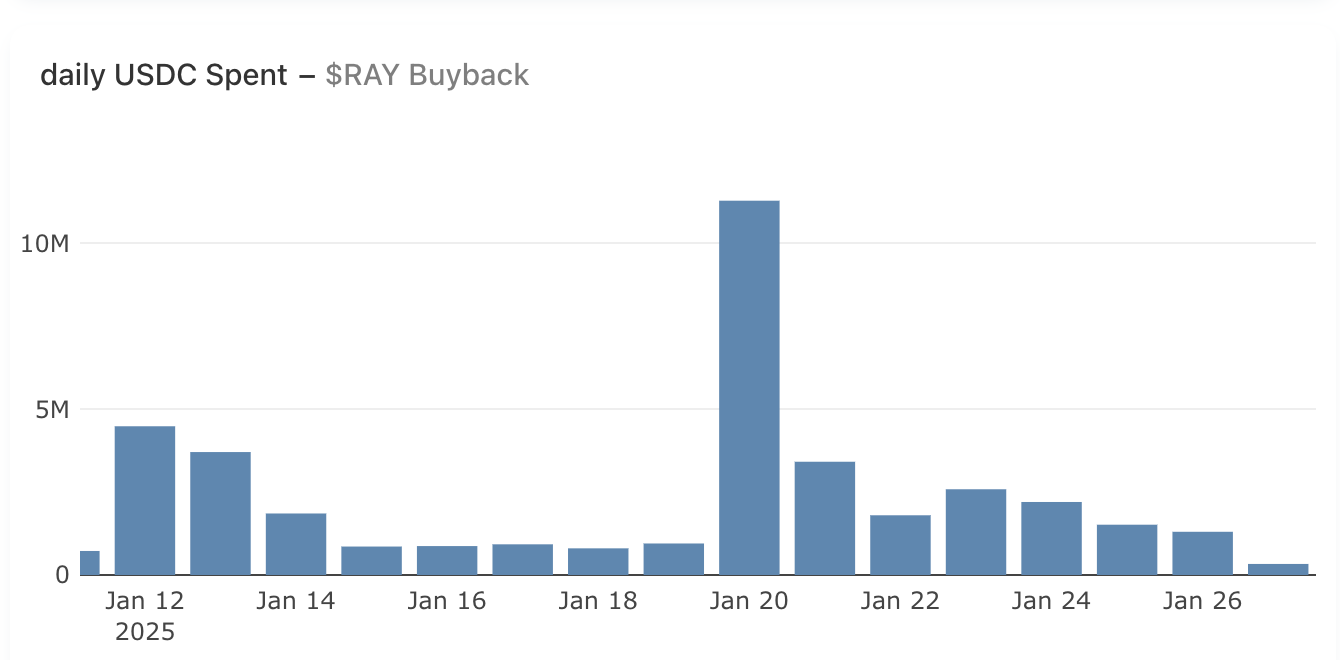

However, if Raydium were to implement similar fees to its competitors after exiting its beta phase, the protocol could expect to boost $RAY buybacks further.

If Raydium were to charge a flat 0.025% fee across all maker and taker trades, $100M in trading volume would add an additional $31,250 to daily buybacks.

While this sounds like a substantial boost, it would only increase daily $RAY buyback by around 1-3%. According to Raydium data, daily buybacks from the protocol’s spot DEX over the last seven days fluctuated between $1.3M and $2.6M.

Read More on SolanaFloor

Crypto enthusiasts are more confident than ever in Solana ETF approvals

Solana ETF Approval Odds at 87% - What Could ETFs Mean For $SOL?

Welcome to Solana DeFi