PYUSD Supply on Solana Up 198% in Two Weeks, What’s Driving PayPal USD’s Explosive Growth?

PayPal USD, the fiat-backed stablecoin launched by one of the world’s most recognizable brands, is finding a home for itself within Solana’s booming DeFi ecosystem.

- Published:

- Edited:

When PYUSD launched on Solana in late May, many network participants saw it as an inferior alternative to established stablecoins like Circle’s USDC. However, a meteoric rise in PYUSD supply in recent weeks suggests that there may be more demand for PayPal USD than originally anticipated.

PYUSD Circulating Supply Grows by 2,500% Since Launch, Gaining on Ethereum Dominance

PYUSD initially launched on the Solana blockchain on May 29th, with a circulating supply of only 5M. At the time, around 400M PYUSD tokens were in circulation on Ethereum, where the centralized stablecoin made its blockchain debut.

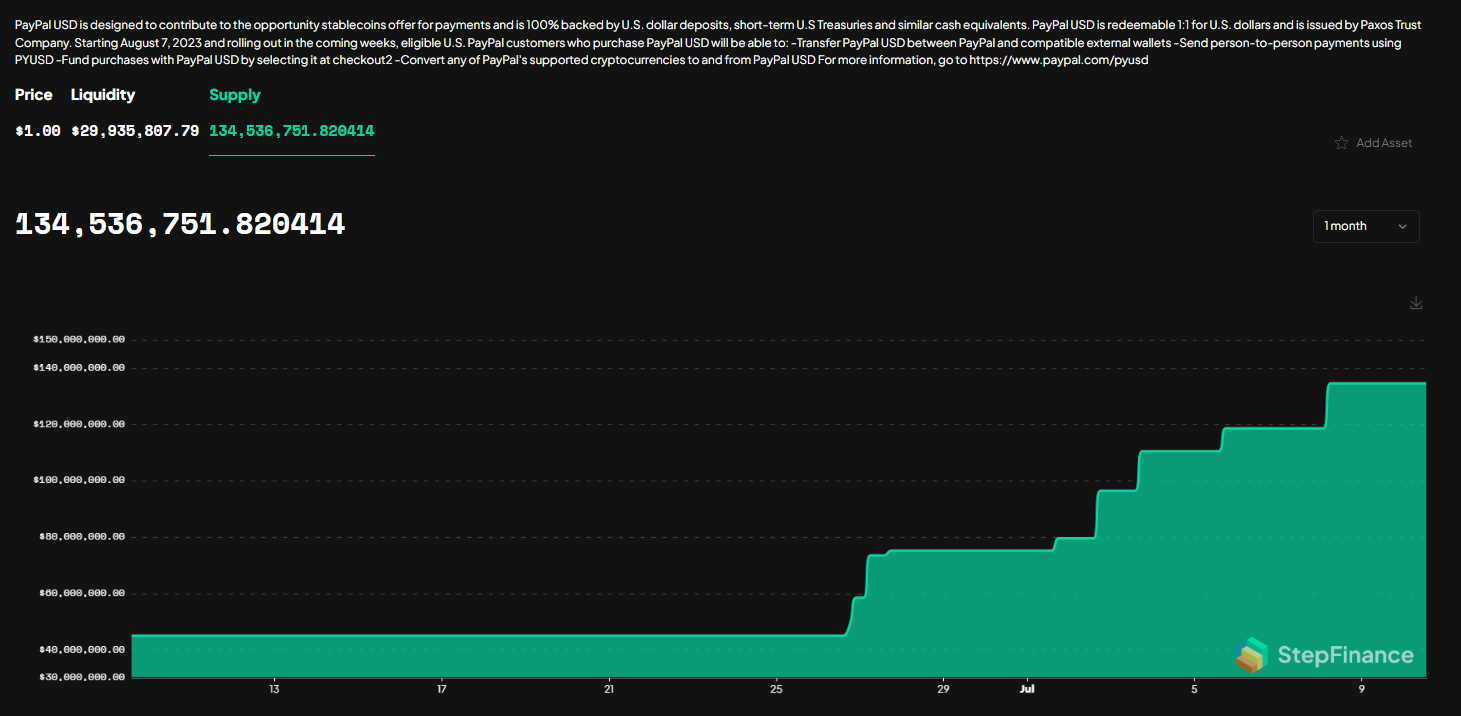

Since then, PYUSD usage and adoption have soared on the Solana network. With 134.5M PYUSD tokens currently circulating on the network, based on Step Finance data, PYUSD issuance has exploded by several orders of magnitude since its launch.

PYUSD’s supply has increased 198% in the last two weeks alone, growing from a supply of 45M to its current supply of 134.5M. This dramatic growth is representative of the surging demand for PYUSD, making it the fastest-growing stablecoin in the Solana ecosystem.

Over on Ethereum PYUSD activity has plateaued, with Ethereum-based PYUSD maintaining a consistent supply of around 398M. Solana-based PYUSD is making ground on its Layer 1 rival, with recent growth bringing Solana’s market share of PYUSD supply up to 33.7%.

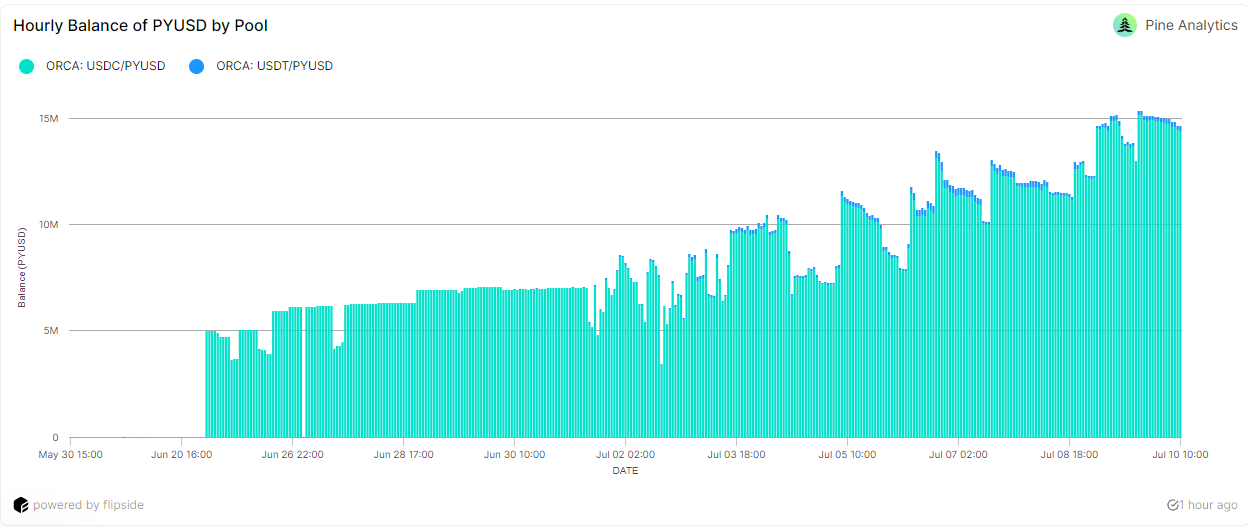

This signals a near 200% supply growth for the asset, which was sitting at a mere 11.4% just a few weeks earlier. Reinforcing this notion, the value of Orca’s PYUSD/USDC liquidity has also increased by just under 200% in the same period based on Flipside Crypto data.

What’s driving PYUSD’s remarkable growth in the Solana ecosystem?

Kamino Vaults Driving Adoption

The biggest vehicle pushing PYUSD use in Solana DeFi is undoubtedly Kamino Finance. Following a milestone partnership between the popular money market and the Tradfi titan, Kamino has established itself as Solana’s ‘primary venue for $PYUSD onchain.’

Since Kamino’s incentivized PYUSD vault went live on July 1st, PYUSD supply on Solana has grown 85.5%, charging from 75.2M to its current supply of 134.5M.

The first Solana-lending protocol to support PayPal USD, Kamino’s PYUSD lending vault offers generous yield and a 3x multiplier on Kamino for depositors. The vault currently distributes 192.3k PYUSD to depositors per week, offering around 16.5% APY.

The campaign is touted to run ‘for the foreseeable future’, with Kamino teasing that ‘incentives will scale as $PYUSD scales’, hinting that the popular lending platform has more PYUSD-based DeFi strategies in store for its faithful users.

PYUSD’s inclusion in the platform marks another key milestone, with the stablecoin being the first token extension-capable asset to be implemented in the application. PayPal’s stablecoin has also been integrated into several other Solana applications, including Orca, Meteora, and Wormhole.

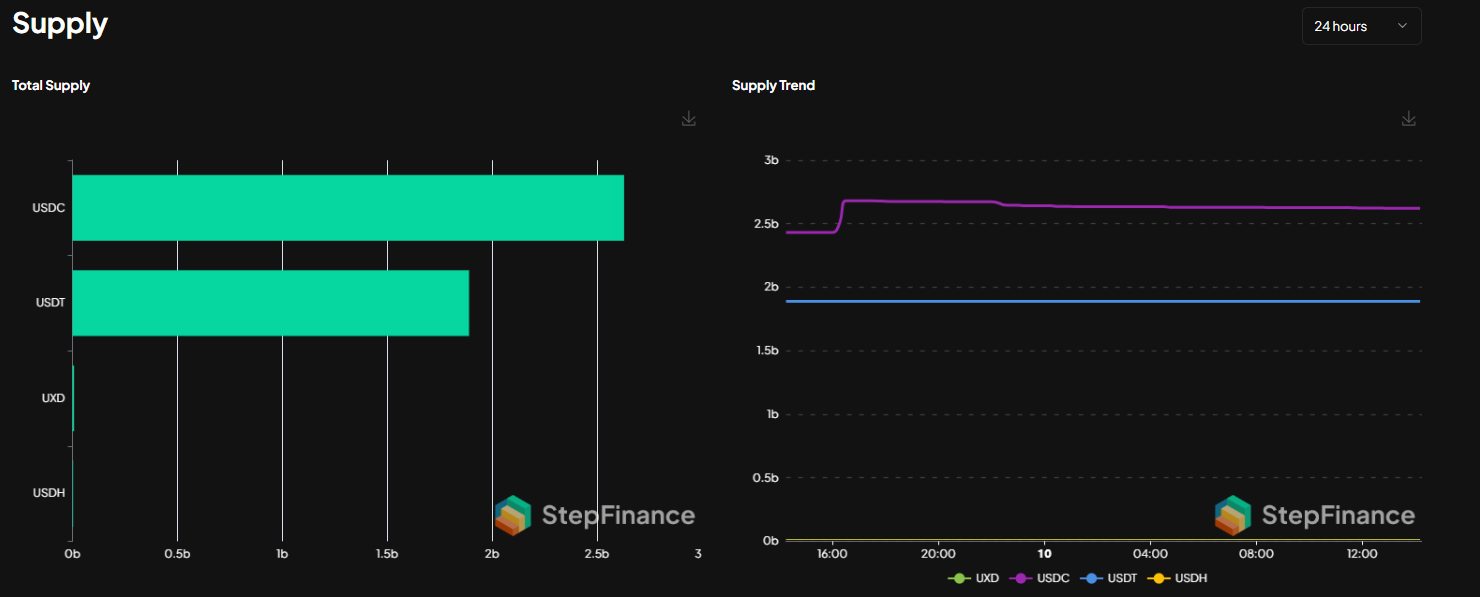

Despite PYUSD’s impressive growth, it still has a long way to go before threatening leading providers like Circle and Tether. According to Step Finance data, the existing stablecoin duopoly accounts for over 97% of Solana’s stablecoin market.

Read More on Solana:

Emerging Layer 2 aims to build SVM solutions on top of Ethereum:

Rome Network Raises $9M to Bring Solana's Speed to Ethereum