Paladin Protocol Promises to Eliminate Predatory MEV and Enrich the Solana Experience - Here’s How

Aiming to “Solve Bad MEV for Good”, the Paladin protocol envisions a new approach to tackling MEV on Solana in a way that benefits the many, rather than the few.

- Published:

- Edited:

After years of development behind the scenes, the Paladin team is finally showing its hand. Proposing a more egalitarian approach to MEV rewards, Paladin aims to discourage MEV frontrunners and provide an alternative that is more profitable for everyone.

With MEV bots reportedly extracting millions from Solana DEX markets every month, Paladin might just be the knight in shining armor that Solana DeFi needs.

Fully decentralized, open-source, and permissionless, Paladin’s mission is to eliminate predatory MEV on Solana. But how does it work?

The Paladin Bot

Designed to run within the Jito client, the Paladin bot is a fast open-source arbitrage bot. It runs locally in a validator and only operates when that particular validator is the leader.

The Paladin bot relies on three distinct features to improve a validator’s APY (Annual Percentage Yield):

-

Atomic Arb Bot - Not to be confused with a frontrunning sandwich bot, Paladin is a high-performance arbitrage bot that is faster than external searchers.

-

CeFi/DeFi Arb - Leveraging a permissionless DeFi bulletin board that communicates directly with slot leaders, Paladin is able to capture MEV through CeFi/DeFi price discrepancies.

-

PALAggregator - Running exclusively within the leader, Paladin bot knows with certainty the exact price of every asset in real time. The bot can use this advantage to find a better path on trades and share the surplus rewards with the wallet that executed the transaction.

Essentially, the Paladin bot is a powerful tool that is altruistically employed to benefit and incentivize honest validator behavior.

To reap the benefits of Paladin, validators need to operate the Paladin bot, which in turn rewards holders and stakers of the protocol's native token, PAL.

Paladin Reward Dynamics - The PAL Token

Breaking the trend of providing speculative governance tokens, Paladin has opted for a more tangible token economy driven genuine value accrual.

PAL, the protocol’s native token, serves as the means by which MEV rewards are distributed to stakers and validators running the Paladin Bot, or ‘Palidators’.

MEV rewards captured by Palidators are distributed as follows:

-

90% is returned to the leader

-

5% is directed to Palidators and their stakers, proportionate to the amount of SOL staked

-

5% is passed to PAL token holders. However, given that 50% is airdropped to validators and PAL stakers, unstaked PAL holders receive 2.5%

While PAL is not a governance token, it does play a crucial role in the ecosystem outside of reward distribution. If Palidators are believed to be operating dishonestly, PAL stakers can vote to slash that Palidator’s stake, burning its PAL.

In a bid to avoid a tragedy of commons, Paladin can be seen as an experiment that discourages greedy validator operation and makes it more profitable to not frontrun.

The protocol aims to distribute MEV rewards among honest ecosystem contributors in a way that everyone wins, as opposed to a competitive scramble for larger pieces of the MEV pie.

Yes, There’s an Airdrop - How to Qualify

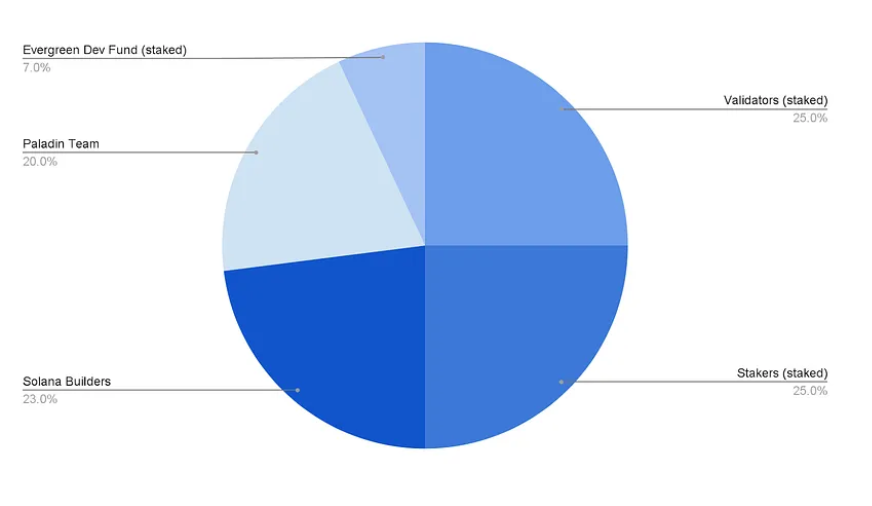

Going against the trend of low float, high FDV (Fully Diluted Value) launches that are plaguing the industry, 100% of PAL tokens will be airdropped and distributed at launch.

Fortunately, qualifying for a PAL airdrop is straightforward. 50% of the total supply will be airdropped to validators, with 25% being distributed to a validator’s stakers on a pro-rata basis.

Despite a relatively muted social presence, the Paladin launch is generating excitement behind closed doors. In an exclusive statement with SolanaFloor, Paladin representative Uri Klarman revealed that “8% of Solana stake have committed to being a launch partner and run Paladin ahead of the launch.”

Additionally, the protocol has plenty of resources to encourage continued development and expansion from ecosystem developers.

According to Klarman, a budget of $5M per year has been committed to continued development, meaning that ecosystem developers may be sufficiently inspired to expand Paladin beyond the Jito client to Firedancer and any subsequent clients in the future.

Paladin’s unique approach to MEV and reward distribution acknowledges that it’s impossible to prevent validators from frontrunning transactions. However, should the Paladin protocol prove successful, its reward structure would be a more economical alternative, hopefully making Solana an efficient DeFi ecosystem for all users.

Read More on SolanaFloor

Pump.fun co-founder weighs in on criticism:

What is Staking on Solana?