Mango DAO Approves SEC Settlement But Refuses Second Proposal to “Burn It All”

Nearly two years after the devastating Mango Markets hack, contradictory governance outcomes elicit confusion within the DAO.

- Published:

- Edited:

Mango Markets, one of Solana’s original DeFi platforms, finds itself in the convoluted throes of governance.

Navigating the repercussions of the protocol’s debilitating October 2022 hack, conflicting governance proposals highlight the complexity of legal proceedings for decentralized platforms.

After the initial proposal to offer a settlement deal to the SEC and discontinue $MNGO was passed, why was a second proposal to burn DAO-owned tokens emphatically denied?

Mango DAO Agrees to Destroy MNGO Tokens, But Not Yet

On the 22nd of August, Mango DAO agreed via governance proposal to offer a settlement deal to the SEC (Securities and Exchanges Commission). In addition to offering to pay a civil penalty to the value of $223,228 from the DAO treasury, Mango DAO also agreed to destroy all $MNGO tokens in the DAO’s possession.

The proposal’s approval was swiftly followed by a second proposal. Aptly titled “Burn it all!”, this proposal suggested burning “the main chunk of $MNGO controlled by the DAO”. Despite DAO-owned $MNGO tokens being slated for destruction through the initial proposal, the second vote was firmly rejected with 99% of participants voting against the proposal.

Adding context to the proposal’s denial in the protocol’s Discord server, Mango Market’s team member pan argues that burning $MNGO tokens now “might be premature”. By denying the proposal, Mango DAO also avoids a situation wherein “the offer [to the SEC] is rejected, we default to litigation, and are left with no mangoes.”

Essentially, the refusal of the second proposal doesn’t mean that $MNGO tokens won’t be destroyed eventually. Instead, it suggests that the Mango DAO simply needs to wait for a response from the SEC before taking any further actions.

Proceedings are complicated further due to the sensitivity of communications between the DAO’s legal representative and the SEC. As per the governance proposal electing the DAO representative, all communication between the two parties must pass through the DAO’s legal counsel before being shared with individual DAO members.

What Happens to Mango DAO Treasury?

Should the SEC accept Mango DAO’s offer to settle, the discontinuation of $MNGO tokens introduces new complications that the DAO will need to navigate. With no governance token, participants will have no way of voting on proposals and the Mango DAO essentially becomes obsolete.

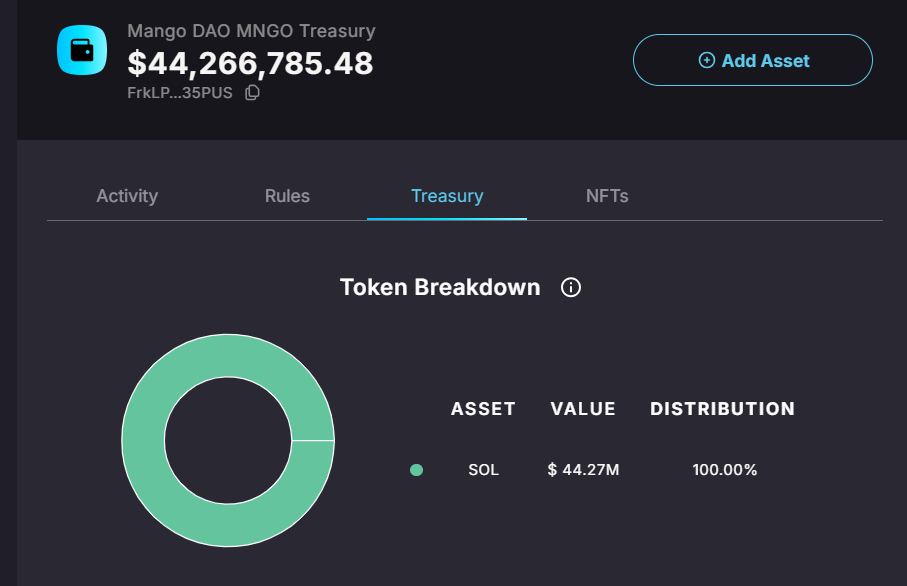

According to Realms data at press time, the Mango DAO Treasury holds over $44M in $SOL. With $MNGO expected to be destroyed and delisted from third-party exchanges, DAO members have lingering questions regarding the management of the remaining funds.

Speculative theories insinuate that the DAO treasury will be dissolved. Hopeful community members suggest the DAO “return the treasury to token holders in a fair and equitable manner”.

While nothing is formally confirmed, the proposal indicates that “Nothing in this provision shall prevent the DAO from conducting a partial or total dissolution or liquidation of its non-MNGO assets in the DAO Treasury through the acquisition of MNGO tokens from DAO members.” - suggesting that the DAO may use the treasury to buy MNGO tokens off token holders.

Other theories include the belief that Mango Markets could re-issue a new, fully compliant token and recreate the Mango DAO.

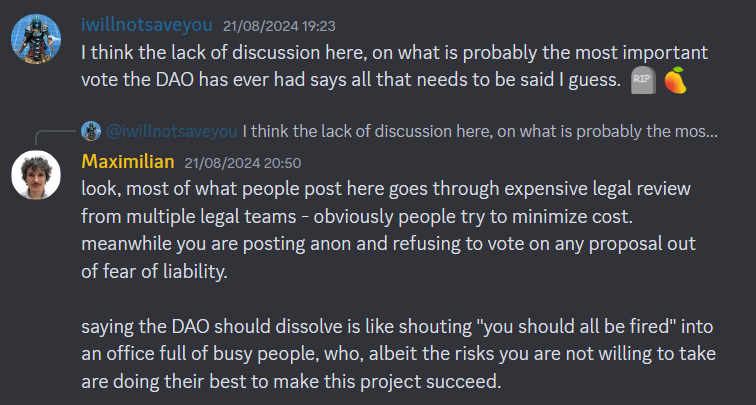

Despite rampant speculation, the Mango Market’s team appears outwardly committed to ensuring the ongoing operation of the protocol and Mango DAO. In response to frustrated comments from community members, Mango team member Maximilian insists they are “doing their best to make this project succeed”.

In an exclusive statement to SolanaFloor, Maximilian posited that the "token will continue to exist and be functional as a governance token for the DAO". Looking to the future, the Mango Market's spokesman asserted that "all further actions will be decided by token holders democratically,"

All eyes now turn to the response of the SEC, which will bring further clarity to the unfolding situation and allow the Mango DAO to collectively navigate future decisions.

Read More on SolanaFloor

Meme coin traders move on, is pump.fun dying?

Pump.fun Records Lowest Number of Launches in 151 Days - Is Tron Really to Blame?

Freshen Up Your DeFi Knowledge: