Lulo Secures $34M in Directed Liquidity as Solana Stablecoins Soar

Off the back of surging stablecoin supplies, Solana’s favorite savings account has doubled its Directed Liquidity in the last 30 days.

- Published:

- Edited:

Lulo Finance, a Solana lending aggregator, continues to sustain its emphatic growth. With Directed Liquidity (DL) growing month-on-month, Lulo is asserting itself as one of Solana’s fastest-growing DeFi protocols.

After joining the prestigious Circle Alliance in July 2024, the platform’s recent $PYUSD integration has only improved its product offering and galvanized its reputation.

Where to next for Lulo Finance?

Lulo Directed Liquidity Up 136% Following $PYUSD Integration

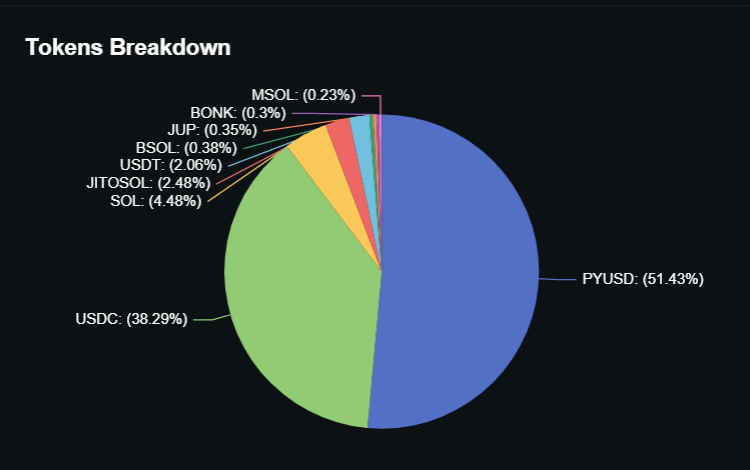

While Lulo Finance deposits have long been dominated by $USDC, Solana’s most prominent stablecoin, the recent integration of PayPal USD ($PYUSD) has elevated Lulo to new heights.

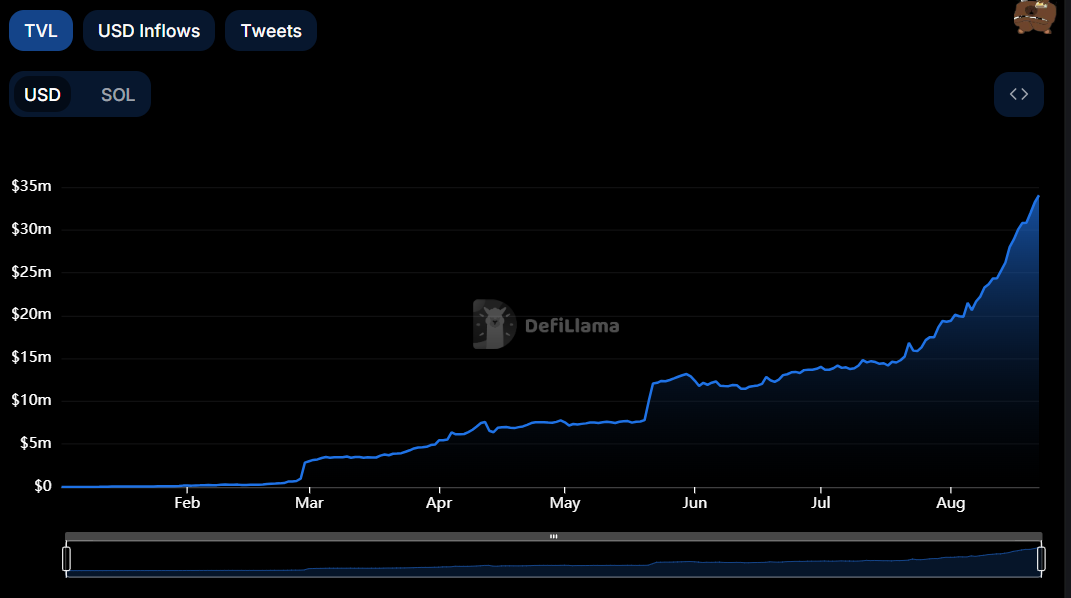

Since integrating $PYUSD into the protocol on July 15th, Lulo Finance DL has risen by 136.67%, surging from $14.3M to secure a new all-time high of $34M, based on DeFiLlama data.

The inclusion of $PYUSD has provided a significant boost for platform growth. According to DefiLlama data, over 51.43% of DL is comprised of $PYUSD deposits.

Similar to Total Value Locked (TVL), Directed Liquidity is a unique term coined by the protocol. Lulo never holds custody of user funds. Instead, the protocol’s smart contracts direct user deposits to third-party Solana DeFi apps like Kamino and Drift. For this reason, Lulo argues that TVL is technically an incorrect term.

Beyond its recent integration of $PYUSD, Lulo’s significant growth could also be due to a downturn in memecoin activity. With memecoin attention shifting to rival blockchains, Solana users may be searching for less volatile revenue generation strategies.

Number of Unique Depositors Breaks New All-Time Highs

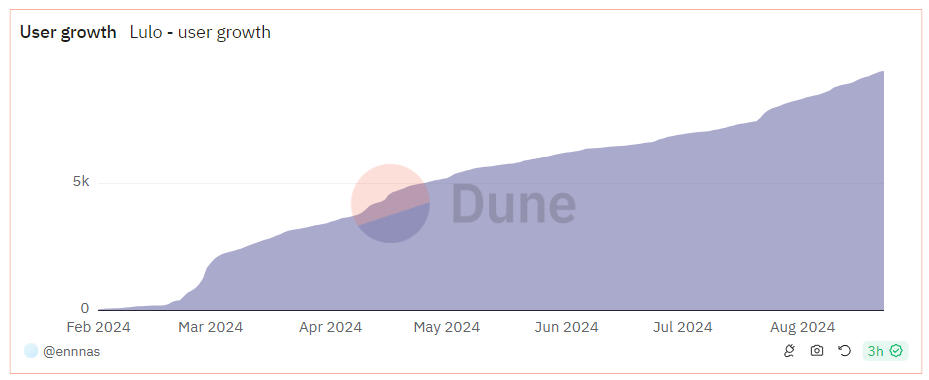

Naturally, Lulo Finance's surging DL correlates to a consistent increase in unique depositors. Based on Dune Analytics data, the platform boasts over 9.4k lifetime depositors, with most users depositing multiple assets.

On top of the steadily increasing number of cumulative depositors, Lulo enjoys impressive retention rates. Approximately 51.24% of depositors have maintained their positions in the platform, suggesting satisfied users and high levels of confidence in the protocol.

In addition to earning optimized yields on their deposits, Lulo users are also eligible for airdrops from within the Solana ecosystem. According to internal Lulo data, roughly 2,500 wallets were eligible to receive $KMNO tokens following Kamino’s Season 2 rewards campaign.

“Your Personal Financial Stack” - What’s Next for Lulo?

With the $30M DL milestone secured, Lulo Finance casts its gaze towards the future. After establishing itself among crypto natives, Lulo envisions further expansion into sectors outside the Web3 world.

Lulo Finance Head of Growth Maurice Chalfin argues that “disambiguating away from blockchain is essential in the longterm… we need to meet people where they’re at,”

During a recent Solana Hacker House, Chalfin took to the streets of London to ask the general public about their banking habits. Unsurprisingly, Lulo discovered that the majority of people were responsive to the idea of earning more on their savings.

Simplicity, convenience, and improved rates stood out as the key factors likely to encourage users to switch banks or use alternative solutions like Lulo’s yield aggregator.

In an exclusive statement with SolanaFloor, Chalfin revealed that Lulo is “working on some secret things, but all the original goals: fiat on/off, debit card, direct deposit” remained the platform’s key areas of development for the future.

Read More on SolanaFloor

Solana ETFs find a home in Brazil:

Brazilian Regulator Approves Second SOL ETF Reinforcing Solana Adoption in Latin America

Why Are Stablecoins so Useful?