Jito Overtakes Circle and Ethereum in Fees as Solana's Onchain Activity Hits Record Highs

Jito overtakes USDC and Ethereum in 24-hour fees, hitting $4.16M, as meme coin trading boosts Solana’s onchain activity.

- Published:

- Edited:

Solana-based liquid staking service protocol Jito has made significant waves in the blockchain industry, surpassing both USDC and Ethereum in 24-hour fee collection. With record-breaking fees of $4.16 million, Jito has cemented itself as the second-highest fee-collecting protocol globally, trailing only Tether (USDT).

The surge in fees positions Jito as the top decentralized application (dApp) in the blockchain ecosystem when stablecoins protocols like Circle (USDC) and Tether (USDT), which are centralized systems for issuing stablecoins, are excluded from the equation. This development highlights Jito's strong growth as it continues to distribute Maximum Extractable Value (MEV) rewards to its users while improving Solana's network performance.

Meme Coin Trading Fuels Jito's Rise

Jito's rapid rise in fees is closely tied to an increase in meme coin trading on the Solana blockchain. As onchain trading intensifies, so does the collection of MEV rewards. Solana has dominated decentralized exchange (DEX) trading, with its DEX volume reaching an all-time high of 33% across all blockchains, processing over $2 billion in DEX trading volume in recent days.

This heightened trading activity is further reflected in the creation of new tokens on Solana, which hit a daily peak of 36,000. The number of new coins minted has almost doubled from previous highs in July 2024, signaling strong demand for Solana's onchain trading ecosystem.

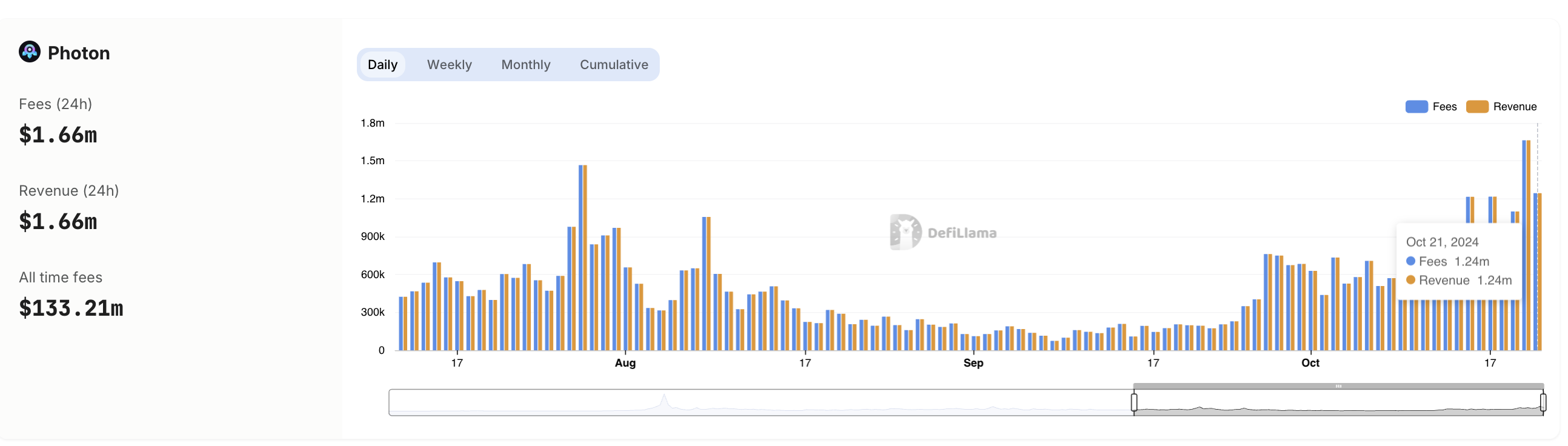

Tools like Photon, a trading and sniping terminal built for meme coin trading, have been among the top beneficiaries, consistently generating over $1 million in revenue for the past four days.

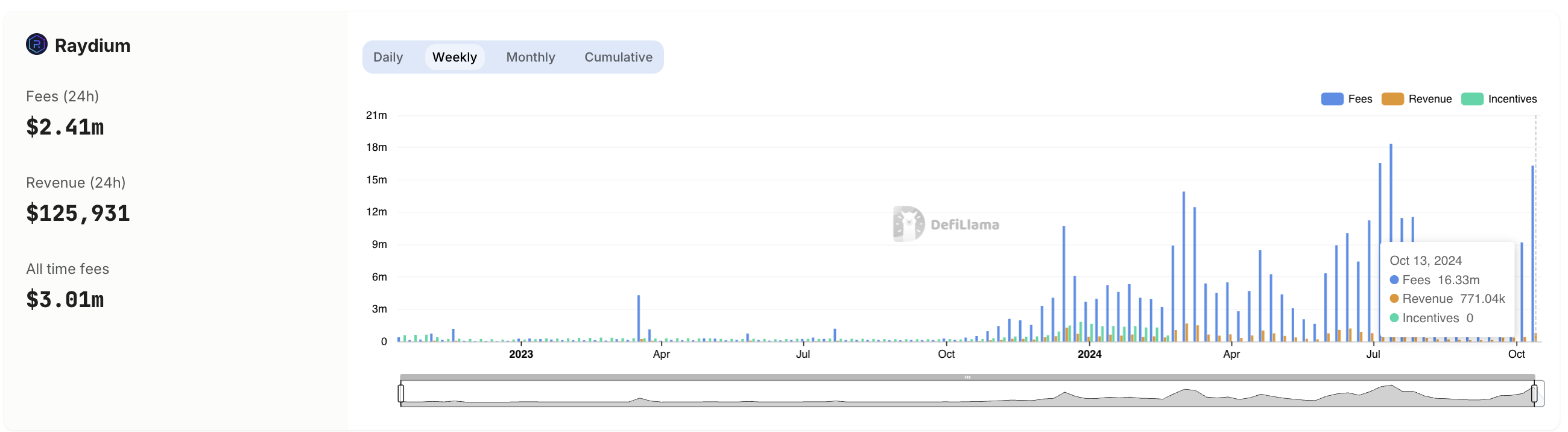

Raydium, Solana's leading DEX, also saw substantial growth in protocol fees, reaching $16 million in the past week. This marks the second-highest weekly fee total of the year, just behind the $18 million collected in July.

Defi Beyond Meme Coins: Liquid Staking Growth

While meme coins have played a pivotal role in Solana's recent onchain boom, the broader decentralized finance (DeFi) ecosystem has also thrived.

The total market cap of liquid staking tokens (LSTs) on Solana has reached a new all-time high of $4.95 billion. Jito's liquid staking token, JitoSOL, has been instrumental in this growth by offering additional rewards from MEV transactions while allowing users to maintain liquidity for DeFi integrations.

Economic Value vs. Activity Metrics

As Solana continues to grow, debates have emerged within the crypto community over how to best measure a blockchain's success. Traditional metrics like active wallets and DEX volume have often been used to gauge performance. However, many analysts argue that the most critical metric is the economic value a chain generates.

Solana first flipped Ethereum in terms of fee and revenue generation in July, and the two chains have remained neck-and-neck in economic value creation. Solana is currently generating 90% of Ethereum's fees, with $3.09 million in fees collected in the past 24 hours, compared to Ethereum's $3.41 million. This raises the question of whether Solana will permanently overtake Ethereum in fee generation in the coming days.

Impact on JITO Token

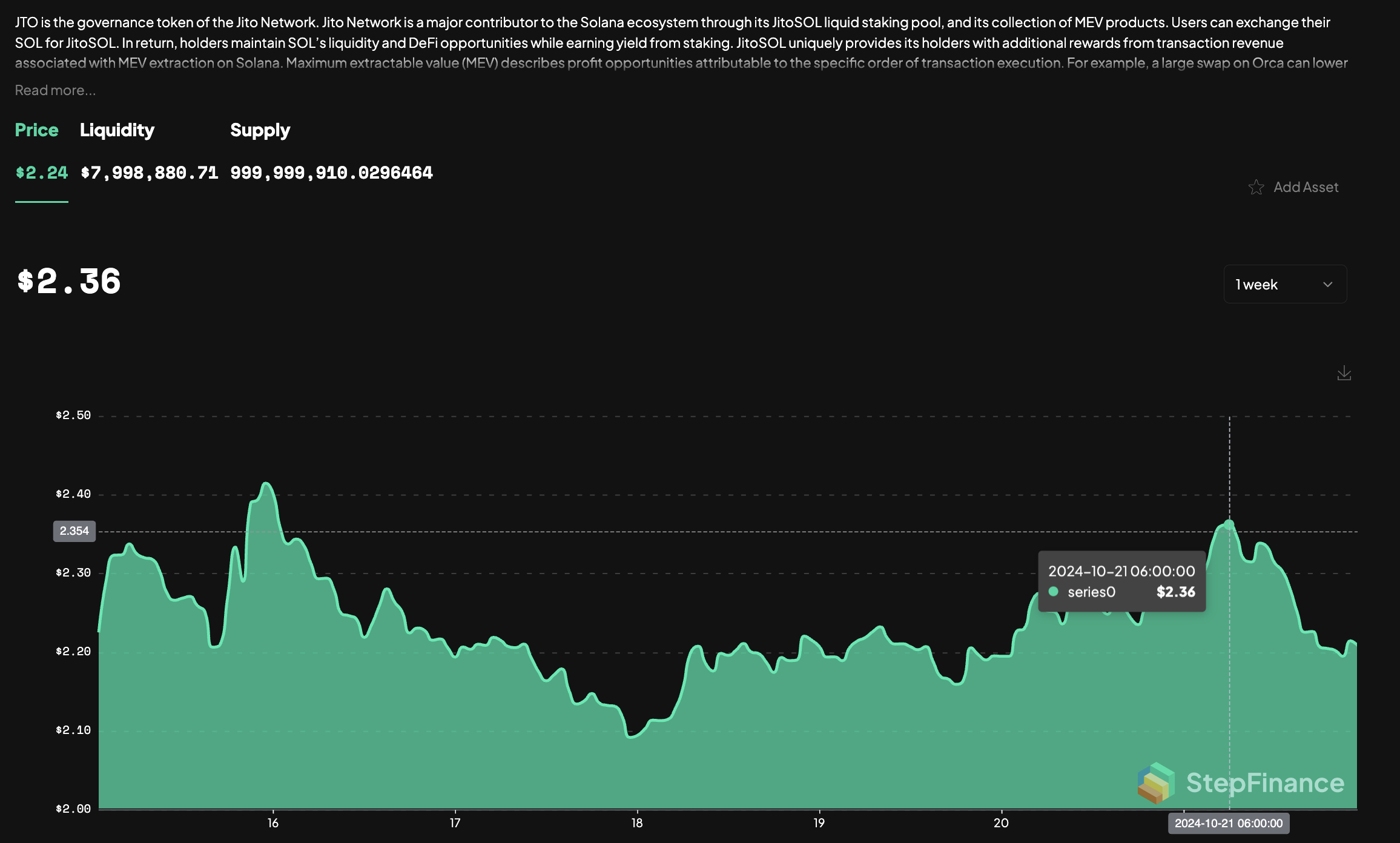

Despite Jito's impressive performance, its governance token, JTO, has remained relatively stable, with its price hovering between $2.15 and $2.36.

JTO Chart (Data by Stepfinance)

JTO Chart (Data by Stepfinance)

It remains to be seen whether traders have already priced in this success or if the token's value will adjust as the market reacts to Jito's growing dominance in the DeFi and staking sectors.

One thing is certain: Solana's DeFi ecosystem continues to flourish, and Jito's liquid staking protocol stands to benefit directly from the surge in onchain activity. As JitoSOL users earn staking and MEV rewards, the protocol's rising fee collection reinforces its position as a key player in the rapidly expanding Solana DeFi landscape.