Hamilton Lane Breaks Ground as First to Offer Institutional Private Credit Fund on Solana

Hamilton Lane Makes History with First Institutional-Grade Private Credit Fund Launch on Solana Blockchain, Unlocking $556M SCOPE Fund Access via Libre Protocol.

- Published:

- Edited:

Hamilton Lane, a global investment giant managing over $900 billion in assets under management, has made a groundbreaking move by launching its Senior Credit Opportunities Fund (SCOPE) on the Solana blockchain. This marks the first time an institutional fund has been directly launched on this high-speed, low-cost blockchain network.

The initiative is a collaborative effort with Libre, a Web3 protocol backed by Brevan Howard's WebN Group and Nomura's Laser Digital, specializing in issuing and distributing on-chain funds. The partnership aims to democratize finance by opening up access to alternative investments traditionally reserved for high-net-worth individuals.

Victor Jung, Head of Digital Assets at Hamilton Lane, said “As a leader in the tokenisation of private markets funds, we are delighted to partner with Libre, who is at the forefront of innovations in the fund distribution space, to reach a broader range of investors as they launch on Solana. This launch will expand access to the historical strong returns and performance opportunities generated within the private markets while increasing efficiency and transparency for all investors.”

The Private Credit Boom and Hamilton's SCOPE

Private credit, a thriving market exceeding $3.14 trillion, has gained traction due to its potential for high returns and diversification benefits. Hamilton Lane's SCOPE, launched in 2022 and boasts $556 million in assets under management (AUM), caters to investors seeking a balance of safety and yield, offering an annualized yield of 10% for USD investors.

SCOPE is an all-weather senior private credit evergreen vehicle designed to provide investors with exposure to a historically stable private markets strategy. This move expands access to private credit opportunities, previously limited to a select group of investors, to a wider audience on the Solana network.

Invest in Alternative Assets with Just $10K, All From Your Phone

With Libre on Solana, the days of needing a quarter-million dollars to invest in private credit funds and other alternative assets are gone. Now, with as little as $10,000, you can access these opportunities directly from your phone, opening up a world of potential for your portfolio. By leveraging blockchain technology and innovative protocols, Libre is breaking down barriers to entry, empowering investors of all backgrounds to participate in alternative asset classes and benefit from the potential growth and diversification they offer.

Key Benefits of the On-Chain Fund:

- Lower Minimum Investment: Libre's platform allows investors to participate with a minimum investment of $10,000, a fraction of the $250,000+ typically required for traditional hedge funds.

- Liquid Flexibility: Unlike traditional funds, which often lock in investments, Libre enables monthly withdrawals with a modest fee, providing investors with greater flexibility.

- Open Access: The fund is accessible to any accredited investor, eliminating the need for large financial advisors and fostering inclusivity in the investment landscape.

Solana: A Strategic Choice for RWA Tokenization

Libre's decision to launch its protocol on Solana stems from the network's unique advantages, including its high throughput, low transaction costs, and innovative features like token extensions. These extensions enable a wide range of use cases for RWA (Real world Asset) on the Solana blockchain, including programmable compliance features and the ability to update RWAs as needed.

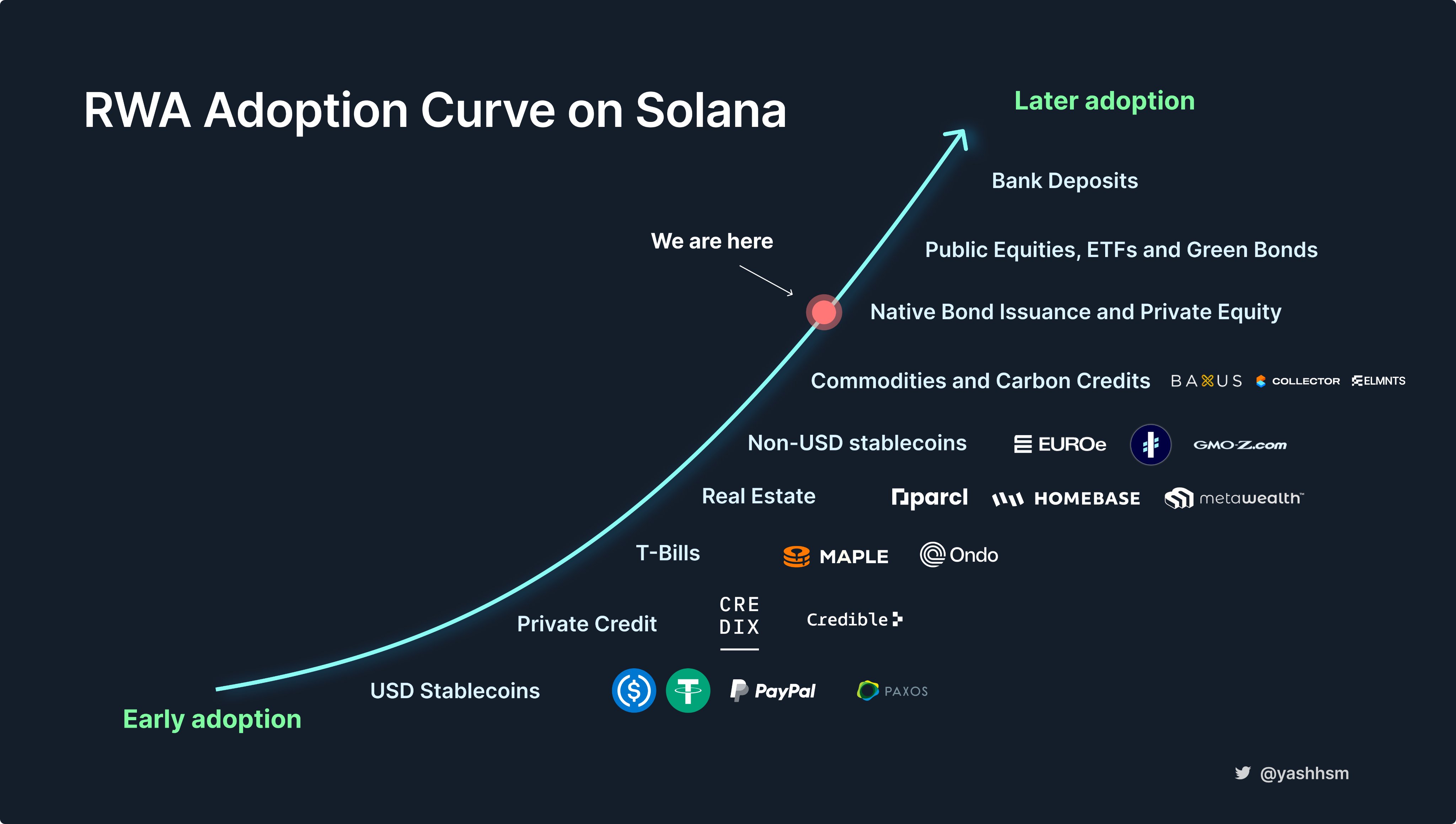

Solana's RWA adoption curve by Yash Agarwal

Solana's RWA adoption curve by Yash Agarwal

Solana's thriving RWA ecosystem is gaining momentum as more protocols and institutions recognize the advantages of the blockchain's low-cost, high-speed capabilities. Just last month, Ondo Finance partnered with Solana's Drift Protocol to introduce USDY, a stablecoin alternative backed by short-term US treasuries yielding an impressive 5.30% APY. PayPal recently launched its stablecoin on Solana, citing the technology's clear advantages, and last year, Visa initiated a pilot program on Solana for USDC settlement, praising the network's capabilities and performance.

The news of Libre's launch and Hamilton Lane's fund on Solana has been met with enthusiasm from the Solana community. Solana co-founders Raj Gokal and Anatoly Yakovenko both reacted to the news on Twitter, calling it a "huge" development.

Austin Federa, Head of Strategy at the Solana Foundation, also tweeted his excitement, stating, "Finance is happening on Solana."

The Future of OnChain Finance

While the demand for tokenized financing platforms is still evolving, this initiative demonstrates the growing interest in bridging traditional finance with the decentralized world. With continued technological advancements and regulatory clarity, the future of on-chain finance looks promising, offering a more inclusive and accessible financial ecosystem for all.