FTX Lawsuit Against Binance, CZ Unlikely to Impact Solana

The seemingly endless FTX saga continues, with the failed exchange suing its biggest rival for $1.6B.

- Published:

- Edited:

Two years after the collapse of the disgraced crypto exchange, the FTX Bankruptcy Estate continues its clawback campaign. Attempting to reclaim as much value as possible, FTX has set its sights on Binance, the industry’s largest crypto exchange.

Plaintiffs argue that Binance is further complicit in FTX’s devastating downfall, claiming that the exchange received over $1.76B worth of funds from FTX in a fraudulent transaction.

The lawsuit also highlights Changpeng Zhou’s public involvement in the FTX collapse, suggesting the Binance founder orchestrated a targeted FUD campaign to destroy his rival.

Binance Sued Over SBF Deal

In a complaint filed on November 10, 2024, the FTX Estate and Alameda Research claim Sam Bankman-Fried, the FTX CEO and founder currently serving 25 years in prison on several counts of fraud, repurchased FTX International and FTX US stock from its competitor.

Bankman-Fried allegedly bought back company stock using FTX’s proprietary token, $FTT, and Binance’s $BNB and $BUSD tokens, to the value of $1.76B.

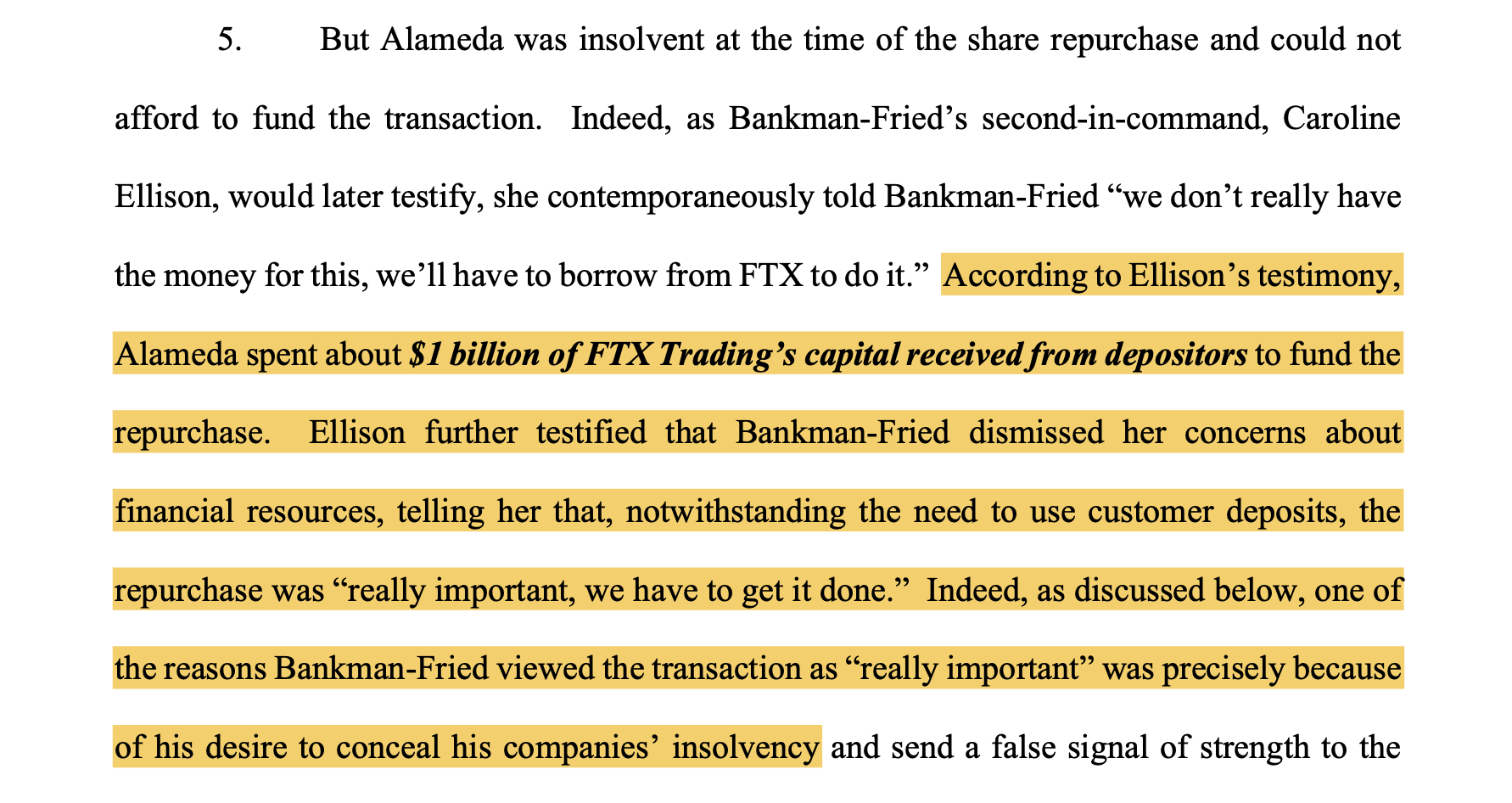

However, the claim indicates that both FTX and its sister company Alameda Research were allegedly insolvent as early as 2021, classifying the stock repurchase as a fraudulent transaction. According to Alameda Research CEO Caroline Ellison’s testimony, over $1B worth of customer deposits were used to fund the repurchase.

According to the complaint, Bankman-Fried believed repurchase transaction was “really important” and something the disgraced firm “had to get done” in an attempt to conceal the company’s insolvency.

Changpeng Zhou’s FUD Campaign

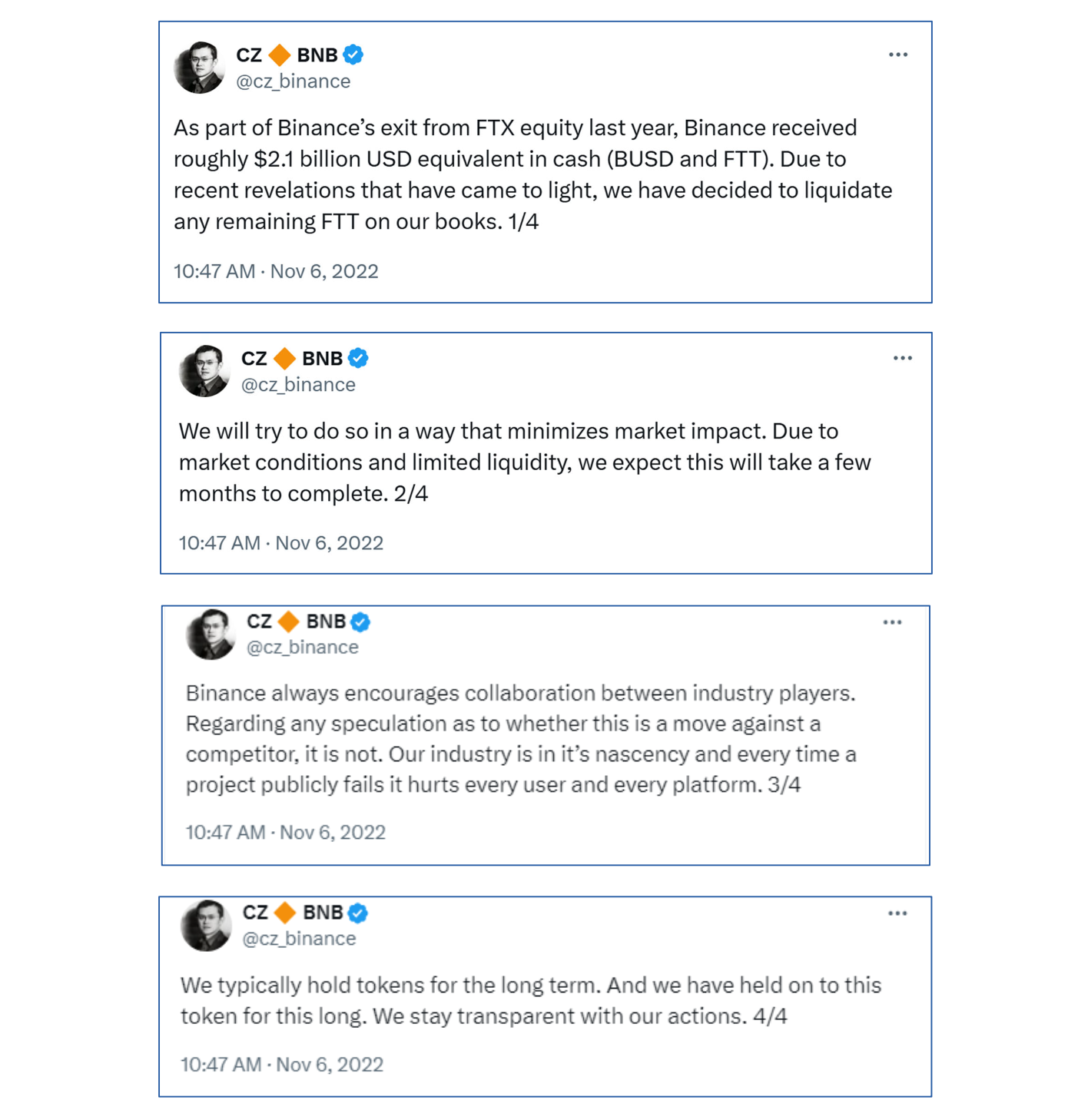

Beyond accusations of fraudulent transactions, the complaint also alleges that Changpeng Zhou choreographed a deliberate public attack on FTX to destroy the rival exchange.

Plaintiff’s argue that Binance’s liquidation of $FTT tokens and Zhou’s social media statements were a calculated ploy to incite panic in crypto markets and discredit the FTX exchange.

Zhou’s comments ultimately initiated a flood of mass withdrawals from FTX, ultimately revealing the company’s insolvency to the industry at large. FTX argues Zhou’s tactics were “maliciously calculated to destroy his rival FTX, with reckless disregard to the harm that FTX’s customers and creditors would suffer”.

Is Solana at Risk?

Fortunately for Solana, FTX’s involvement in the ecosystem has been greatly reduced since the FTX Estate sold off the majority of its SOL holdings in Pantera Capital and Galaxy Trading. Even if the court sides with the FTX Estate and finds Binance guilty of fraudulent transactions, this is unlikely to directly affect Solana.

While $1.76B is a considerable sum, Binance is no stranger to hefty fines. In November 2023, the crypto exchange was fined $4B on charges concerning AML, Unlicensed Money Transmitting, and Sanctions Violations. To date, this is the largest fine ever paid in crypto history and had little impact on asset values across the industry.

Read More on SolanaFloor

$cbBTC lands on Solana

Where Can You Get Solana’s Best $cbBTC Yield?

Looking to Get Started in Crypto?