Drift Protocol’s BET Flips PolyMarket in 24-Hour Volume, What Caused $20M Spike?

An incredible surge of activity has catapulted Drift Protocol’s BET platform to prediction market stardom, boosting daily trade volume by 3,398%.

- Published:

- Edited:

Drift Protocol, a popular perpetual exchange on Solana, has witnessed an explosion of trading activity on BET, its new prediction marketplace. The platform enables users to trade the outcome of real-world events.

In just two weeks following its launch, BET has flipped PolyMarket, the industry’s leading prediction marketplace, in 24-hour trade volume. However, the protocol’s dramatic surge has left some network participants scratching their heads.

BET 24-Hour Trade Volume Surges by 3,398%

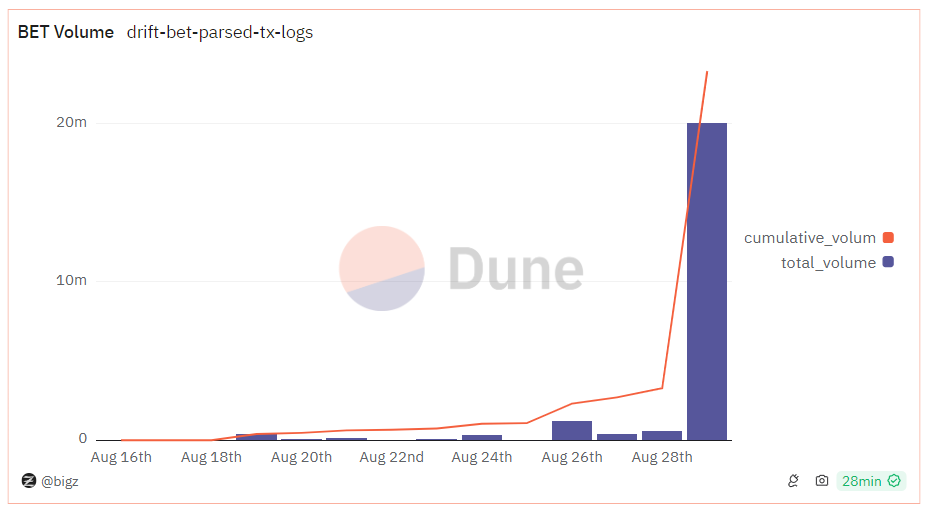

On August 29, Drift Protocol’s prediction marketplace BET secured a new all-time high in daily trading volume, based on Drift’s internal data and supported by Dune Analytics.

Note: total_volume label signifies daily trading volume

Recording just over $20M, the spike in daily volume represents a 3,398% increase from the preceding day and a 1,520% increase from BET’s previous ATH recorded a few days earlier.

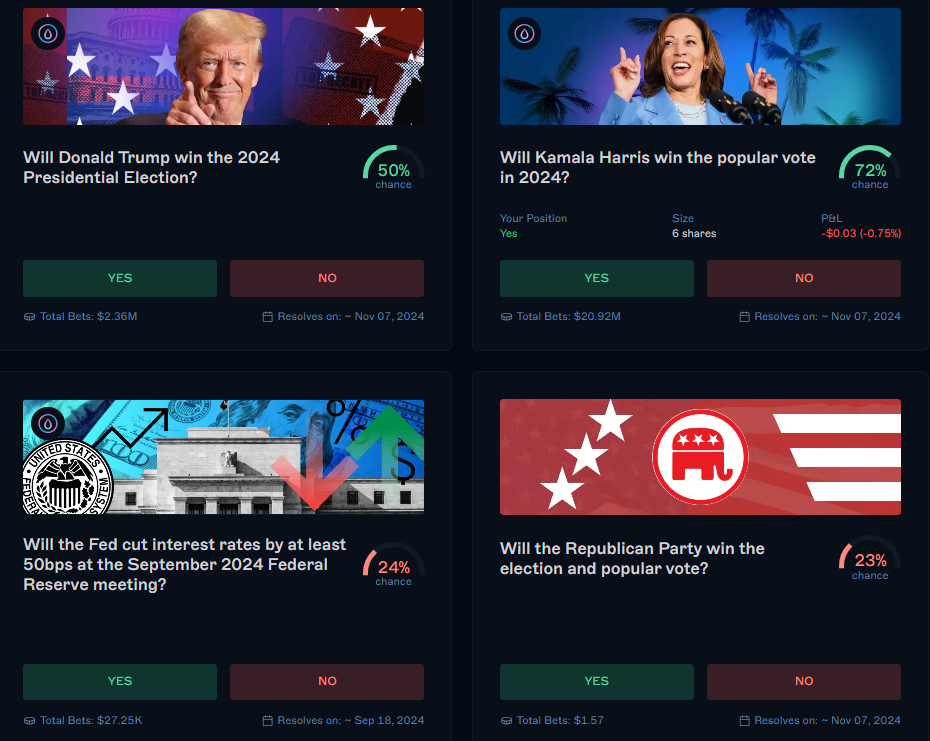

BET’s “Will Kamala Harris win the popular vote in 2024?” market led all trading activity, boasting over $20M in total bets. In contrast, markets speculating on Donald Trump’s presidential victory, FED rate cuts, and a Republican party victory currently hold $2.36M, $27k, and $1 respectively.

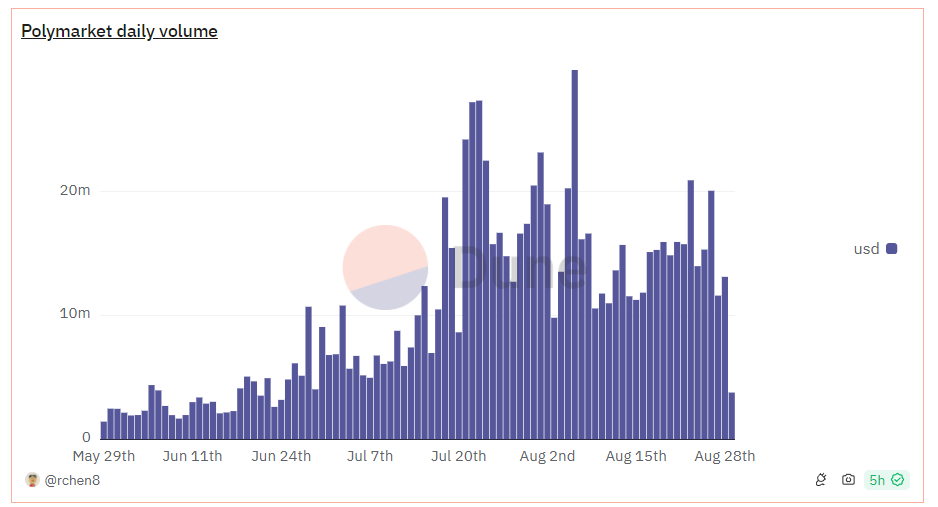

On top of achieving new all-time highs in trading volume, BET’s impressive surge also dethroned PolyMarket as the industry’s leading prediction marketplace. Based on Dune Analytics data, PolyMarket recorded just over $13M in the same time frame.

BET’s dramatic increase in trading volume and its resulting rise to prediction market dominance indicates the growing demand for expanded DeFi products on the Solana network. Solana’s DeFi scene has enjoyed continuous growth throughout 2024, flipping the Ethereum Layer 1 in DEX trading volume in July.

However, BET’s meteoric rise has raised plenty of eyebrows across the Solana community, with some commentators questioning the validity of the volume.

Trade Volume Rises While Trade Count Falls - Are Whales Piling In?

With daily trade volumes rising over 3,000%, some network participants have expressed suspicion regarding the source of such liquidity.

Commentators have highlighted that, despite BET’s increase in volume, the number of trades executed on the platform has steadily declined over the past three days.

These contrasting trends suggest one of two things. Either the protocol is becoming more popular among large-ticket traders and whales, or some users are executing a high frequency of trades in a short time frame.

Ilemi, a reputable blockchain data analyst, contends that while he hasn’t “looked deep at the queries” used to create BET’s volume dashboard, he trusts that the dashboard’s creator “decoded events correctly.”

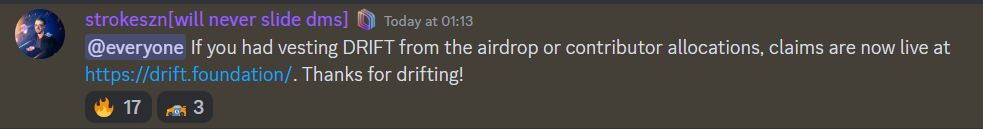

The spike in volume on BET has also coincided with the release of vested $DRIFT airdrop and contributor allocations, which were announced as being available to claim on the protocol’s Discord server.

SolanaFloor engaged Drift Protocol for comment regarding the source of BET’s newfound volume. At press time, Drift has declined the request.

Read More on SolanaFloor

There’s a new player in Solana DeFi:

Taxing DeFi Earnings as Capital Gains? Carrot Secures $2M TVL in Beta Launch Amid Solana Yield Wars

Get Started in Solana DeFi: