Binance, ByBit, and BitGet Tease Launch of Sanctum-Powered Solana LSTs

Sanctum’s LST model is attracting some of the world’s biggest crypto companies. What does this mean for $CLOUD?

- Published:

- Edited:

Centralized exchanges across the crypto industry are establishing firmer footholds in Solana’s growing DeFi ecosystem.

While exchanges typically operate their own validators, some of crypto’s biggest trading platforms have expanded their offering, teasing the launch of upcoming LSTs (Liquid Staking Tokens).

$BNSOL, $bbSOL, and $BGSOL Announced, Who’s Next?

As of August 29, three popular crypto exchanges have teased their intent to launch proprietary LST tokens.

Binance, the industry’s largest exchange by trading volume, was the first to announce its LST, named $BNSOL. It is widely believed Sanctum will be powering the Binance LST.

Following Binance’s announcement, the Sanctum 𝕏 account wasted no time sharing the post with a handshake emoji. Given that Sanctum powers the bulk of Solana LSTs, it is unsurprising that platforms like Binance would turn to the Sanctum team for its expertise.

The move reinforces Binance’s growing interest in the wider Solana staking ecosystem. Binance Labs, the exchange’s venture arm, also recently announced its investment in Solayer, a Solana restaking protocol.

While Binance’s entrance into Solana’s LST attracted plenty of attention, it wasn’t the only centralized exchange stepping into the ring. Piggy-backing off the excitement, ByBit and BitGet also announced their intention to launch their own LSTs, $bbSOL and $BGSOL.

$CLOUD Up 47% - Are CEX Listings On the Horizon?

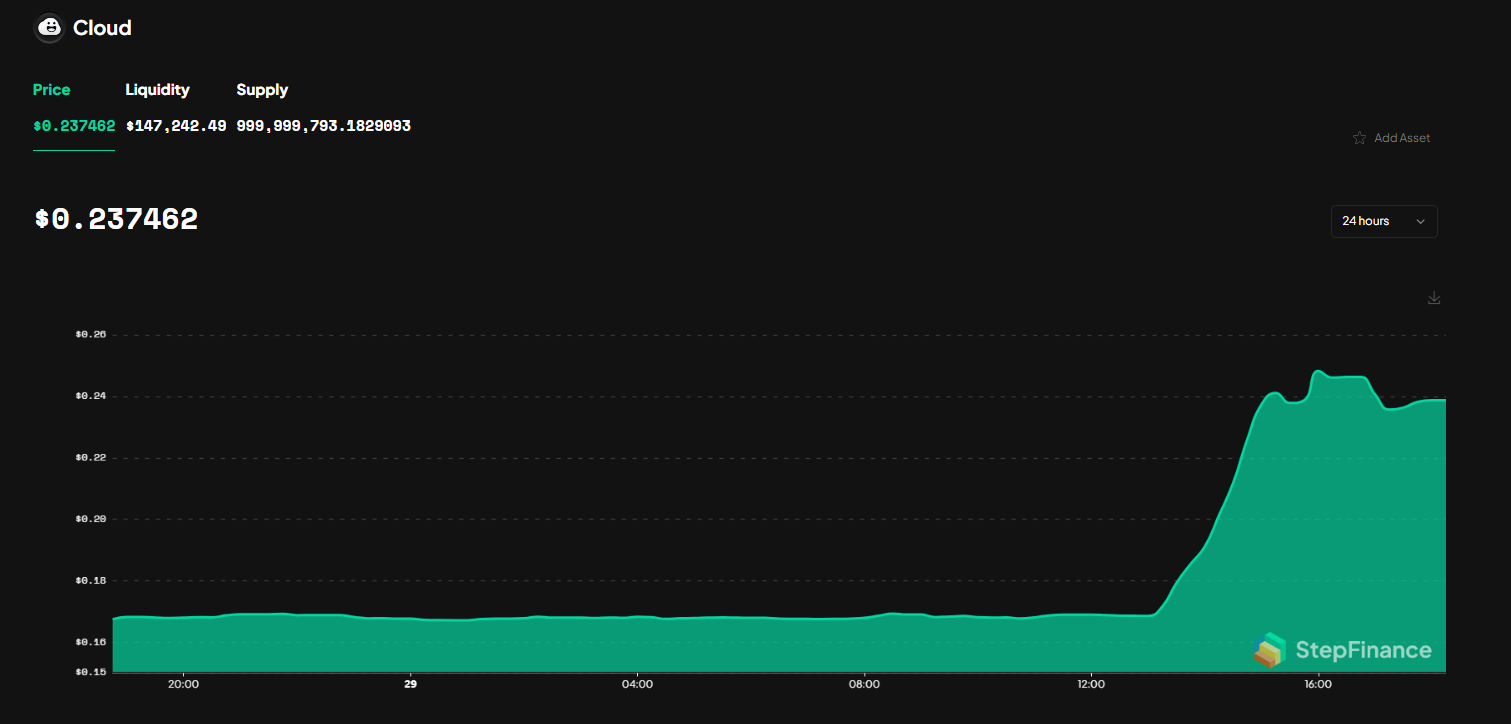

$CLOUD, Sanctum’s native governance token, reacted positively to the announcement. Prior to the event, $CLOUD had found support and consistently traded around the $0.18 mark.

Following the reveal, $CLOUD surged by 47%, climbing to $0.25 in a matter of minutes based on Step Finance data. $CLOUD has continued to find buyers in the hours following the move and currently exchanges hands at $0.23.

The collaboration has stoked fires of speculation within the Solana community. Some network participants suggest that Binance might be more willing to list $CLOUD if the exchange relies on Sanctum to power its Solana LST.

Before that happens, it is more likely that markets will see exchanges list their own LSTs first. ByBit and BitGet both list stETH, an Ethereum-based LST. It makes sense they would also list Solana-based LSTs, especially those associated with the exchange.

According to Solana Compass data, Binance’s Solana validator currently holds 5.6M SOL, currently valued at over $811M. If Binance were to transition all SOL staked in the validator to an LST, Binance would become the 2nd largest LST provider in the ecosystem, trailing Jito.

With centralized exchanges taking bold new steps into LSTs, Binance, ByBit, and BitGet have affirmed their belief in the future of Solana DeFi.

Read More on SolanaFloor

Overnight, Drift becomes crypto’s largest prediction marketplace

Drift Protocol’s BET Flips PolyMarket in 24-Hour Volume, What Caused $20M Spike?

Refresh Your Crypto Security Basics